TTEC Holdings Inc (TTEC) Reports Mixed Q1 2024 Results: Navigates Challenges While Meeting Key ...

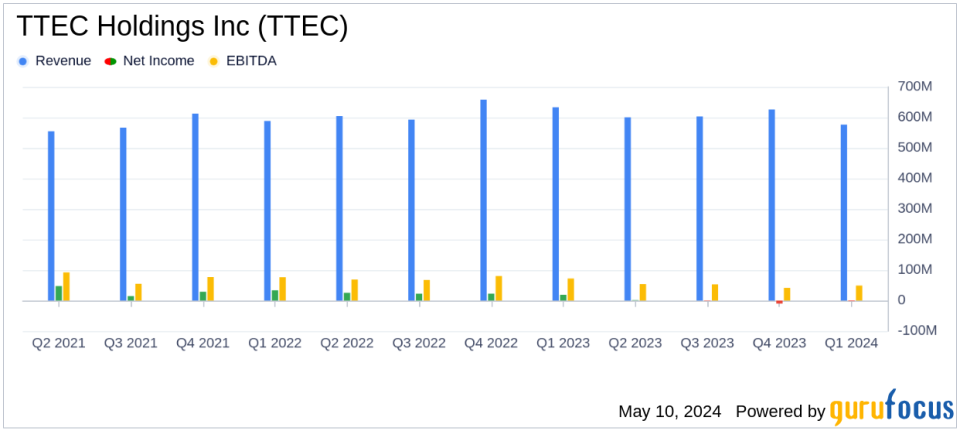

Revenue: Reported at $576.6 million, down 8.9% year-over-year, exceeding estimates of $557.60 million.

Net Income: Stood at $0.5 million, significantly below the estimated $15.98 million.

Earnings Per Share (EPS): Recorded at $0.01, markedly below the estimated $0.32 per share.

Operating Income: Was $22.7 million, representing 3.9% of revenue.

Adjusted EBITDA: Amounted to $54.9 million, or 9.5% of revenue.

Full-Year Revenue Outlook: Reaffirmed, with expected revenue between $2,275 million and $2,365 million.

Non-GAAP Adjusted EBITDA Outlook: Forecasted to be between $215 million and $259 million for the full year.

TTEC Holdings Inc (NASDAQ:TTEC), a leading global innovator in customer experience technology and services, disclosed its financial outcomes for the first quarter ended March 31, 2024. The company announced these results through its 8-K filing on May 8, 2024. Despite facing a challenging demand environment, TTEC met its initial quarter objectives, focusing on diversifying its client base and enhancing its technological capabilities.

Company Overview

TTEC Holdings Inc provides sophisticated customer engagement management tools and services. The company operates through two main segments: TTEC Digital and TTEC Engage. TTEC Digital focuses on developing customer experience strategies using cloud and on-premises solutions. TTEC Engage, which generates the majority of the revenue, offers solutions that enhance customer interaction and optimize customer experience, primarily in the United States and Canada, with significant operations in the Philippines, Asia-Pacific, and India.

Financial Performance Insights

For Q1 2024, TTEC reported a revenue of $576.6 million, a decrease of 8.9% from the previous year. This decline is significant as it fell short of the estimated revenue of $557.60 million. The company's operating income was reported at $22.7 million, or 3.9% of revenue, with a non-GAAP figure of $37.9 million, or 6.6% of revenue. Net income stood at a mere $0.5 million, or 0.1% of revenue, starkly lower than the estimated $15.98 million. This resulted in a fully diluted EPS of $0.01, with a non-GAAP EPS of $0.27, underperforming against the expected $0.32.

Strategic Developments and Segment Performance

Despite the financial downturn, TTEC has made strategic advancements, particularly in its TTEC Digital segment, which is gaining traction as a dominant partner in integrating contact center technology with CRM, AI, and analytics. The company has also been proactive in establishing over two dozen new client relationships, including several large enterprises poised for long-term growth. TTEC Engage continues to attract new enterprise clients, although it faces headwinds that the company anticipates overcoming in the latter half of the year.

Future Outlook and Management Commentary

Looking ahead, TTEC remains committed to improving its profit margins, particularly in the TTEC Engage segment. The company reiterates its full-year 2024 revenue guidance to be between $2,275 million and $2,365 million, with a mid-point of $2,320 million. Non-GAAP adjusted EBITDA is expected to range from $215 million to $259 million. Management expresses confidence in navigating the current challenges and capitalizing on the growth opportunities presented by the evolving customer experience landscape.

Conclusion

While TTEC Holdings Inc faced a tough quarter with significant declines in revenue and net income, the strategic initiatives underway and the robust pipeline in TTEC Digital suggest potential for recovery and growth. Investors and stakeholders will likely watch closely how the company maneuvers through the anticipated challenges and leverages its technological and service capabilities to enhance profitability in the upcoming quarters.

Explore the complete 8-K earnings release (here) from TTEC Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance