Top 3 Blue-Chip Picks as Dow Posts an Eight-Day Winning Run

U.S. stock markets regained momentum in May after a disappointing April. The 15-month impressive bull run of Wall Street ended last month. The Dow, despite participating in the bull run, always a lagged to its peers — the S&P 500 and the Nasdaq Composite.

However, things have taken a different turn in May. Month to date, the S&P 500 and the Nasdaq Composite are up 3.7% and 5%, respectively. The Dow is also up 4.5% in the same period. On May 10, the Dow — popularly known as Wall Street’s blue-chip index — posted an eight-day winning streak, for the first time since Dec 15, 2023.

For the week ended May 10, the Dow gained 2.25, marking its best week so far this year and the fourth positive week in a row. The S&P 500 and the Nasdaq Composite both posted the third consecutive winning week, rising 1.9% and 1.2%, respectively.

Dow Likely to Gather Momentum

The Dow recorded its all-time high of 39,889.05 on an intraday basis on Mar 21 and 39,807.37 on a closing basis on Mar 28. Technically, at its current level of 39,512.84, the Dow is well above its 50-day and 200-day moving averages of 38,748.71 and 36,503.03, respectively.

The 50-day moving average line is generally recognized as a short-term trendsetter in financial literature, while the 200-day moving average is considered a long-term trendsetter. Historically it has been noticed in the technical analysis space that whenever the 50-day moving average line surges ahead of the 200-day moving average line, a long-term uptrend for the asset (in this case the Dow Index) becomes a strong possibility.

Recent Restructuring of Dow

On Feb 26, the restructuring of the 30-stock index resulted in the exit of medical retailer Walgreens Boots Alliance Inc. (WBA) and the entry of the e-commerce super giant Amazon.com Inc. AMZN.

The inclusion of Amazon is seen as a strategic move to increase the blue-chip index’s exposure to new-economy stocks. Broadly, Amazon is categorized as a consumer discretionary company.

However, its massive adoption of high-end technologies compelled a large section of financial analysts to categorize it as a technology bigwig. Amazon’s entry will significantly increase the exposure of the blue-chip index in the e-commerce, consumer retail and technology space.

Our Top Picks

We have narrowed our search to three Dow stocks that have strong earnings growth potential for 2024. These stocks have seen positive earnings estimate revisions in the last 60 days. Finally, each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

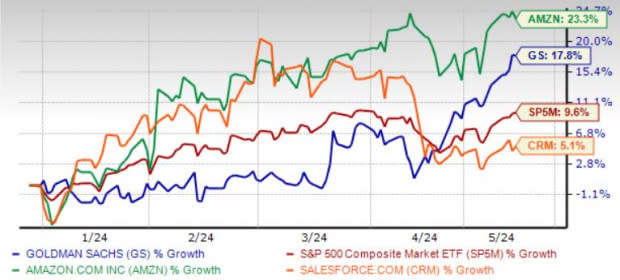

The chart below shows the price performance of our three picks year to date.

Image Source: Zacks Investment Research

Amazon is gaining on solid Prime momentum owing to ultrafast delivery services and a strong content portfolio. The strengthening relationship with third-party sellers is a positive. Additionally, the strong adoption rate of AWS is aiding AMZN’s cloud dominance. An expanding AWS services portfolio is continuously helping AMZN in gaining momentum among customers.

AMZN’s strong global presence and solid momentum among the small and medium businesses remain tailwinds. Growing capabilities in grocery, pharmacy, healthcare and autonomous driving are the other positives. A deepening focus on generative AI is a major plus.

Amazon.com has an expected revenue and earnings growth rate of 11% and 56.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 11.8% over the last 30 days.

salesforce.com inc. CRM is benefiting from a robust demand environment as customers are undergoing a major digital transformation. CRM’s sustained focus on aligning products with customer needs is driving the top line. Continued deal wins in the international market are also growth catalysts.

The buyout of Slack has positioned the company as a leader in enterprise team collaboration and improved CRM’s competitive standing versus Microsoft Teams. CRM’s strategy of continuously expanding generative AI offerings will help it tap the growing opportunities in the space.

salesforce.com has an expected revenue and earnings growth rate of 8.8% and 18.1%, respectively, for the current year (January 2025). The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 60 days.

The Goldman Sachs Group Inc. GS intends to refocus on the core strengths of investment banking (IB) and trading businesses. Improvement in global deal-making and underwriting activities and GS’ leading position are likely to offer leverage and drive IB fees. We expect the metric to grow 8.8% in 2024. Also, the decent liquidity of GS aids sustainable capital distribution.

The Goldman Sachs Group has an expected revenue and earnings growth rate of 12.1% and 60.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2% over the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance