ASX 200 property stock Goodman Group (ASX: GMG) is trading 4.35% higher on Thursday at $34.82.

In earlier trading, the industrial real estate giant hit a new 52-week high of $35.09, up 5.15%.

With no news out of Australia's biggest real estate investment trust (REIT) today, it is likely Goodman shares are just riding the wave of a buoyant market, with the S&P/ASX 200 Index (ASX: XJO) up 1.64%.

The industrial property specialist has ripped up the charts over the past 12 months, gaining 73% in new value. This compares to its peers in the S&P/ASX 200 A-REIT Index (ASX: XPJ), which is up 21%.

What's got this ASX 200 stock screaming higher?

Goodman Group is a property development and management behemoth with a $63.37 billion market capitalisation. Last year, it was among the top five most profitable large-cap ASX 200 stocks.

What's got the Goodman share price shooting the lights out?

Well, first of all, the business appears to be in great shape.

Last week, the company's third-quarter operational update revealed $800 million of completed developments during the quarter, with 96% of year-to-date completions committed.

Its total property portfolio is worth $80.5 billion and it's got 98% occupancy. The 12-month rolling like-for-like net property income (NPI) growth is 4.9%.

There is $12.9 billion of development work in progress (WIP) across 82 projects, with 59% committed. The yield on cost is 6.8% and 74% of the WIP is either pre-sold or being built for third parties or partners.

All of this resulted in the company upgrading its guidance for FY24 for a second time. Management now expects operating earnings per share (EPS) growth of 13% in FY24.

The ASX 200 property stock dipped 0.26% on the day the update was released.

What did management say?

CEO Greg Goodman said:

Our active asset management continues to optimise returns for our investors as we deliver essential infrastructure for the expanding digital economy.

The location and quality of our properties enables increased productivity, driving demand as our logistics customers are seeking to improve their supply chain efficiency using automation and offering faster transit times.

What makes Goodman different to other REITs?

A second factor likely prompting excited investors to plough more funds into this ASX 200 stock is Goodman's industrial property specialisation and its exposure to the artificial intelligence (AI) megatrend.

Goodman is actively positioning itself to take advantage of the AI boom by building the data centres needed to make it all work.

Currently, data centres under construction represent approximately 40% of Goodman Group's $12.9 billion WIP pipeline.

The company said it was progressing its data centre strategy and reviewing additional sites for potential data centre use now.

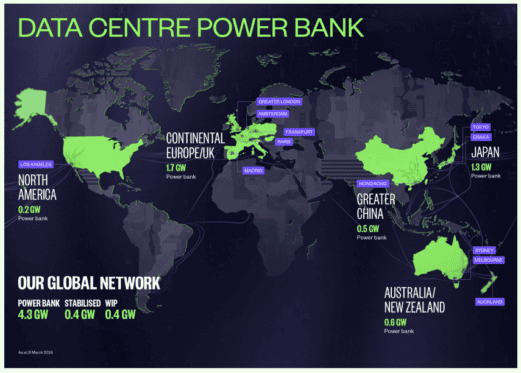

Goodman's global power bank totals 4.3GW across 12 major cities, following a 0.3GW addition during the third quarter.

Source: Goodman Group third quarter update

The bank comprises 2.1GW of secured power, including 0.4GW that is stabilised and owned, and 0.4GW that is under development, and 2.2GW of power in the advanced stages of procurement.

Goodman says it has the proven development capabilities and strong balance sheet to continue buying and developing high-tier data centres in popular, supply-constrained locations.

Goodman said:

We continue to develop large-scale, high value, data centres, and expand our global power bank to address growing data centre demand as AI usage and cloud computing expands.

ASX 200 stock price snapshot

This ASX 200 property stock has gained 153.5% in market cap over the past five years.

This compares to 9.3% for the S&P/ASX 200 A-REIT Index.