Akebia Therapeutics Reports Q1 2024 Financial Results: A Detailed Overview

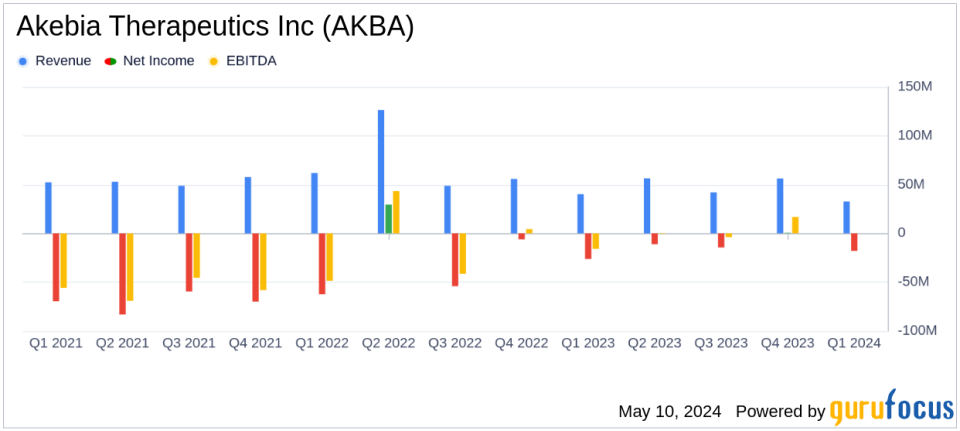

Revenue: Reported at $32.6 million for Q1 2024, a decrease from $40.0 million in Q1 2023, falling short of the estimated $46.09 million.

Net Product Revenue: Auryxia generated $31.0 million, down from $34.7 million in the previous year's first quarter.

Net Loss: Recorded at $18.0 million for the quarter, an improvement from a net loss of $26.9 million in Q1 2023, but still above the estimated net loss of $14.95 million.

Cost of Goods Sold (COGS): Decreased to $11.6 million from $20.2 million in the same quarter last year, reflecting improved cost management.

Research and Development Expenses: Lowered to $9.7 million from $19.7 million in Q1 2023, indicating a significant reduction in R&D spending.

Selling, General and Administrative Expenses: Slightly increased to $25.4 million from $25.1 million year-over-year.

Cash Position: Ended the quarter with $42.0 million in cash and cash equivalents, supporting operational sustainability for the next two years.

Akebia Therapeutics Inc (NASDAQ:AKBA) disclosed its financial outcomes for the first quarter of 2024 on May 9, 2024, through its 8-K filing. The company, a key player in the biopharmaceutical sector focusing on kidney disease therapies, reported a net loss of $18.0 million, a notable improvement from the $26.9 million loss in the same quarter the previous year. This financial snapshot provides insights into both the challenges and progress of Akebia Therapeutics.

Company Overview

Akebia Therapeutics Inc is dedicated to the development and commercialization of novel therapeutics for individuals suffering from kidney disease. Its portfolio includes Auryxia (ferric citrate), used to control serum phosphorus levels in patients with dialysis-dependent chronic kidney disease (CKD) and treat iron deficiency anemia in non-dialysis-dependent CKD patients. Another significant product is Vafseo (vadadustat), a recently FDA-approved treatment for anemia due to CKD in dialysis patients.

Financial Performance and Strategic Highlights

The company's total revenue for Q1 2024 was $32.6 million, down from $40.0 million in Q1 2023. This decrease was primarily due to lower license, collaboration, and other revenues, which dropped to $1.6 million from $5.3 million year over year. However, net product revenues from Auryxia were $31.0 million, slightly down from $34.7 million in the prior year's quarter. Akebia has reaffirmed its expectation of revenue growth for Auryxia in 2024 compared to 2023.

Significant reductions were seen in both cost of goods sold, which decreased to $11.6 million from $20.2 million, and research and development expenses, which were nearly halved to $9.7 million from $19.7 million. These reductions contributed to the improved net loss figure. Selling, general, and administrative expenses remained stable at approximately $25.4 million.

The company's strategic developments include the FDA approval of Vafseo and the initiation of launch activities, with commercial availability expected in January 2025. Akebia is also engaging in significant contracting discussions to ensure broad access to Auryxia starting January 2025, aligning with new CMS guidelines.

Analysis of Financial Health

Akebia's cash position at the end of Q1 2024 stood at approximately $42.0 million. The management believes that current cash reserves, along with expected operational cash flows, should sustain planned activities, including the Vafseo launch, for at least the next two years. This projection is crucial as it underscores the company's strategic financial planning aimed at maintaining stability through upcoming product launches and expansions.

Challenges and Forward-Looking Statements

Despite the promising developments, Akebia faces challenges, including the competitive landscape for its products and the inherent risks involved in launching new pharmaceutical products in a highly regulated market. The company's ability to successfully commercialize Vafseo and expand the market for Auryxia will be critical in determining its financial trajectory in the coming years.

In conclusion, Akebia Therapeutics Inc's first quarter of 2024 reflects a period of strategic realignment and anticipation of future growth, marked by significant regulatory approvals and operational scaling. Investors and stakeholders will likely watch closely as the company advances towards these milestones.

Explore the complete 8-K earnings release (here) from Akebia Therapeutics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance