Bridge Investment Group Holdings (NYSE:BRDG) Has Announced A Dividend Of $0.12

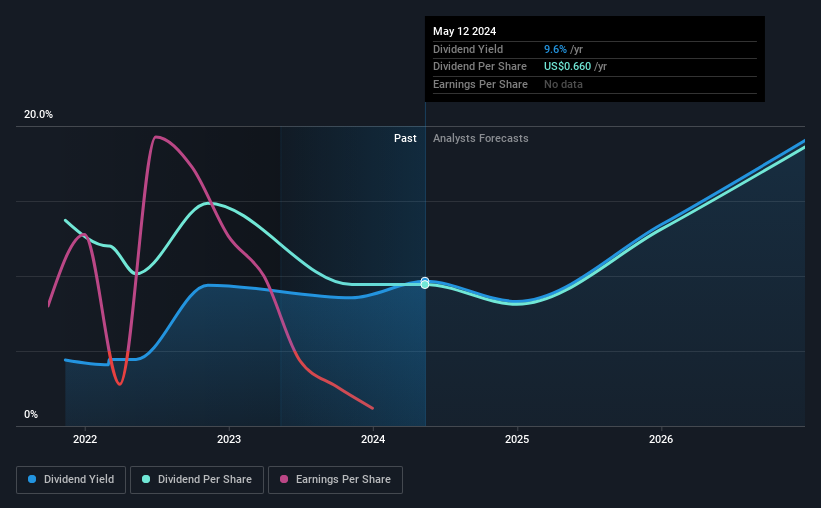

Bridge Investment Group Holdings Inc. (NYSE:BRDG) will pay a dividend of $0.12 on the 14th of June. The dividend yield of 9.6% is still a nice boost to shareholder returns, despite the cut.

View our latest analysis for Bridge Investment Group Holdings

Bridge Investment Group Holdings' Distributions May Be Difficult To Sustain

If the payments aren't sustainable, a high yield for a few years won't matter that much. While Bridge Investment Group Holdings is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. This gives us some comfort about the level of the dividend payments.

Over the next year, EPS might fall by 131.6% based on recent performance. This means that the company won't turn a profit over the next year, but with healthy cash flows at the moment the dividend could still be okay to continue.

Bridge Investment Group Holdings' Dividend Has Lacked Consistency

Looking back, the company hasn't been paying the most consistent dividend, but with such a short dividend history it could be too early to draw solid conclusions. The annual payment during the last 2 years was $0.96 in 2022, and the most recent fiscal year payment was $0.66. Dividend payments have fallen sharply, down 31% over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Bridge Investment Group Holdings' earnings per share has fallen 132% over the past year. Decreases in earnings as large as this could start to put some pressure on the dividend if they are sustained for several years. However, we would never make any decisions based on only a single year of data, especially when assessing long term dividend potential.

The Dividend Could Prove To Be Unreliable

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think Bridge Investment Group Holdings is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 3 warning signs for Bridge Investment Group Holdings that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance