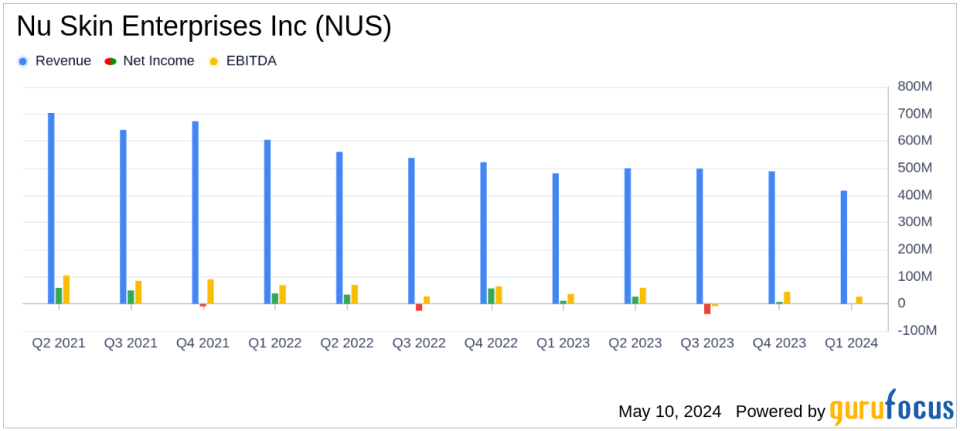

Nu Skin Enterprises Inc (NUS) Q1 Earnings: Aligns with EPS Projections Amidst Revenue Decline

Revenue: Reported at $417.3 million, down 13.3% year-over-year, below estimates of $453.02 million.

Net Income: Information on actual net income not provided in the earnings summary.

Earnings Per Share (EPS): Reported a GAAP EPS of $(0.01), below the estimated EPS of $0.34.

Gross Margin: Stood at 70.5%, a decrease from the previous year's 72.3%.

Operating Margin: Reported at 2.1%, or 3.8% excluding restructuring charges, compared to 3.3% or 5.4% in the prior year.

Rhyz Revenue: Increased by 57.5% to $62.5 million, indicating strong growth in this segment.

Customer and Affiliate Numbers: Customers decreased by 19% to 875,261, and paid affiliates decreased by 30% to 154,171.

On May 8, 2024, Nu Skin Enterprises Inc (NYSE:NUS) disclosed its first quarter results through an 8-K filing, revealing a challenging quarter that aligned with earnings per share (EPS) projections but saw a notable decline in revenue. The global health and beauty direct-selling company, which operates under the Nu Skin and Pharmanex brands, reported a downturn in sales amidst a tough macro-economic environment, though it achieved some growth in its Rhyz business segment.

Quarterly Financial Performance

Nu Skin's revenue for the first quarter of 2024 totaled $417.3 million, a decrease of 13.3% from the previous year's $481.5 million, influenced heavily by a 3.8% foreign exchange impact. This decline was slightly below the analyst estimates of $453.02 million. The company's EPS stood at $(0.01), or $0.09 excluding restructuring charges, which is consistent with the adjusted EPS forecast of $0.34 by analysts, considering the exclusion of one-time charges.

Operational Highlights and Challenges

The company experienced a decrease in key performance indicators such as the number of customers and paid affiliates, which dropped by 19% and 30% respectively. This reduction reflects the ongoing challenges in the global economic landscape affecting consumer spending. Despite these challenges, Nu Skin's Rhyz segment, which focuses on innovation within beauty, wellness, and lifestyle categories, grew by 57.5%, signaling a successful pivot towards emerging business areas.

Strategic Initiatives and Future Outlook

Nu Skin's management remains committed to navigating through the macro-economic challenges by continuing its business transformation efforts. According to CEO Ryan Napierski, the company is focused on developing an integrated beauty, wellness, and lifestyle ecosystem. For the upcoming quarters of 2024, Nu Skin projects a revenue range of $1.73 to $1.87 billion and an EPS range of $0.77 to $1.16, reflecting cautious optimism about recovering from current economic pressures.

Financial Health and Shareholder Value

The company's balance sheet remains robust with strategic initiatives aimed at enhancing shareholder value. During the quarter, Nu Skin paid dividends totaling $3.0 million and reported no new stock repurchases, keeping $162.4 million available for future buybacks. This approach underscores a balanced strategy of rewarding shareholders while maintaining financial flexibility.

Investor and Analyst Perspectives

While the first quarter results reflect the resilience of Nu Skin amidst challenging conditions, the alignment with EPS projections and strategies for recovery and growth may hold the interest of investors looking for long-term value. The detailed financial performance and strategic initiatives indicate a clear path forward as outlined by the management during their recent conference call, accessible through the company's investor relations page.

As Nu Skin continues to adapt to the global economic environment and refine its business model, investors and stakeholders will likely keep a close watch on the company's ability to sustain its dividend payments, manage operational costs, and leverage its Rhyz segment for future growth.

For more detailed information and to stay updated on Nu Skin's progress, visit the Investor Relations section of their website or follow ongoing reports and analyses on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Nu Skin Enterprises Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance