Holley Rebrands

Holley designs, markets, and manufactures high-performance automotive aftermarket products such as fuel injection systems, tuners, and exhaust products. The firm’s portfolio features well-known brands, including Holley, APR, MSD, and Flowmaster. Beyond providing quality products, Holley has positioned itself as a consumer-first brand, driving innovation and fostering a solid M&A process to diversify its platform. Recently, the company underwent an organizational transformation to accelerate growth. Key hires have been made to strengthen the sales, marketing, and product strategy departments. Moreover, the company rebranded to ”Holley Performance Brands” to reinforce its presence within the high-performance automotive industry. An ongoing evaluation process is underway to eliminate nonvalue-added items and foster product innovation. Additionally, they have initiated an overhaul of the product launch process to increase the adoption rate of new products, ensuring they reach the target audience faster and more efficiently.Analysis of Holley’s Recent Financial Results

The first quarter saw a 7.9% decrease in net sales, falling to $158.6 million from $172.2 million the previous year. However, it came in slightly above the consensus estimate of $154.93 million. The contraction was primarily the result of increased inventory levels at the end of 2023, lower-than-anticipated holiday demand, and a softening consumer environment. Net income decreased to $3.7 million, a decline from $4.2 million for the first quarter of 2023. EPS of $0.03 per share missed consensus estimates of $0.05 and marked a decline from $0.04 per share from the previous year. Management has lowered guidance for the next quarter and 2024. Net sales for the second quarter are projected to be between $165 million and $175 million, slightly under consensus estimates of $183.09 million. Meanwhile, the full-year forecast of net sales in the range of $640 million to $680 million is still in line with the consensus, pegged at $661.56 million.What is the Price Target for HLLY Stock?

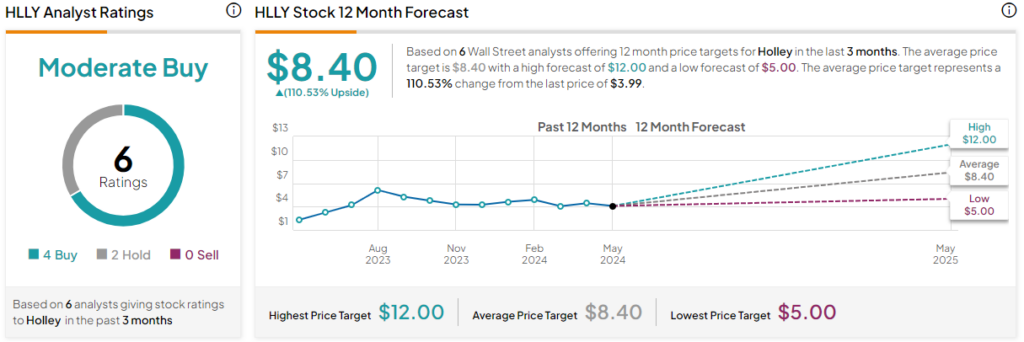

Analysts following the company have mostly been cautiously optimistic about the stock. For example, Canaccord analyst Brian McNamara recently lowered the price target on the stock from $9 to $8 while maintaining a Buy rating, citing new management’s recent steps are likely to mark a return of sustainable top-line growth. Holley is rated a Moderate Buy based on the recommendations and 12-month price targets six Wall Street analysts issued over the past three months. The average price target for HLLY stock is $8.40, representing a 110.53% upside from current levels. The stock has been trending down, shedding over -23% in the past 90 days. It trades at the lower end of its 52-week price range of $2.77-$8.06 and continues to show negative price momentum, trading below the 20-day (4.11) and 50-day (4.24) moving averages. Despite the slide in price, it appears relatively fairly valued, with a P/S ratio of 0.7x in line with the Auto Part industry average of 0.6x.