Diagnostic imaging company Lantheus Holdings (NASDAQ:LNTH) offers investors access to two pharmaceutical products already on the market that have significant growth potential. It also offers an attractive pipeline, a record of outperformance relative to analyst predictions, and solid financial stability. Following Lantheus’ strong first-quarter earnings report earlier this month, several analysts across Wall Street have reiterated their Buy ratings on this up-and-coming radiopharmaceuticals firm.

I agree that LNTH stock has many positive attributes and echo this sentiment. Let’s take a closer look at why Lantheus stands out below.

Two Exceptional Radiopharma Products

Lantheus is known for DEFINITY an ultrasound contrast agent used to enhance echocardiograms, and PYLARIFY, a prostate cancer diagnostic imaging agent. DEFINITY is the most-utilized enhancing agent of its kind among U.S. patients. With two decades of history among adult patients, the product received FDA approval for pediatric patients in March of this year.

Lantheus’ DEFINITY revenue for the first quarter increased 11.2% year-over-year to $76.6 million, and that is only including a period of less than a month in which the product was approved for pediatric patients.

DEFINITY is a driver of Lantheus’ top-line growth, but PYLARIFY has the potential to be a blockbuster pharmaceutical product. This is currently the only imaging agent available for prostate-specific membrane antigen (PSMA) targeted positron emission tomography (PET) scans, one of the latest and most effective scans for prostate cancer approved by the FDA. About one in eight men is diagnosed with prostate cancer.

PYLARIFY holds a key position in the field of diagnostic imaging with significant potential for growth, and this is reflected in the first-quarter sales figures for this product. PYLARIFY sales jumped by 32.4% year-over-year to $258.9 million. This was instrumental in boosting overall revenue for the quarter by 23.0% and in generating quarterly net income of $131.1 million compared with a net loss in the prior-year quarter.

Potent Pipeline Possibilities

Besides its two leading products that are already commercially available, Lantheus has multiple radiopharmaceutical products in its development pipeline that merit attention. First, in December of last year it announced that the Phase 3 SPLASH trial of PNT2002 met a key test metric among patients with metastatic castration-resistant prostate cancer. There is another readout of the trial on the way in the third quarter of this year.

Last quarter, the FDA accepted Lantheus’ Abbreviated New Drug Application for Lutetium Lu 177 Dotatate, a generic form of the drug Lutathera, for patients with certain types of neuroendocrine tumors.

Potential upcoming successes for either or both of these therapeutics in development could further solidify Lantheus’ position as a leading radiopharmaceuticals firm.

LNTH’s Solid Financial Results

Lantheus had an impressive first quarter, thanks in large part to its two key products. It reported earnings per share of $1.69, 15 cents above analyst predictions. Revenues of $370.0 million also topped expectations for the quarter by $20 million. It has a strong cash base and generated $119 million in free cash flow in the first three months of the year.

Looking forward, Lantheus expects to enjoy continued rapid top- and bottom-line growth. The company boosted its full-year 2024 revenue guidance to a range of $1.50-1.52 billion, up from $1.41-1.45 billion issued in February. Lantheus also expects full-year adjusted diluted EPS to reach as high as $7.20, while in the previous earnings report it said it anticipated this figure to be only as high as $6.70.

Is LNTH Stock a Buy, According to Analysts?

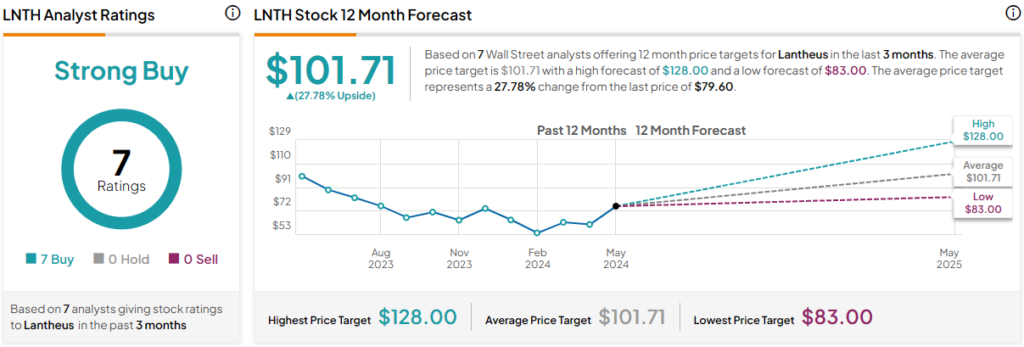

Lantheus shares have fallen 22.1% in the last year. Still, the stock currently enjoys a Strong Buy rating among Wall Street analysts based on seven Buys, zero Holds, and zero Sells. The average LNTH stock price target is $101.71, representing 27.8% upside potential.

Conclusion: Products and Pipeline Poised for a Breakout

Lantheus sports a strong, if limited, list of radiopharmaceutical products with significant growth potential and multiple drug candidates with promise in the pipeline. The company has a record of outperformance, rapid sales growth, and a favorable cash position. Combining all of these factors, it’s no surprise that it has received unanimous Buy ratings among Wall Street analysts.