Productivity Actions Drive Diageo (DEO) Amid Cost Woes

Diageo plc DEO has been in a good spot, thanks to its focus on improving productivity, along with its diversified footprint, advantaged portfolio of brands, innovation and marketing investments, and pricing initiatives. Moreover, DEO looks well-poised for growth, driven by strength in the overall beverage industry. It is confident about the long-term growth potential of the beverage alcohol sector. The company is on track with its medium-term view of 5-7% organic sales growth and 6-9% organic operating profit growth.

However, the company has lately been witnessing soft trends in its operations in Latin America and the Caribbean (LAC), which contributes 10% to its net sales. The fast-changing consumer sentiment and high inventory levels have been significantly impacting the total business performance in the LAC region, as was identified at the end of fiscal 2023. Also, inflation in commodity costs, mainly related to increased prices for glass, paper, metal, and higher energy and transportation costs, have been persistent headwinds.

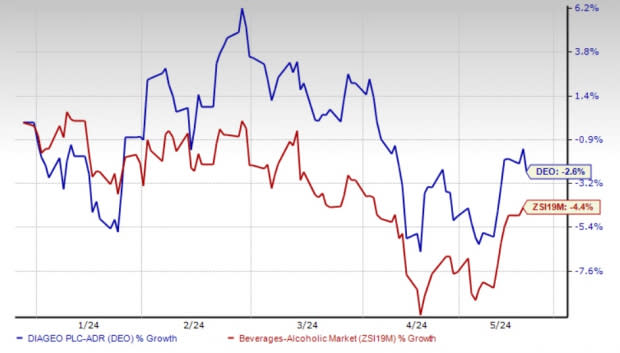

Given the mixed sentiment, shares of the Zacks Rank #3 (Hold) company have lost 2.6% in the year-to-date period, compared with the industry’s decline of 4.4%.

Image Source: Zacks Investment Research

Productivity Endeavors

Diageo is progressing well with its new productivity commitment to deliver $2 billion of productivity savings between fiscal 2025 and fiscal 2027, as announced at the Capital Markets Event in November 2023.

Per the plan, the company expects to deliver this accelerated productivity commitment across the cost of goods, marketing spends and overheads. It plans to support this acceleration through investments, including its supply-chain agility program announced in July 2022. The company expects benefits from the supply-chain agility program to increase from fiscal 2025 and accelerate in the following years.

Notably, DEO earned an additional $335 million of productivity cost savings in the cost of goods, marketing expenses and overheads in the first half of fiscal 2024. It is on track to surpass its three-year productivity savings target of $1.5 billion by the end of fiscal 2024.

What’s More?

DEO has been witnessing solid business momentum, strong consumer demand and market share gains, which have been boosting its performance. Additionally, the company has been witnessing significant gains from improved price/mix, which has been aiding growth despite soft volume. The higher price/mix is mainly the result of price increases across all regions, supported by the efficient product portfolio.

In the first half of fiscal 2024, the company reported a 4.6% improvement in price/mix, driven by growth across all regions, except for LAC. Price contribution to organic net sales was in the low to mid-single digits, driven by price increases, which helped mitigate the impacts of cost inflation and protect margins.

Going forward, Diageo expects to invest strongly in marketing and innovation, and leverage its revenue growth management capabilities, including strategic pricing actions. The company expects the organic net sales growth rate in the second half of fiscal 2024 to steadily improve from the growth rate in the first half.

In North America, Diageo expects organic net sales to improve gradually in the second half of fiscal 2024. While it expects a decline in LAC, the company anticipates continued net sales growth in Europe, the Asia Pacific and Africa in the second half of fiscal 2024.

Hiccups to Note

As already stated, the company’s LAC business is likely to continue impacting results in the quarters ahead. The region has been pressured with excess inventory levels at its direct customers. Despite corrective measures, the elevated inventory levels impacted LAC in the first half of fiscal 2024 performance.

LAC reported a year-over-year net sales decline of 18% in the first half of fiscal 2024. The decline was led by a 23.5% decrease in organic net sales due to lower consumption and reduced consumer demand from macroeconomic pressures in the region. While the company has managed to reduce inventories with direct customers to some extent, inventory levels continue to be high in this channel.

Diageo anticipates the macroeconomic pressures in LAC to persist in the second half of fiscal 2024, which is likely to continue impacting inventory levels. Consequently, DEO expects organic net sales in LAC to decline 10-20% year over year in the second half of fiscal 2024. However, the company expects to finish fiscal 2024 with a more appropriate level of inventory for the current consumer environment.

Diageo also suffers from persistent inflationary pressures, induced by higher commodity costs, particularly agave, energy expenses and supply disruptions. As a substantial portion of DEO’s business comes from international operations, exchange rate fluctuations have been hampering its sales for a while.

Key Picks

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely Vita Coco Company COCO, PepsiCo Inc. PEP and The J. M. Smucker Co. SJM.

Vita Coco, which develops, markets and distributes coconut water products in the United States, Canada, Europe, the Middle East and the Asia Pacific, currently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 25.3%, on average. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for COCO’s current financial-year sales and earnings indicates growth of 3.5% and 37.8%, respectively, from the year-earlier reported figures. The consensus mark for COCO’s EPS has moved up 7.4% in the past 30 days.

PepsiCo, one of the leading global food and beverage companies, currently carries a Zacks Rank of 2 (Buy). PEP has a trailing four-quarter earnings surprise of 5.1%, on average.

The Zacks Consensus Estimate for PepsiCo’s current financial year’s sales and EPS indicates growth of 3.4% and 7.1%, respectively, from the year-ago reported figures. The consensus mark for PEP’s EPS has moved up by a penny in the past 30 days.

The J. M. Smucker, a leading marketer and manufacturer of consumer food and beverage products and pet food and pet snacks in North America, currently carries a Zacks Rank #2. SJM has a trailing four-quarter earnings surprise of 7.5%, on average.

The Zacks Consensus Estimate for The J. M. Smucker’s current financial-year EPS indicates growth of 7.6% from the year-ago reported number. The consensus mark for SJM’s EPS has been unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Diageo plc (DEO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance