Eli Lilly (LLY) Settles With Spa Selling Mounjaro, Zepbound Copies

Eli Lilly and Company LLY announced a settlement agreement with Totality Medispa that sold compounded products in the name of its popular tirzepatide drugs, Mounjaro and Zepbound. The medical spa coaxed customers into believing that its compounded tirzepatide products have undergone clinical tests and have been proven safe and effective.

Eli Lilly’s Mounjaro was launched in mid-2022 for type II diabetes. Zepbound was launched in November 2023 for patients who were obese or overweight with weight-related comorbidities. Despite a short time on the market, Mounjaro and Zepbound have become key top-line drivers for the company, with demand for weight loss drugs rising rapidly.

Mounjaro and Zepbound include the same compound tirzepatide, a dual GIP and GLP-1 receptor agonist (GIP/GLP-1 RA). The GLP-1 segment is a very important class of drugs for multiple cardiometabolic diseases and is gaining significant popularity. GLP-1 drugs work by mimicking the hormone GLP-1, resulting in weight loss, lowering hemoglobin A1c (HbA1c) and reducing cardiovascular risks.

Per the settlement deal, Totality Medispa will have to make a monetary payment to Lilly. It will also have to refrain from using Lilly’s branding to promote its compounded tirzepatide products.

The spa will also have to refrain from selling compounded tirzepatide products that are not produced lawfully. It will have to clearly state on its website that its compounded tirzepatide products are not approved by the FDA and inform the regulatory body if any customer experiences any side effects after using these custom-made versions of the original drugs.

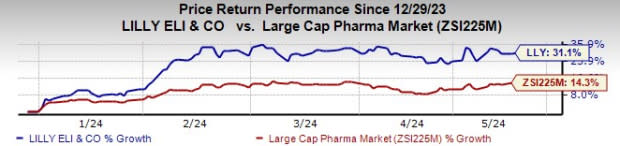

Eli Lilly’s stock has risen 31.1% year to date compared with an increase of 14.3% for the industry.

Image Source: Zacks Investment Research

The settlement comes amid a huge demand for obesity drugs for cosmetic use, which is causing a supply shortage. Lilly has time and again warned against the use of custom-made products claiming to contain tirzepatide that are made or distributed by compounding pharmacies. These products are not approved by the FDA and can pose serious health risks to users.

Eli Lilly believes some of these products contain bacteria and their impurity levels are high. They have different chemical structures and colors than Mounjaro or Zepbound. Lilly has sued several pharmacies, weight loss clinics and medical spas selling/making compounded versions of Mounjaro and Zepbound. Lilly has also warned that Mounjaro and Zepbound should not be used for cosmetic weight loss. Mounjaro and Zepbound should only be used when prescribed by a doctor for “treating” type II diabetes and obesity, respectively.

Obesity has become a global health problem as it can cause other diseases like heart disease, diabetes and stroke, leading to an exponential increase in demand for obesity medicines. Also, social media has somewhat hyped the benefits of these medications.

Eli Lilly’s tirzepatide medicines face strong competition from Novo Nordisk’s NVO semaglutide. Semaglutide is approved as Ozempic pre-filled pen and Rybelsus oral tablet for type II diabetes and as Wegovy injection for weight management. Despite supply challenges, Wegovy is seeing strong prescription trends and is generating impressive revenues and profits for Novo Nordisk, which has also filed lawsuits against pharmacies that claim their products contain its active ingredient, semaglutide.

Viking Therapeutics VKTX is also progressing with the development of its GIP/GLP-1 agonist called VK2735 for obesity. VK2735 has shown impressive weight loss reductions in studies for both the subcutaneous (phase II) and novel oral (phase I) formulations. Viking Therapeutics plans to advance both formulations into further development later this year.

Amgen AMGN also has a GLP-1 receptor candidate, MariTide (maridebart cafraglutide), for obesity in its pipeline. Earlier this month, Amgen said it was “very encouraged” with the interim data from the phase II study on MariTide. Top-line 52-week data from the phase II study is expected in late 2024. Amgen is planning to conduct a comprehensive phase III program on the candidate across obesity, obesity-related conditions and diabetes

Eli Lilly currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Eli Lilly and Company Price and Consensus

Eli Lilly and Company price-consensus-chart | Eli Lilly and Company Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Viking Therapeutics, Inc. (VKTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance