Enbridge (ENB) Q1 Earnings Beat Estimates, Revenues Fall Y/Y

Enbridge Inc. ENB reported first-quarter 2024 adjusted earnings per share (EPS) of 68 cents, which beat the Zacks Consensus Estimate of 59 cents. The bottom line also increased from the year-ago quarter’s 63 cents.

Total quarterly revenues of $8.2 billion decreased from $8.9 billion in the prior-year quarter. The top line also missed the Zacks Consensus Estimate of $8.9 billion.

The strong quarterly earnings resulted from increased contributions across all segments.

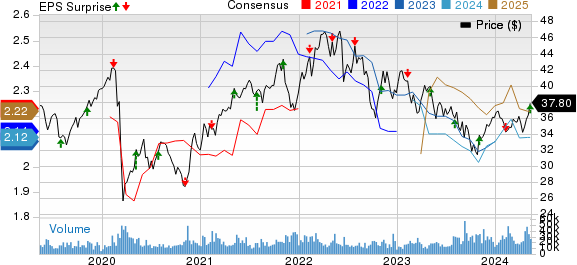

Enbridge Inc Price, Consensus and EPS Surprise

Enbridge Inc price-consensus-eps-surprise-chart | Enbridge Inc Quote

Segmental Analysis

Enbridge conducts business through five segments — Liquids Pipelines, Gas Transmission, Gas Distribution and Storage, Renewable Power Generation and Eliminations and Other.

Liquids Pipelines: The segment’s adjusted earnings before interest, income taxes, and depreciation and amortization (EBITDA) totaled C$2.46 billion, up from C$2.34 billion in the year-earlier quarter. Higher contributions from Gulf Coast and Mid-Continent systems primarily aided the segment.

Gas Transmission: Adjusted earnings at this segment totaled C$1.27 billion, up from C$1.19 billion recorded in first-quarter 2023. Higher contributions from the United States and Canadian gas transmission segment primarily aided its performance.

Gas Distribution and Storage: The unit generated a profit of C$765 million, up from C$716 million in the prior-year quarter due to increased contributions from the U.S. Gas Utilities.

Renewable Power Generation: The segment recorded earnings of C$279 million, up from C$139 million in the prior-year quarter.

Eliminations and Other: The segment incurred a profit of C$176 million, up from C$82 million in the first quarter of 2023.

Distributable Cash Flow (DCF)

In first-quarter 2024, Enbridge reported a DCF of C$3.46 billion, up from the C$3.18 billion recorded a year ago.

Balance Sheet

At the end of the first quarter, ENB reported long-term debt of C$81.4 billion. It had cash and cash equivalents of C$1.39 billion. The current portion of long-term debt was C$5.9 billion.

Outlook

For 2024, the company reiterated its adjusted EBITDA guidance on base business of $16.6-$17.2 billion and DCF per share of $5.40 to $5.80.

Growth in 2024 is anticipated to be driven by contributions from recent acquisitions and assets placed into service and toll escalators, partially offset by lower Mainline tolls, higher financing costs and higher current income taxes.

Zacks Rank & Stocks to Consider

Currently, ENB carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector may look at some better-ranked stocks like Hess Corporation HES, SM Energy Company SM and Matador Resources Company MTDR. While Hess and SM Energy sport a Zacks Rank #1 (Strong Buy), Matador Resources carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hess operates primarily in two areas — the Bakken shale and the Stabroek project offshore Guyana. It is currently in the process of being acquired by supermajor Chevron in an all-stock deal worth $53 billion. HES currently has a Growth Score of B.

The Zacks Consensus Estimate for 2024 and 2025 EPS is pegged at $9.17 and $11.15, respectively. The company has witnessed upward earnings estimate revisions for 2025 in the past seven days.

SM Energy is set to expand its oil-centered operations in the coming years with an increasing focus on crude oil, especially in the Permian Basin and Eagle Ford regions. The company’s attractive oil and gas investments can create long-term value for shareholders.

The Zacks Consensus Estimate for SM’s 2024 EPS is pegged at $6.53. The company has a Zacks Style Score of B for Value. It has witnessed upward earnings estimate revisions for 2024 and 2025 in the past seven days.

Matador Resources’ upstream operations are primarily concentrated in the Delaware Basin, which is among the United States' most prolific oil and gas regions. The company has demonstrated a consistent upward trend in total production since 2019.

The Zacks Consensus Estimate for MTDR’s 2024 EPS is pegged at $7.67. The company has a Zacks Style Score of A for Value. It has witnessed upward earnings estimate revisions for 2024 and 2025 in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hess Corporation (HES) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

Enbridge Inc (ENB) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance