U.S. Consumer Sentiment Plummets in May: 5 Safe Stock Picks

The sentiment of American consumers on the economy has plunged in May. On May 10, the University of Michigan reported that the preliminary index of consumer sentiment tumbled to a reading of 67.4%. The consensus estimate was 76%. The final reading of April was also revised downward to 77.2% from 77.9%, as reported earlier.

May’s preliminary reading marks a 12.7% decline in month over month. The primary reason for this decline was a sharp increase in consumers’ expectations for the inflation rate.

The outlook for one-year inflation expectation jumped to 3.5%, indicating a month-over-month rise of 0.3% and the highest level since November 2023. Similarly, the outlook for five-year inflation expectation climbed to 3.1%, suggesting a month-over-month rise of 0.1% and the highest level since November 2023.

The current conditions sub-index, which measures consumers’ thinking about their current financial situation, dropped to 68.8% in May from 78.8% in April. The expectation sub-index, which measures consumer’s expectations for the next six months, declined to 66.5% in May from 76% in April.

According to the survey’s director, Joanne Hsu, “While consumers had been reserving judgment for the past few months, they now perceive negative developments on a number of dimensions. They expressed worries that inflation, unemployment and interest rates may all be moving in an unfavorable direction in the year ahead.”

A significant drop in consumer sentiment is awful for the U.S. economy. Weak sentiment may result in a contraction in consumer spending going forward. However, consumer spending is the biggest driver of the U.S. economy constituting more than 2/3 of the GDP. Low consumer spending may lead to a recession.

Another Similar Survey

On Apr 30, the Conference Board reported that consumer confidence deteriorated for the third consecutive month in April to 97%. The consensus estimate was 103.5%. The reading for March was also revised downward to 103.1% from 104.7% reported earlier.

The Present Situation Index — based on consumers’ assessment of current business and labor market conditions — declined to 142.9% in April from a downwardly revised 146.8% in March. The Expectations Index — based on consumers’ short-term outlook for income, business, and labor market conditions — fell to 66.4% from a slightly upwardly revised 74% last month. An Expectations Index reading below 80% often signals a forthcoming recession.

“Confidence retreated further in April, reaching its lowest level since July 2022 as consumers became less positive about the current labor market situation, and more concerned about future business conditions, job availability, and income.”, said Dana M. Peterson, Chief Economist at The Conference Board.

How to Invest?

At this stage, it will be prudent to invest in defensive stocks like consumer staples, utilities, and health care to safeguard one’s portfolio from volatile trading. We have narrowed our search to five such stocks with strong potential for the rest of 2024.

These stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

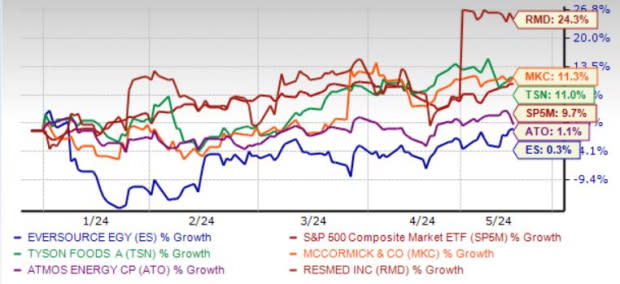

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Tyson Foods Inc. TSN is focused on executing fundamental strategies to maximize its multi-protein portfolio. TSN raised its adjusted operating income guidance for fiscal 2024, reflecting confidence in future performance.

With a diverse portfolio of core proteins and iconic brands, TSN continues to invest in brand building and innovation to drive long-term growth, domestically and internationally. The operational excellence of TSN remains another upside, with initiatives like plant closures and digitalization.

Tyson Foods has an expected revenue and earnings growth rate of 0.1% and 85.1%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 6.4% over the last 30 days.

McCormick & Company Inc.’s MKC recent success stems from its robust strategic initiatives, driving shares up against industry decline. With a global portfolio aligned with consumer trends and innovative product platforms, MKC's focus on growth areas and efficiency bolsters its market presence.

MKC projects continued growth, prioritizing investments and cost-saving programs. Despite challenges like cost inflation and volume declines, MKC’s acquisitions and efficiency programs promise margin expansion.

McCormick & Company has an expected revenue and earnings growth rate of 0.3% and 5.6%, respectively, for the current year (ending November 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last 60 days.

Atmos Energy Corp. ATO continues to benefit from rising demand, courtesy of an expanding customer base. ATO’s long-term investment plan will further help increase the safety and reliability of its natural gas pipelines.

ATO gains from industrial customer additions and constructive rate outcomes. Returns within a year of capital investment will further boost the company’s performance. ATO has enough liquidity to meet debt obligations.

Atmos Energy has an expected revenue and earnings growth rate of 9.5% and 9%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.8% over the last seven days.

Eversource Energy ES has long-term capital investment plans to expand its transmission and distribution infrastructure to provide reliable electricity and natural gas to its customers. The acquisition of NiSource’s gas assets will allow ES to expand its operations.

ES has plans to expand its water business through acquisitions and invest $1.1 billion in water operations during 2024-2038. ES’ stable performance allows it to continue with its shareholder-friendly moves.

Eversource Energy has an expected revenue and earnings growth rate of 9.5% and 9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last 60 days.

ResMed Inc. RMD benefits from the global supply of its cloud-connected platforms, AirSense10 and AirSense11. The strong uptake of the RMD’s myAir app with Air 11 is likely to drive higher adherence to therapy in patients.

RMD continues to see strong growth in the U.S. mask and accessories business, where resupply programs are powered by a digital health ecosystem, including AirView for physicians, Brightree for home care medical equipment providers, and myAir for patients. The MEDIFOX DAN business of RMD contributes to the robust organic growth of the SaaS business, raising optimism.

ResMed has an expected revenue and earnings growth rate of 10.4% and 17.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ResMed Inc. (RMD) : Free Stock Analysis Report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance