Key highlights

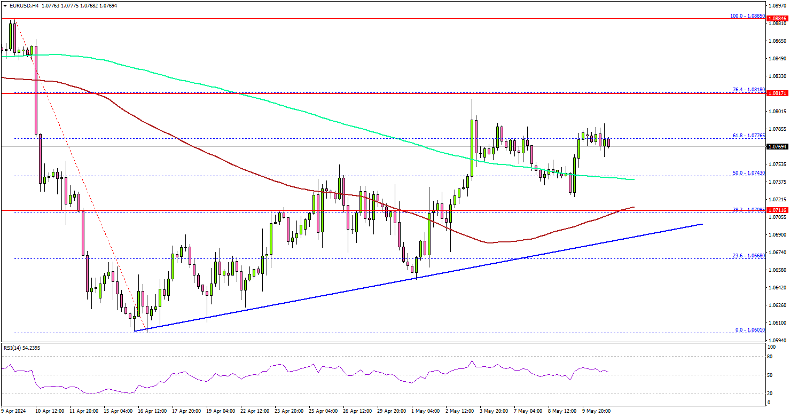

- EUR/USD started a decent increase and climbed above 1.0750.

- A key bullish trend line is forming with support at 1.0700 on the 4-hour chart.

EUR/USD technical analysis

Looking at the 4-hour chart, the pair surpassed the 50% Fib retracement level of the downward move from the 1.0885 swing high to the 1.0601 low. It also settled above the 100 simple moving average (red, 4-hour) and tested the 200 simple moving average (green, 4-hour).

The bears are now active near the 1.0800 level. The first major resistance is near 1.0820 or the 76.4% Fib retracement level of the downward move from the 1.0885 swing high to the 1.0601 low.

A clear move above the 1.0820 resistance might send it toward the 1.0865 level. Any more gains might call for a move toward the 1.0920 level in the near term.

Immediate support is near the 1.0740 level and the 200 simple moving average (green, 4-hour). The next major support is at 1.0720. There is also a key bullish trend line forming with support at 1.0700 on the same chart.

If there is a downside break below the 1.0720 support, the pair might test 1.0665. Any more losses might send the pair toward 1.0600.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

AUD/USD tumbles to six-day low and hovers around 0.6600

The Australian Dollar lost 0.20% against the US Dollar for the third straight day on Thursday as investors digested the latest S&P Global PMI report in the US, hinting the economy is reaccelerating. The AUD/USD trades around 0.6605.

EUR/USD slips further back on Thursday as rate cut hopes dry up

EUR/USD headed lower on Thursday, driven closer to the 1.0800 handle after an unexpected upswing in US Services PMI figures sparked renewed fears of fewer Fed rate cuts. This sent investors into the safe-haven US Dollar and deflated the Euro despite better-than-expected HCOB PMI figures earlier in the day.

Gold dives amid elevated US Treasury yields underpinned by strong US data

Gold price tanks for the third straight day on Thursday, refreshing one-week lows after economic data from the United States spurred a jump in US Treasury yields and boosted the US Dollar. The XAU/USD trades near $2,332, plunging 1.90% after reaching a high of $2,383.

SEC approves spot Ethereum ETFs after shocking U-turn

The US SEC approved spot ETH ETF applications on Thursday after initial delays. SEC surprisingly began to engage with issuers on Monday after weeks of silence. Ethereum may set a new all-time high as Bitcoin did after ETF approval.

Is the Federal Reserve just winging it?

Are the central bankers at the Federal Reserve just winging it? It sure seems that way if you step back and take a long view of their decision-making. Fed officials project this aura of authority.