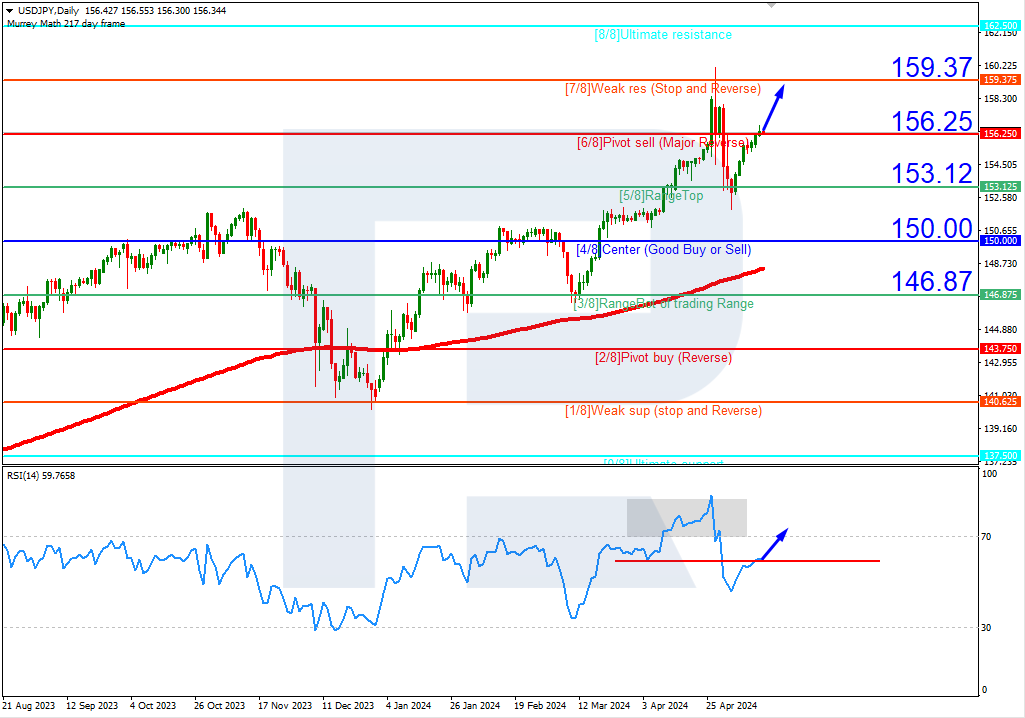

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI has surpassed the resistance line. In this situation, the pair is expected to rise further to 7/8 (159.37). The scenario could be cancelled by a breakout of the 5/8 (153.12) support level. In this case, the quotes could drop to 4/8 (150.00).

On M15, the upper line of the VoltyChannel is broken, which increases the probability of a further price rise.

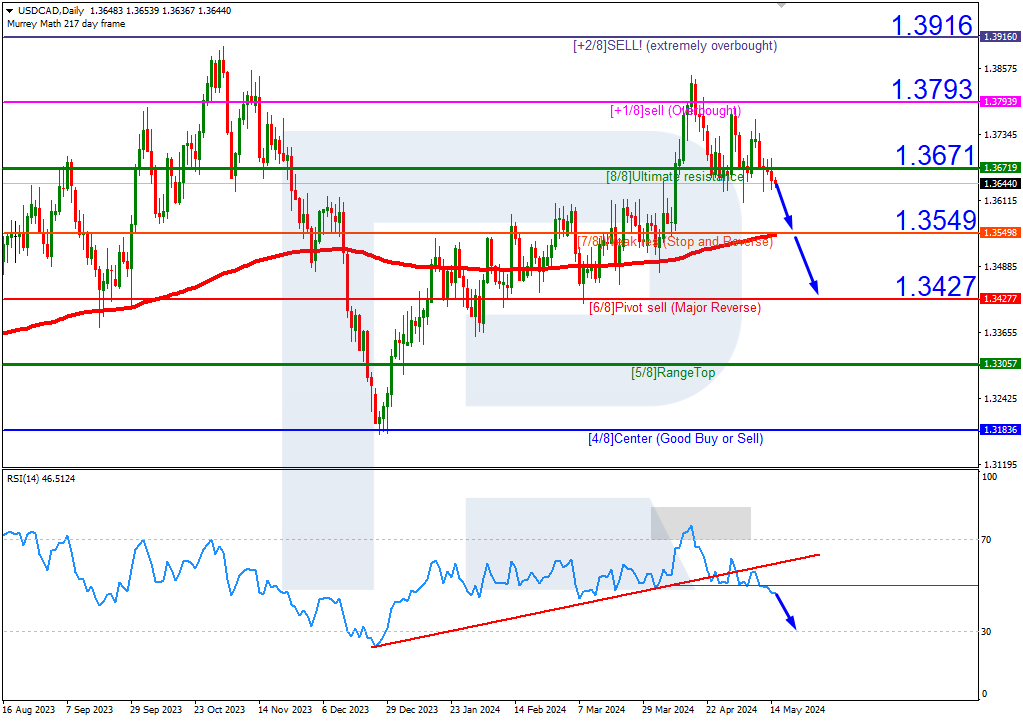

USD/CAD, “US Dollar vs Canadian Dollar”

USD/CAD quotes have breached the 8/8 (1.3671) level and exited the overbought area on D1. The RSI has broken the support line. In this situation, the price is expected to decline further to the 6/8 (1.3427) support level. The scenario could be cancelled by rising above 8/8 (1.3671). In this case, the quotes might return to the +1/8 (1.3793) resistance level.

On M15, the lower line of the VoltyChannel is broken, which increases the probability of a price decline.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD trades deep in red below 1.0750, pressured by EU politics

EUR/USD stays deep in negative territory below 1.0750 in the American session. Lingering EU political concerns, following the announcement of a snap election in France, weigh on the Euro, while the US Dollar preserves its strength following Friday's upbeat jobs data.

GBP/USD struggles to rebound, holds above 1.2700

GBP/USD erased its daily losses and stabilized above 1.2700 following a bearish opening to the week. The pair, however, struggles to gather recovery momentum as the cautious market stance ahead of the key macroeconomic events helps the US Dollar stay resilient.

Gold recovers above $2,300 as markets turn risk-averse

Gold clings to daily recovery gains above $2,300 in the American session on Monday after suffering large losses on Friday. The negative shift seen in risk mood ahead of this week's highly-anticipated Fed meeting helps Gold find demand as a safe haven.

Ripple CEO comments on meme coins, XRP hovers around $0.50

Ripple is embroiled in a legal battle with the US Securities and Exchange Commission for nearly four years. The SEC vs. Ripple lawsuit drags on as holders await the SEC’s response to the payment firm’s filing from May 29.

Five fundamentals for the week: Fed-CPI “Super Wednesday” to provide double whammy Premium

A fresh read on US inflation may ease fears triggered by the strong Nonfarm Payrolls. Any Federal Reserve's rate cut signals are at the center of its decision. BoJ officials are likely to weigh on the Yen after weak GDP, raising intervention risks.