Bank of America (NYSE:BAC) is a prominent commercial and retail bank known for its retail locations throughout the United States and its wealth management subsidiary, Merrill Lynch. I’ve been bullish on BAC for some time and even owned it briefly in 2020 and 2022. However, I’m taking a more cautious stance now. The bank has some underlying issues with its capital allocation and balance sheet. Combine this with a low valuation and good business model, and I’m neutral on Bank of America stock.

Bank of America Is an Innately Good Bank

Bank of America is innately a good bank. Its sprawling retail locations and a trove of non-interest-bearing deposits give it a low cost of funds. Because the interest expense on its deposits and other liabilities are low, it’s fairly easy for management to lend out this cash at higher rates and earn a good spread. The company is also well-positioned in wealth management and has a good brand.

BAC’s Capital Allocation Hasn’t Been Ideal

Despite being an innately good bank, Bank of America has gotten into some trouble on the asset side of its balance sheet. First off, the bank invested enormous sums of money into held-to-maturity (HTM) debt securities in 2020 and 2021, when interest rates were at 5,000-year lows. You can see how a bank is allocating its capital by looking at the “investing activities” section of its cash flow statement. Here’s Bank of America’s cash flow statement for the years 2022, 2021, and 2020 (in that order):

Notice the huge negative numbers in 2021 and 2020? That means Bank of America was buying debt securities in these two years, and they were doing so at very low yields. Looking back, this was a really silly decision because interest rates quickly reverted to their 5000-year mean of around 5%. When interest rates rise, bond values fall. This resulted in enormous unrealized losses at Bank of America.

Today, Bank of America carries held-to-maturity securities on its balance valued at cost ($587 billion); however, at fair value, these securities are only worth $478 billion. This means Bank of America has a $109 billion unrealized loss. This doesn’t show up in the company’s book value or net income because it’s unrealized (it hasn’t been sold), but it’s there.

This $109 billion loss is also far more than Bank of America’s peers. Despite being larger banks in terms of assets, JPMorgan Chase and Citigroup had fewer paper losses on HTM bonds, at $27 billion and $21 billion, respectively.

The Balance Sheet Could Be Better

This $109 billion unrealized loss just adds to a balance sheet that isn’t particularly strong, in my opinion. For example, Bank of America’s CET1 ratio sits at just 11.8%, which is significantly less than other large-cap banks like Citigroup (NYSE:C) (13.5%) and JPMorgan Chase (NYSE:JPM) (15%). The bank is also less liquid and has a higher loans-to-deposits ratio.

In my opinion, Citigroup and JPMorgan Chase are unfairly subject to higher capital requirements because of their complexity and global presence. I believe Bank of America has a higher-risk balance sheet and some equally risky assets, such as U.S. commercial real estate loans, credit card loans, underwater HTM bonds, and mortgage-backed securities.

Also, while Europe and Asia experienced economic weakness in 2022 and 2023, the U.S. economy is now beginning to show some cracks.

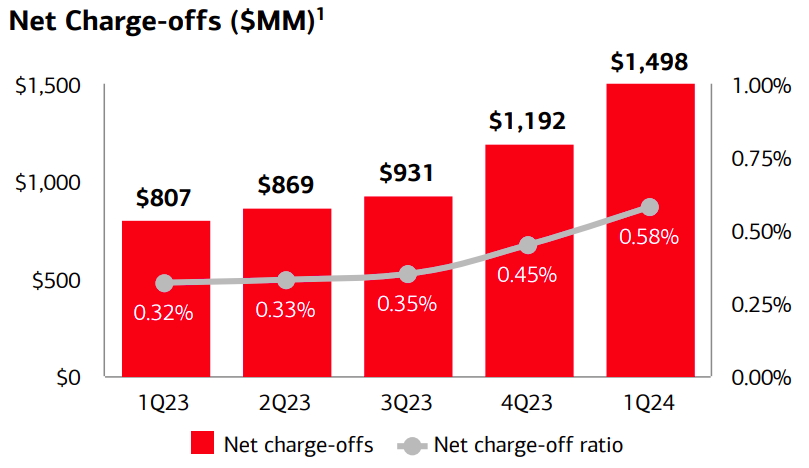

Bank of America is a U.S.-centric bank with limited international exposure. It has enjoyed very low default rates because the U.S. economy has been booming due to government stimulus. However, this is beginning to change now with Bank of America’s net charge-offs (loan defaults) rising, as you can see in the image below. Because of the weakness we’ve seen in Asia, South America, and Europe in recent years, I actually think these economies could begin to outgrow North America.

The Valuation Is Still Cheap

So with a relatively negative outlook for Bank of America, why am I neutral on the stock? Well, the valuation isn’t particularly high at 1.1x book value and a forward PE of 11.9x. Even if one were to normalize the company’s earnings, using its average return on assets, the equity isn’t expensive.

So, I expect Bank of America to experience some pain in the short term. But if the bank can improve its balance sheet and capital allocation, it could do okay in the long term.

Is BAC Stock a Buy, According to Analysts?

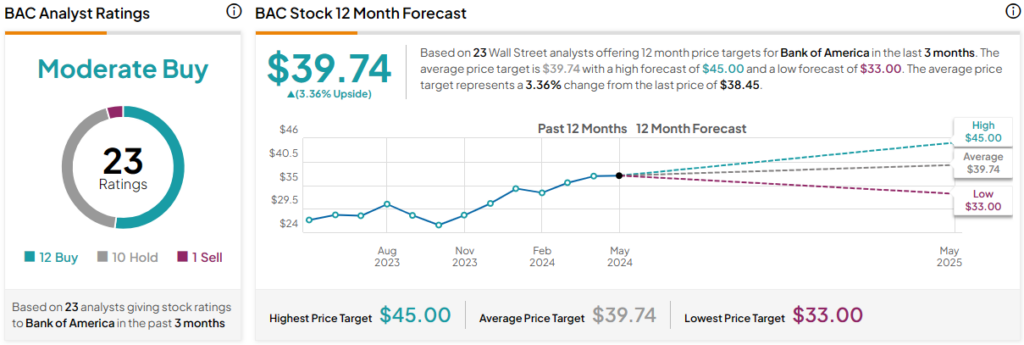

Currently, 12 out of 23 analysts covering BAC give it a Buy rating, resulting in a Moderate Buy consensus rating. The average Bank of America stock price target is $39.74, implying upside potential of 3.36%. Analyst price targets range from a low of $33.00 per share to a high of $45.00 per share.

The Bottom Line on BAC Stock

Bank of America’s valuation looks cheap on paper, but there are some underlying issues. The bank has $109 billion of paper losses on its HTM securities, along with a less liquid balance sheet and lower CET1 ratio than its larger peers. Also, Bank of America’s assets are concentrated in the United States, where loan defaults are rising. Consequently, I’m neutral on BAC stock despite its low valuation.