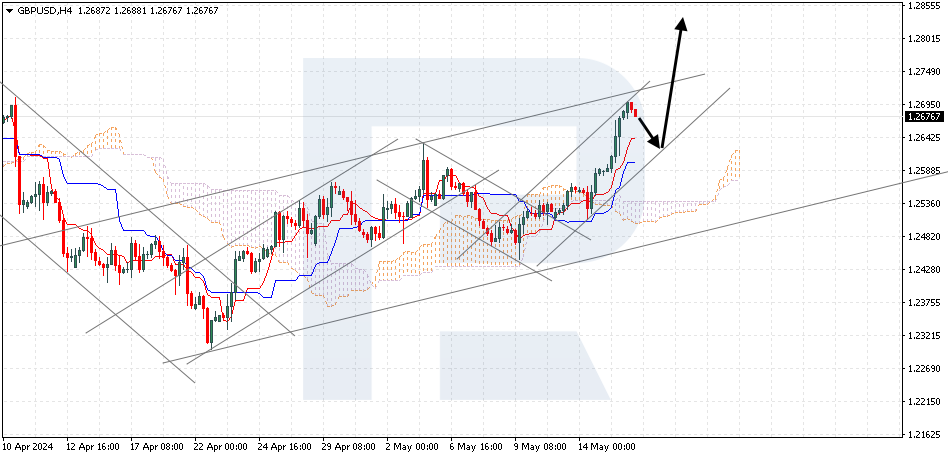

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD is rising within a bullish channel. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 1.2635 is expected, followed by a rise to 1.2835. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario could be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 1.2475, indicating a further decline to 1.2385. Meanwhile, the rise could be confirmed by a breakout of the upper boundary of the bullish channel, with the price establishing itself above 1.2755.

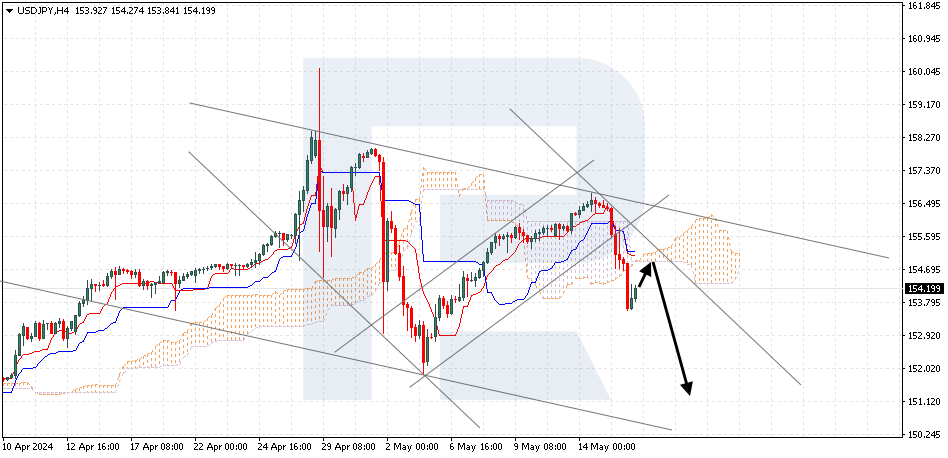

USD/JPY, "US Dollar vs Japanese Yen"

USD/JPY has rebounded from the support level. The pair is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Cloud’s lower boundary at 154.65 is expected, followed by a decline to 151.15. An additional signal confirming the decline will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud, with the price securing above 156.55, which will signal a further rise to 157.45.

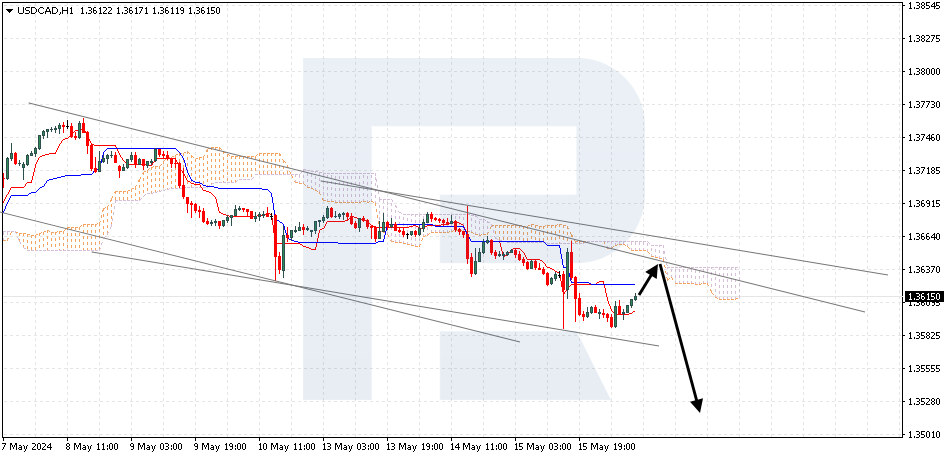

USD/CAD, “US Dollar vs Canadian Dollar”

USD/CAD has gained a foothold above the Tenkan-Sen line. The pair is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Cloud’s lower boundary at 1.3640 is expected, followed by a decline to 1.3525. An additional signal confirming the decline will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud, with the price securing above 1.3695, which will indicate a further rise to 1.3785.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD retreats from session highs after US data, holds above 1.0850

After rising toward 1.0900 earlier in the day, EUR/USD lost its traction and turned negative on the day below 1.0870. The upbeat ISM Services PMI data provides a boost to the US Dollar and causes the pair to stay on the back foot.

USD/CAD rises after BoC cuts interest rates, US Services PMI rises

USD/CAD rallies after the Bank of Canada decides to cut its key interest rate at its June meeting. The decision was widely expected but still weighs on the Canadian Dollar, lifting USD/CAD. The pair also gets a second boost after US ISM Services PMIs surprise to the upside, showing sector resilience.

Gold pressuring the upper end of its weekly range

Gold struggles to preserve its bullish momentum and trades below $2,340 following a move toward $2,350 earlier in the session. The renewed US Dollar strength and recovering US T-bond yields after strong US PMI data makes it difficult for XAU/USD to continue to push higher.

Reserve Rights Price Prediction: A 25% jump looms

Reserve Rights price is facing a pullback after testing the 61.8% Fibonacci retracement level at $0.0100. On-chain data suggests that RSR development activity is growing. A daily candlestick close below $0.0057 would invalidate the bullish thesis.

ECB preview: Rate cut assured, but what next?

With the ECB all but certain to cut rates on Thursday, the attention will be on comments around inflation and further easing. Inflation has ticked up but remains on a broadly downward trend and ECB officials have clearly already made up their minds to cut this week.