Seer Inc (SEER) Q1 2024 Earnings: Revenue Declines but Losses Narrow, Meeting Some Analyst ...

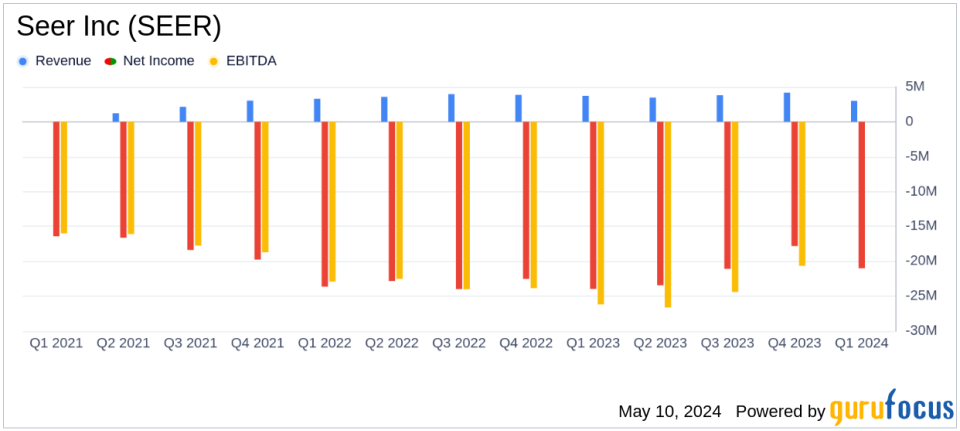

Revenue: Reported $3.1 million, a 24% decrease year-over-year from $4.1 million, falling short of the estimated $3.8 million.

Net Loss: Recorded at $20.7 million, an improvement from the previous year's $24.0 million, but still above the estimated net loss of $22.8 million.

Earnings Per Share (EPS): Stood at -$0.32, missing the estimated EPS of -$0.30.

Gross Margin: Achieved a gross margin of 44%, with a gross profit of $1.4 million.

Operating Expenses: Decreased to $26.6 million from $29.5 million in the prior year, reflecting a reduction in employee and stock-based compensation expenses.

Cash Reserves: Ended the quarter with substantial liquidity of $359.2 million in cash, cash equivalents, and investments.

Share Repurchase Program: Announced an open-market share repurchase program of up to $25 million.

On May 8, 2024, Seer Inc (NASDAQ:SEER), a pioneering life sciences company, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a revenue of $3.1 million, which shows a decrease from the previous year but aligns closely with analyst expectations of $3.8 million. The net loss improved to $20.7 million from a prior $24.0 million, reflecting a reduction in operating expenses and aligning with the anticipated loss per share of -$0.30.

About Seer Inc

Seer Inc is at the forefront of the biotechnology industry, focusing on revolutionizing proteomics through its Proteograph Product Suite. This suite, based on proprietary engineered nanoparticle technology, allows for deep, unbiased, and large-scale proteome analysis, which is crucial for advancing biomedical research and developing therapeutic strategies.

Financial Highlights and Strategic Initiatives

The reported quarter saw Seer Inc generating $3.1 million in revenue, a 24% decrease year-over-year, primarily due to lower product and related party revenues. Despite this, the company achieved a gross margin of 44%, with a gross profit of $1.4 million. This financial period also highlighted a decrease in operating expenses by 10% to $26.6 million, thanks to reduced employee compensation and laboratory costs.

Strategically, Seer Inc has expanded its Seer Technology Access Center (STAC) to Europe and launched the 2024 Seer Insights Grant Program, enhancing the accessibility of its Proteograph Product Suite. Additionally, the company has authorized a share repurchase program of up to $25 million, underscoring its confidence in its financial health and future prospects.

Analysis of Financial Statements

The balance sheet remains robust with $359.2 million in cash, cash equivalents, and investments. This strong liquidity position supports Seer's strategic initiatives and provides resilience against ongoing market challenges. The income statement reflects a disciplined approach to cost management, with significant reductions in key expense areas, contributing to a reduced net loss compared to the previous year.

Looking Ahead

For the full year 2024, Seer Inc expects revenue to be in the range of $16 million to $18 million, consistent with the revenue of 2023. This guidance reflects the company's cautious yet optimistic outlook towards achieving stable growth amidst dynamic market conditions.

In conclusion, Seer Inc's first quarter of 2024 illustrates a company navigating through revenue challenges while effectively managing its expenses and laying down strategic initiatives to bolster future growth. The alignment of its financial outcomes with analyst expectations and its strategic expansions are pivotal in its journey towards transforming proteomics research.

Explore the complete 8-K earnings release (here) from Seer Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance