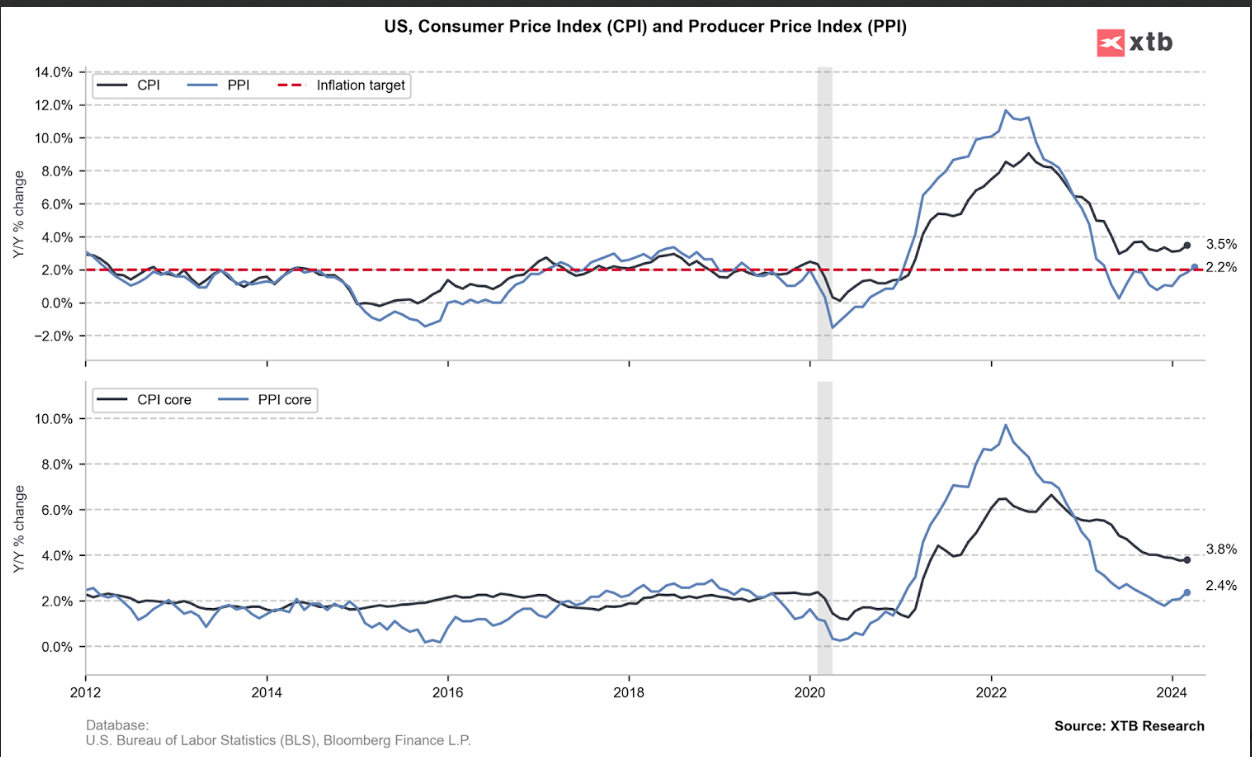

US producer price data for April surprised on the upside, suggesting that inflation pressure at the start of the inflation pipeline could be building once again. Final demand PPI rose to 2.2% from 1.8%, while core producer prices, adjusting for food, energy and trade, rose by a 3.1% annual rate, the first time core PPI has had a 3% handle since April 2023.

Service inflation drove producer prices in April, rising by 1.8% YoY. This compares to goods producer prices, which rose by 0.3% on an annual basis. The key question for investors, will this herald a strong CPI reading for April?

PPI and CPI relationship is not clear cut

The immediate market reaction to the PPI data is a stronger dollar and stronger US Treasury yields. The 2-year Treasury yield initially jumped 5 basis points on the PPI data, however, it has since retreated, possibly because the relationship between PPI and CPI is not as strong as you might think. For example, the 1-year correlation between the annual rates of headline PPI and CPI is only 57%, just marginally positive. On a longer 2-year time frame there is no meaningful relationship between PPI and CPI. This means that the relationship between producer prices and consumer prices has increased in the last year, but it still not super close.

April PPI and CPI, headline and core

Source: XTB

Corporate pricing power may be decreasing

Producer prices are important because they flow into the PCE numbers, which is the Fed’s preferred measure of inflation. However, there is little evidence that this will feed into CPI, which is scheduled for release on Wednesday. The market is expecting annual headline inflation to moderate to 3.5%, while annual core inflation is expected to fall back to 3.6% from 3.8%. One reason why PPI may not influence CPI is that companies’ pricing power could decrease if the economy slows. Downside surprises in US economic data have picked up in recent weeks, suggesting that the US economy could be losing momentum. This may limit the amount of price increases companies can pass onto consumers, which could weaken the relationship between PPI and CPI even more.

Meme stocks surge for a second day

Elsewhere, meme stocks are exploding once more. GameStop is up 120% in pre-market trading, and AMC is higher by 107%. However, on Monday the new kid on the block Vinfast, which joined the Nasdaq last year, rose by 50%, with some people arguing that Vinfast was jumping on the meme stock bandwagon. However, it has not managed to keep up with GameStop and AMC on Tuesday and is higher by only 2% so far today, although we will watch it closely in case it jumps higher at some point during this trading session.

Why GameStop may not see the same interest as it did in 2021

The meme stock explosion has coincided with the resumption of tweets by Roaring Kitty, an account on X that claims it is an original method for hunting for stocks and investment opportunities. GameStop’s market capitalization rose by $4bn on Monday, which is rekindling memories of the 2021 meme stock craze. However, there are a couple of differences between 2021 and 2024, not least that the stock price is far higher now than it was before the meme stock craze in 2021. Back then it was trading around $5, today it is trading at $30, so it may not be as much of a bargain as it once was.

The rally in meme stocks is at odds with the rest of the blue-chip market. The S&P 500 is set to open lower on Tuesday, and European stock indices are either flat or up slightly, as the markets await the latest CPI data from the US on Wednesday.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD holds gains above 0.6650 after mixed Australian data

AUD/USD caught a brief bid wave and edged toward 0.6700 after Australian CPI unexpectedly ticked higher to 3.6% YoY in April. However, a surprise drop in the country's Construction Output for Q1 curbs the Aussie's enthusiasm. A cautious mood also acts as a headwind for the pair.

USD/JPY approaching 157.40 amidst broad Yen weakness

USD/JPY drifted into the high end on Tuesday, testing towards 157.40 as broad-market weakness in the Japanese Yen sends Yen pairs broadly higher. Japanese Tokyo CPI inflation remains a key print for Yen traders this week.

Gold price snaps the three-day winning streak on Fed’s hawkish remarks

Gold price snaps the three-day winning streak on Wednesday amid the modest rebound of the Greenback. Additionally, the hawkish remarks from several Federal Reserve officials and stronger-than-expected US economic data diminish expectations of the Fed rate cut in September.

Bitcoin long-term holders begin re-accumulation after Semler Scientific and Mt Gox make major whale moves

Bitcoin declined briefly from the $70,000 mark on Tuesday as Semler Scientific and Mt Gox made notable whale moves. Glassnode also shared key on-chain insights that breathe clarity into the market's current state.

Price inflation isn't an accident; It's a policy

If you listen to government officials and central bankers talk about price inflation, you might think they don’t have the foggiest idea of what caused it. It might have been supply chain problems, or perhaps it was Putin’s fault.