CION Invt Corp (CION) Reports Q1 2024 Earnings: A Detailed Analysis

Net Investment Income: Reported at $32.59 million for Q1 2024, significantly exceeding the estimated $23.15 million.

Total Investment Income: Reached $73.55 million, surpassing the estimated $57.17 million for the quarter.

Earnings Per Share (EPS): Recorded at $0.60, significantly higher than the estimated $0.43.

Net Asset Value Per Share: Decreased to $16.05 from $16.23 at the end of the previous quarter.

Portfolio Adjustments: Total investment portfolio valued at $1.74 billion, a decrease from $1.84 billion at the end of the previous quarter.

Dividend Increase: Quarterly base dividend raised to $0.36 per share, up from $0.34, reflecting a 5.9% increase.

Debt-to-Equity Ratio: Maintained at 1.24, consistent with the previous quarter.

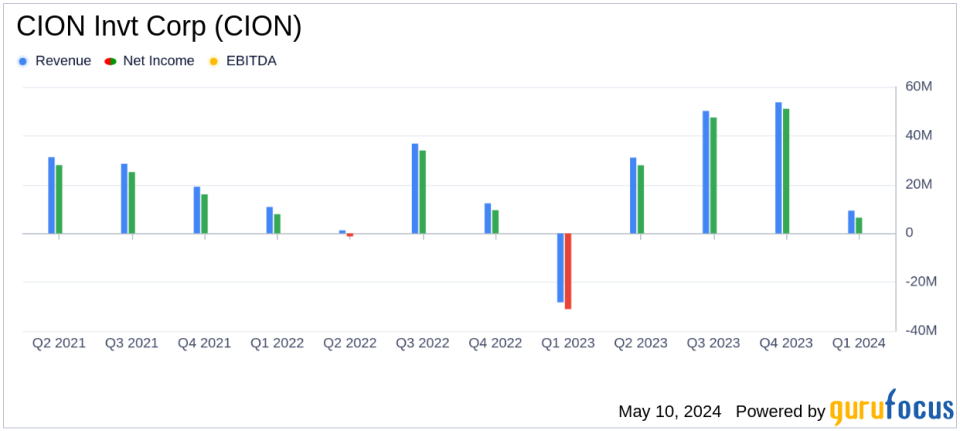

CION Invt Corp (NYSE:CION) released its 8-K filing on May 9, 2024, detailing its financial results for the first quarter ended March 31, 2024. The company, a prominent business development entity focusing on investments in U.S. middle-market companies, has demonstrated a robust operational performance this quarter, leading to a record quarterly net investment income and an increased second quarter 2024 base distribution of $0.36 per share.

Company Overview

CION Invt Corp operates as an externally managed, non-diversified, closed-end management investment company. It primarily invests in senior secured debt, including first lien, second lien, and unitranche loans. The company also makes investments in unsecured debt, equity, and other securities of private and thinly-traded U.S. middle-market companies. This strategic focus is designed to generate current income and, to a lesser extent, capital appreciation for its investors.

Financial Performance Insights

For the quarter ended March 31, 2024, CION reported a net investment income of $32.59 million, a significant increase from $21.76 million in the previous quarter. This growth was primarily fueled by additional investment income from origination and restructuring activities, alongside fees received from the repayment of portfolio investments. Total investment income for the period stood at $73.55 million, up from $60 million in the preceding quarter.

The company's operating expenses also rose to $40.96 million from $38.24 million, mainly due to higher advisory fees linked to the increase in total investment income. Despite these higher costs, the net increase in net assets resulting from operations was reported at $6.45 million, compared to $50.99 million in the previous quarter, influenced by net realized losses of $9.74 million and unrealized losses of $16.41 million during the quarter.

Portfolio and Investment Activity

As of March 31, 2024, CION's investment portfolio was valued at fair value at approximately $1.74 billion. The portfolio primarily consisted of senior secured first lien debt, which made up 84.2% of the portfolio. The company's investment activity during the quarter included $125.19 million in new investment commitments across 12 portfolio companies, with significant repayments amounting to $207.24 million.

The company's balance sheet remains strong with net assets standing at $863.06 million and a net asset value per share of $16.05. The debt-to-equity ratio was stable at 1.24, reflecting a conservative leverage position.

Strategic Developments and Future Outlook

Michael A. Reisner, co-Chief Executive Officer of CION, expressed optimism about the company's performance and its strategic position for future growth. The increase in the quarterly base dividend to $0.36 per share reflects confidence in the company's long-term earnings potential and robust distribution coverage.

The company's strategic focus on high-quality middle-market investments, combined with disciplined underwriting practices, positions it well to capitalize on market opportunities and deliver sustainable returns to shareholders.

Conclusion

CION Invt Corp's first quarter of 2024 illustrates a solid financial and operational performance, aligning closely with analyst expectations. The company's proactive management strategies and robust portfolio performance continue to support its commitment to delivering shareholder value through consistent income and prudent capital growth.

For detailed financial figures and further information, please refer to the full earnings report and supplementary materials available on CION's website.

Explore the complete 8-K earnings release (here) from CION Invt Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance