Goodyear's (GT) Shares Rise 4.3% Since Q1 Earnings Beat

Shares of Goodyear Tire GT have risen 4.3% since the company reported first-quarter 2024 results. It reported first-quarter 2024 adjusted earnings per share (EPS) of 10 cents, surpassing the Zacks Consensus Estimate of breakeven earnings. The company had incurred a loss of 29 cents in the year-ago quarter.

The company generated net revenues of $4.53 billion, which declined 8.2% on a year-over-year basis and missed the Zacks Consensus Estimate of $4.78 billion due to lower replacement volume.

In the reported quarter, tire volume was 40.4 million units, down 3.3% from the year-ago period's levels.

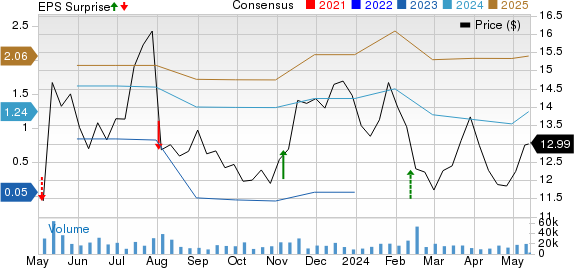

The Goodyear Tire & Rubber Company Price, Consensus and EPS Surprise

The Goodyear Tire & Rubber Company price-consensus-eps-surprise-chart | The Goodyear Tire & Rubber Company Quote

Segmental Performance

In the reported quarter, the Americas segment generated revenues of $2.59 billion, which declined 9.7% year over year and missed our estimate of $2.76 billion due to lower volume and unfavorable price/mix. The segment registered an operating income of $179 million, which surged 126.6% from the year-ago period's figures. The operating margin benefited from lower transportation cost, Goodyear Forward initiatives and favorable net price/mix. The figure, however, missed our expectation of $211.3 million.

Revenues in the Europe, Middle East and Africa segment were $1.35 billion, down 9.7% from the year-ago period's levels due to lower replacement volume and unfavorable price/mix. The figure also missed our estimate of $1.55 billion. The operating income for the segment was $8 million, which remained flat on a year-over-year basis. Our estimate was pegged at an operating loss of $0.6 million.

Revenues in the Asia Pacific segment rose 3.4% year over year to $602 million due to higher original equipment volume and surpassed our estimate of $590.7 million. The segment’s operating profit was $60 million, up 57.9% from the year-ago quarter’s figure due to favorable net price/mix, higher volume and benefits from the Goodyear Forward plan.

Financial Position

Selling, general & administrative expenses rose to $696 million from $664 million in the year-ago period.

Goodyear had cash and cash equivalents of $893 million as of Mar 31, 2024, down from $902 million as of Dec 31, 2023.

Long-term debt and finance leases amounted to $7.48 billion as of Mar 31, 2024, up from $6.83 billion as of Dec 31, 2023.

Capital expenditure in the quarter was $318 million, up from $291 million reported in the year-ago quarter.

Updated 2024 Outlook

Based on recent commodity rates, the company expects a benefit of $325-$350 million on raw material costs in 2024.

Capital expenditures are expected in the range of $1.2-$1.3 billion.

For the full year, interest expenses are estimated between $520 million and $540 million. Depreciation and amortization is expected to be $1 billion.

Zacks Rank & Key Picks

GT currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Geely Automobile Holdings Limited GELYY, Blue Bird Corporation BLBD and Oshkosh Corporation OSK, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GELYY’s 2024 sales suggests year-over-year growth of 36.6%. The EPS estimates for 2024 and 2025 have moved up 34 cents and 54 cents, respectively, in the past 60 days.

The Zacks Consensus Estimate for BLBD’s 2024 sales and earnings suggests year-over-year growth of 17.29% and 116.82%, respectively. The EPS estimates for 2024 and 2025 have moved up 22 cents each in the past seven days.

The Zacks Consensus Estimate for OSK’s 2024 sales and earnings suggests year-over-year growth of 9.86% and 10.72%, respectively. The EPS estimates for 2024 and 2025 have improved 73 cents and 70 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Geely Automobile Holdings Ltd. (GELYY) : Free Stock Analysis Report

Blue Bird Corporation (BLBD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance