Insider Buying: EVP, CLO and General Counsel Timothy Donovan Acquires Shares of Vestis Corp (VSTS)

Timothy Donovan, the Executive Vice President, Chief Legal Officer, and General Counsel of Vestis Corp (NYSE:VSTS), purchased 12,975 shares of the company on May 10, 2024. The transaction was documented in a recent SEC Filing.

Vestis Corp operates in the retail sector, focusing on the sale of apparel and accessories. The company's commitment to expanding its market presence is evident through strategic initiatives and product diversification.

The shares were bought at a price of $11.57 each, totaling an investment of approximately $149,982.65. Following this transaction, the market cap of Vestis Corp stands at $1.51 billion.

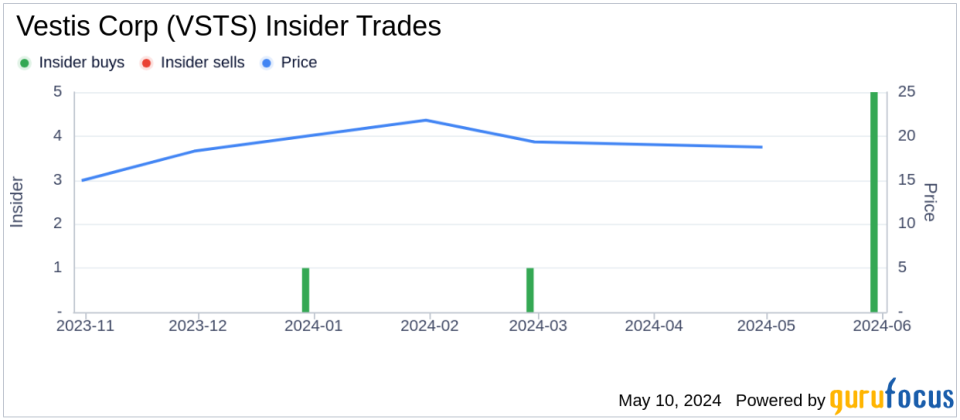

This purchase aligns with a broader trend of insider buying at Vestis Corp. Over the past year, there have been seven insider buys and no insider sells. The insider's recent acquisition reflects a continued confidence in the company's prospects.

The current price-earnings ratio of Vestis Corp is 15.85, which is below both the industry median of 18.13 and the company's historical median. This valuation metric suggests that the stock might be undervalued relative to its earnings potential.

For more detailed valuation metrics, investors might consider looking at the GF Value, which provides a deeper insight into the company's fair value considering historical trading prices, earnings, and growth rates.

The insider's recent purchase could be a signal to investors about the potential undervaluation or future growth prospects of Vestis Corp. As always, potential investors should conduct their own research or consult with financial experts before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance