Silver has long been a critical component in various industries like photography, medicine, and water purification. However, the recent surge in demand for electric vehicles and solar panels has exerted upward pressure on prices. Meanwhile, gold prices have recently hit historically high levels. For producers like Fortuna Silver Mines (NYSE:FSM), this has led to a surge in profits. The stock is up over 82% in the past 90 days and likely to be driven higher as it’s relatively undervalued. This makes FSM an attractive option for investors interested in mining stocks.

Fortuna Silver Mines is a Canadian-based mining firm that specializes in precious metals mining. The company operates five mines in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, and Peru. It primarily produces gold and silver.

Fortuna’s Expanding Operations

Most recently, the company has successfully expanded operations at the Séguéla Mine in Cote d’Ivoire, which offers numerous prospective targets with high-grade deposits. In Mexico, the discovery of the Yessi silver-gold vein at the San Jose Mine presents the potential for an ongoing ramp-up of high-grade production. Finally, the Diamba Sud Gold Mine in Senegal is in the early stages of discovery, but successful findings from an initial drilling campaign suggest upside potential.

Fortuna’s Recent Financial Results & Outlook

Fortuna Silver Mines posted strong results in Q1 2024. Despite marginally missing revenue estimates by $1.1 million, the company generated substantial revenue of $224.9 million, an impressive 28% increase year-over-year. In addition, net income of $26.3 million marked a considerable 143% increase from Q1 2023’s $10.9 million. Non-GAAP EPS of $0.09 surpassed forecasts by $0.04.

With an average gold price of $2,087 per ounce, up from $1,990 in Q4 2023, and a steady silver price at $23, gold constituted 81% of the company’s $225 million sales, while silver contributed 10%. Gold equivalent production amounted to 112,543 ounces, which indicated a solid year-over-year increase despite a drop from 136,154 ounces observed in Q4 2023. Meanwhile, consolidated all-in sustaining cash costs (AISC) per ounce slightly declined to $1,495 from the previous quarter’s $1,509, boosted mainly by the Séguéla Mine’s first full quarter of operation.

Thanks to a robust Q1 performance, Fortuna repaid $40 million of credit, boosting the company’s balance sheet flexibility, and bought back over a million shares. In a forward-looking move, Fortuna has also attained a 50% stake in Séguéla Mine’s net smelter return, suggesting optimism in future operations.

Is FSM Stock a Buy?

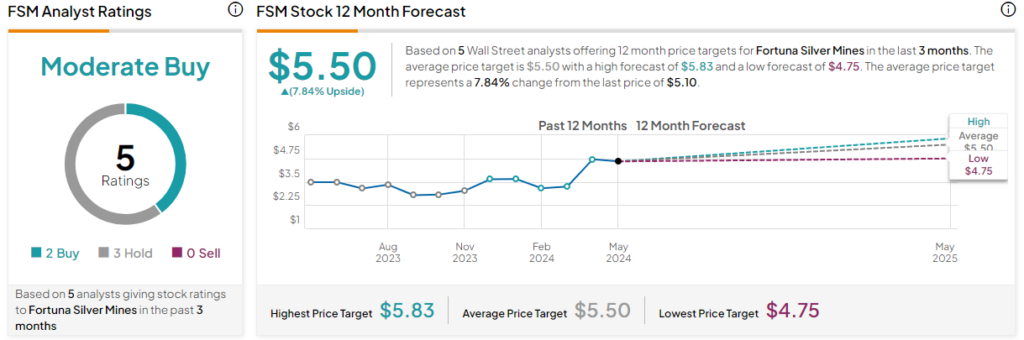

Analysts following the company have been cautiously optimistic about the stock. BMO Capital analyst Kevin O’Halloran recently raised the price target for the stock to $5.83 while maintaining an Outperform rating. He cites the lower cost of AISC continuing to drive strong cash flows.

Overall, Fortuna Silver Mines is rated a Moderate Buy based on the recommendations and 12-month price targets five Wall Street analysts issued over the past three months. The average price for FSM stock is $5.50, which represents a 7.84% upside from current levels.

The stock has been trending upward, climbing over 30% year-to-date. It trades at the high end of its 52-week price range of $2.58-$5.27 and continues to show positive price momentum, trading above the 20-day (4.72) and 50-day (4.27) moving averages. The stock appears to be relatively undervalued, with a P/B ratio of 1.2x comparing favorably with the Gold industry average of 1.7x.

Fortuna Looks to Continue Benefitting from Increasing Silver Demand

Fortuna Silver Mines looks to continue benefiting from increasing demand for silver in emerging industries and surging gold prices, which are significantly propelling profits upward. Fortuna’s outlook is bullish, with the company’s AISC remaining well below consolidated sales and a strong balance sheet. The company’s attractive valuation and continued momentum underscore its potential as a compelling option for investors seeking exposure to the mining sector.