Full House Resorts Inc. (FLL) Q1 Earnings: Misses Revenue Estimates, Reports Widening Losses

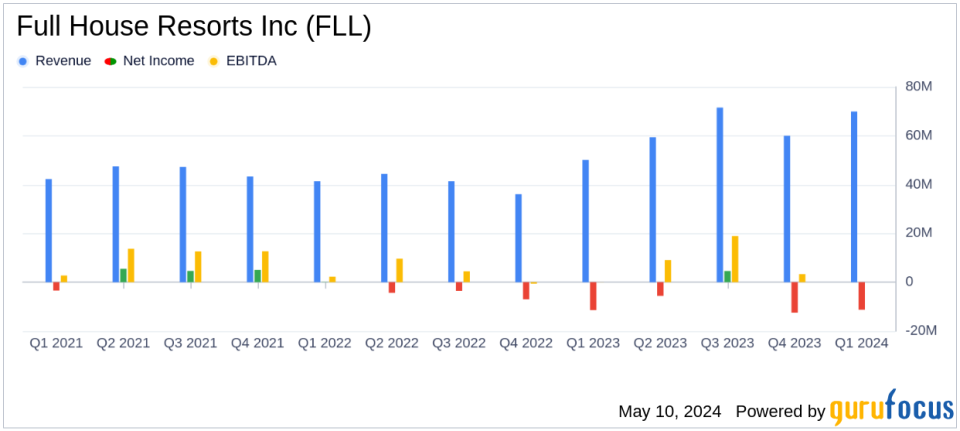

Revenue: Reached $69.9 million in Q1 2024, up 39.6% year-over-year, falling short of estimates of $76.65 million.

Net Loss: Reported at $11.3 million in Q1 2024, compared to a net loss of $11.4 million in the prior-year period, significantly above the estimated net loss of $5.97 million.

Earnings Per Share: Recorded at -$0.33, consistent with the previous year, and significantly below the estimated -$0.17.

Adjusted EBITDA: Increased by 22.6% to $12.4 million from $10.1 million in the prior-year period.

Liquidity: Held $46.3 million in cash and cash equivalents as of March 31, 2024.

Debt Profile: Reported $450.0 million in outstanding senior secured notes and $27.0 million outstanding under the revolving credit facility.

Operational Highlights: American Place and Chamonix Casino Hotel contributed to revenue growth with new facilities and amenities coming online.

On May 8, 2024, Full House Resorts Inc (NASDAQ:FLL) disclosed its first-quarter financial results through an 8-K filing, revealing significant insights into its operations and financial health. The company, known for its ownership and management of casino and related hospitality and entertainment facilities, reported a 39.6% increase in revenue, reaching $69.9 million for the quarter ended March 31, 2024, up from $50.1 million in the same period last year.

Company Overview

Full House Resorts Inc operates across several key segments, including Midwest & South, West, and Contracted Sports Wagering. The majority of its revenue is generated from the Midwest & South segment, which includes properties like Silver Slipper Casino and Hotel, Rising Star Casino Resort, and American Place. The West segment comprises Grand Lodge, Stockman's Casino, Bronco Billy's Casino and Hotel, and Chamonix Casino Hotel.

Financial Performance

The reported revenue, however, fell short of the analyst expectations which estimated revenues to be around $76.65 million. The net loss for the quarter was $11.3 million, or $(0.33) per diluted common share, consistent with the prior-year period but significantly below the analyst estimate of a net loss of $5.97 million. This loss includes substantial preopening costs and depreciation and amortization charges associated with the new American Place and Chamonix facilities.

Operational Highlights and Challenges

During the quarter, Full House Resorts saw substantial growth at American Place, celebrating its first anniversary with revenue reaching its highest at $25.8 million and Adjusted Property EBITDA at $7.4 million. The company also continued the phased opening of Chamonix Casino Hotel, enhancing its offerings with new hotel rooms and the launch of its high-end steakhouse, 980 Prime.

Despite these positive developments, the company faced challenges such as adverse weather conditions which impacted several of its markets. Additionally, the ongoing high costs associated with the opening and ramping up of new facilities have pressured the overall profitability.

Liquidity and Capital Resources

As of March 31, 2024, Full House Resorts reported having $46.3 million in cash and cash equivalents. The company's debt profile included $450.0 million in outstanding senior secured notes and $27.0 million under its revolving credit facility. This level of liquidity is crucial as the company continues to fund its expansion and manage operational costs.

Managements Perspective

"We had a strong quarter of growth, led by American Place," stated Daniel R. Lee, President and CEO of Full House Resorts. He highlighted the ongoing improvements and revenue growth at American Place and expressed confidence in the phased opening strategy for Chamonix, anticipating similar upward trends in revenue and profitability.

Future Outlook

Looking ahead, Full House Resorts is optimistic about the potential of its recent and ongoing projects. The full opening of Chamonixs amenities and the maturation of its customer base are expected to significantly contribute to future revenues and profitability. The company remains focused on enhancing its operational efficiencies and leveraging its expanded facilities to drive growth.

Investors and stakeholders will likely keep a close watch on how Full House Resorts manages its operational challenges and capitalizes on its growth initiatives in the coming quarters. For more detailed financial information and future updates, interested parties are encouraged to visit the investor relations section of Full House Resorts website.

Explore the complete 8-K earnings release (here) from Full House Resorts Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance