High-rolling investors have positioned themselves bullish on Phillips 66 (NYSE:PSX), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in PSX often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 10 options trades for Phillips 66. This is not a typical pattern.

The sentiment among these major traders is split, with 50% bullish and 40% bearish. Among all the options we identified, there was one put, amounting to $41,860, and 9 calls, totaling $471,137.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $70.0 and $165.0 for Phillips 66, spanning the last three months.

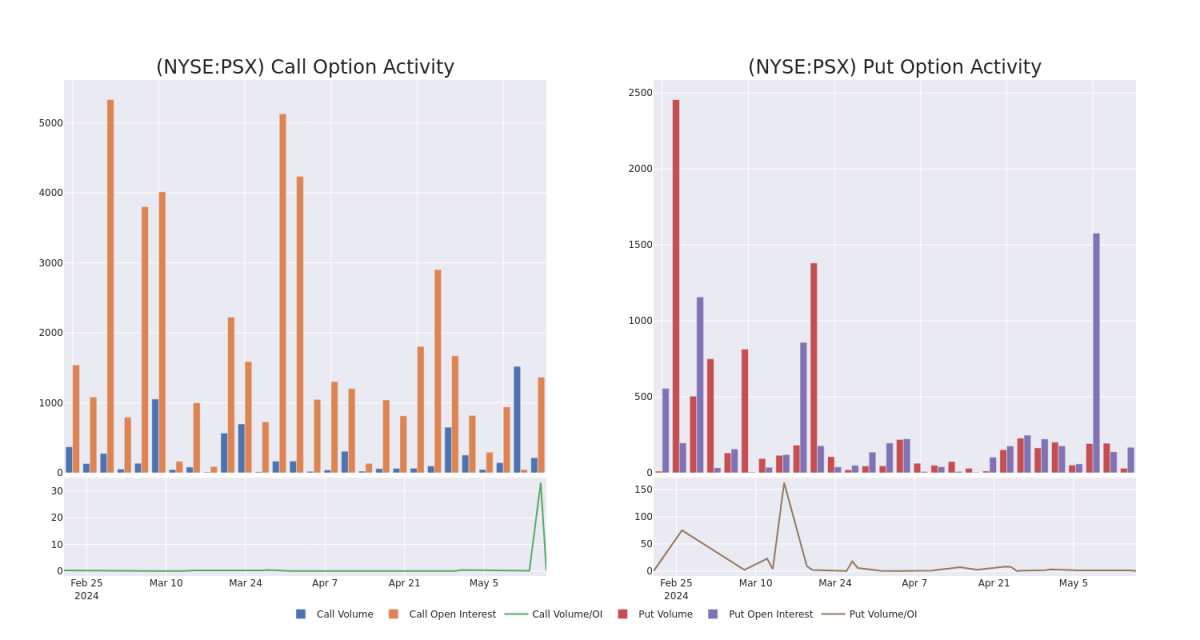

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Phillips 66 options trades today is 170.44 with a total volume of 246.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Phillips 66's big money trades within a strike price range of $70.0 to $165.0 over the last 30 days.

Phillips 66 Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PSX | CALL | TRADE | NEUTRAL | 01/17/25 | $78.5 | $74.7 | $76.45 | $70.00 | $91.7K | 26 | 0 |

| PSX | CALL | TRADE | BULLISH | 01/16/26 | $36.5 | $35.2 | $36.5 | $120.00 | $73.0K | 104 | 20 |

| PSX | CALL | TRADE | BULLISH | 06/21/24 | $17.2 | $15.4 | $16.7 | $130.00 | $66.8K | 608 | 40 |

| PSX | CALL | TRADE | BEARISH | 08/16/24 | $11.4 | $11.2 | $11.2 | $140.00 | $63.8K | 124 | 57 |

| PSX | CALL | SWEEP | BEARISH | 01/16/26 | $22.9 | $22.4 | $22.4 | $145.00 | $47.0K | 173 | 46 |

About Phillips 66

Phillips 66 is an independent refiner with 12 refineries that have a total crude throughput capacity of 1.8 million barrels per day, or mmb/d. In 2023, the Rodeo, California, facility ceased operations and be converted to produce renewable diesel. The midstream segment comprises extensive transportation and NGL processing assets and includes DCP Midstream, which holds 600 mbd of NGL fractionation and 22,000 miles of pipeline. Its CPChem chemical joint venture operates facilities in the United States and the Middle East and primarily produces olefins and polyolefins.

Current Position of Phillips 66

- Trading volume stands at 850,344, with PSX's price down by -0.16%, positioned at $145.98.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 76 days.

What Analysts Are Saying About Phillips 66

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $157.33333333333334.

- Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Phillips 66, targeting a price of $147.

- An analyst from Piper Sandler has decided to maintain their Overweight rating on Phillips 66, which currently sits at a price target of $170.

- An analyst from Barclays persists with their Equal-Weight rating on Phillips 66, maintaining a target price of $155.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Phillips 66 with Benzinga Pro for real-time alerts.