Exploring Three TSX Growth Companies With High Insider Ownership

In recent times, the Canadian market has shown resilience, navigating through fluctuating economic trends and evolving market conditions. As investors seek stability and growth potential amidst these changes, companies with high insider ownership often attract attention due to their aligned interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Aritzia (TSX:ATZ) | 19% | 51.6% |

Payfare (TSX:PAY) | 15% | 63.8% |

Allied Gold (TSX:AAUC) | 22.4% | 74.8% |

ROK Resources (TSXV:ROK) | 16.6% | 135.9% |

Silver X Mining (TSXV:AGX) | 14.3% | 133.8% |

Artemis Gold (TSXV:ARTG) | 31.8% | 58.9% |

Ivanhoe Mines (TSX:IVN) | 13.1% | 37.2% |

Almonty Industries (TSX:AII) | 12.6% | 76.2% |

UGE International (TSXV:UGE) | 35.4% | 63.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Green Thumb Industries

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Green Thumb Industries Inc. operates in the United States, focusing on the manufacturing, distribution, marketing, and sale of cannabis products for both medical and adult use, with a market capitalization of approximately CA$4.21 billion.

Operations: The company generates revenue through the manufacturing, distribution, marketing, and sale of cannabis products designed for both medical and adult-use markets in the U.S.

Insider Ownership: 10.9%

Earnings Growth Forecast: 24% p.a.

Green Thumb Industries, a growth company with insider trading activity, has shown a mixed financial trajectory. Despite trading 34.8% below its estimated fair value and expecting earnings to grow significantly at 24% annually—outpacing the Canadian market forecast of 13.3%—its revenue growth projections are modest at 10.4% yearly, slightly above the Canadian market's 6.9%. Recent expansions include opening new dispensaries in Florida, enhancing its retail footprint and community engagement through charitable initiatives during grand openings.

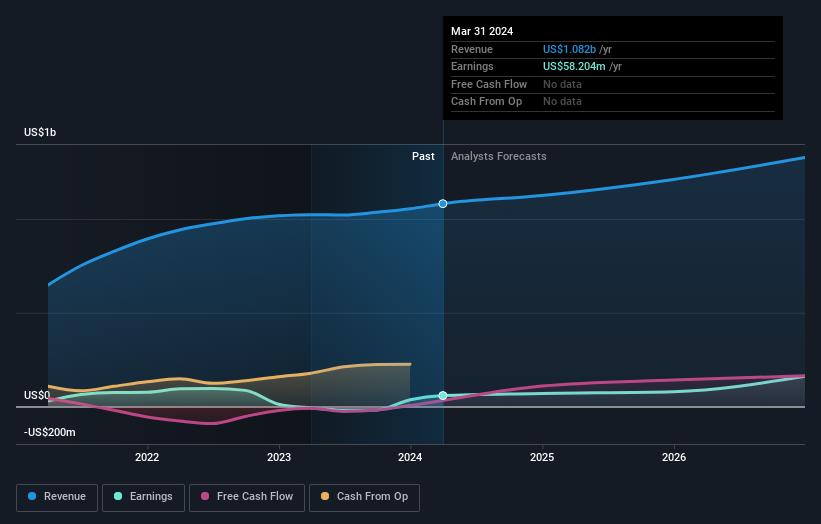

Canada Goose Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canada Goose Holdings Inc. operates globally, designing, manufacturing, and selling performance luxury apparel across multiple regions, with a market capitalization of approximately CA$1.47 billion.

Operations: The company generates revenue primarily through its Wholesale and Direct-To-Consumer segments, with CA$316.40 million from Wholesale and CA$906.70 million from Direct-To-Consumer sales.

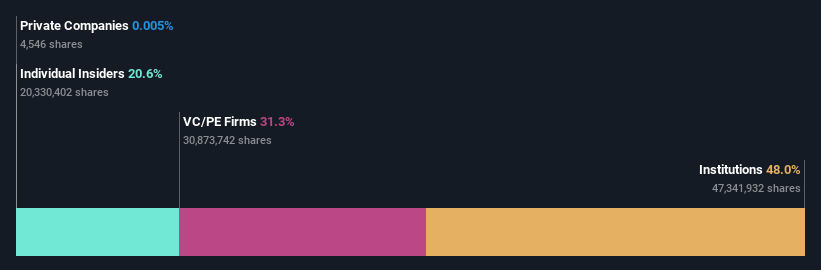

Insider Ownership: 20.6%

Earnings Growth Forecast: 34.7% p.a.

Canada Goose Holdings, amidst management restructuring and strategic role expansions, is poised for notable earnings growth, forecasted at 34.71% annually over the next three years. Despite a slow revenue growth rate of 7.3% per year and a recent dip in profit margins to 4%, the company's stock is currently valued at 45.9% below its estimated fair value, suggesting potential upside. However, financial challenges persist as interest payments are not well covered by earnings.

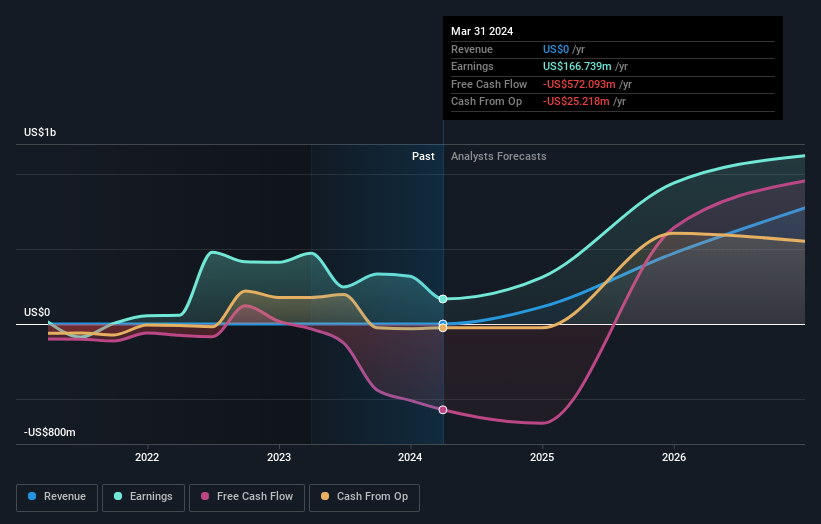

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. focuses on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$25.04 billion.

Operations: The company primarily generates revenue from the mining, development, and exploration of minerals and precious metals in Africa.

Insider Ownership: 13.1%

Earnings Growth Forecast: 37.2% p.a.

Ivanhoe Mines, actively pursuing mergers and acquisitions, positions itself as a potential acquirer rather than a target. Despite recent financial setbacks including a net loss of US$65.55 million in Q1 2024, the company is optimistic about expanding copper production in the Western Forelands. Forecasted revenue growth at 48.1% annually surpasses market expectations significantly, coupled with an anticipated earnings growth of 37.2% per year, although concerns remain due to shareholder dilution and significant insider selling recently.

Taking Advantage

Reveal the 33 hidden gems among our Fast Growing TSX Companies With High Insider Ownership screener with a single click here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include CNSX:GTII TSX:IVN and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance