FIGS Inc (FIGS) Q1 2024 Earnings: Subdued Performance Amid Strategic Adjustments

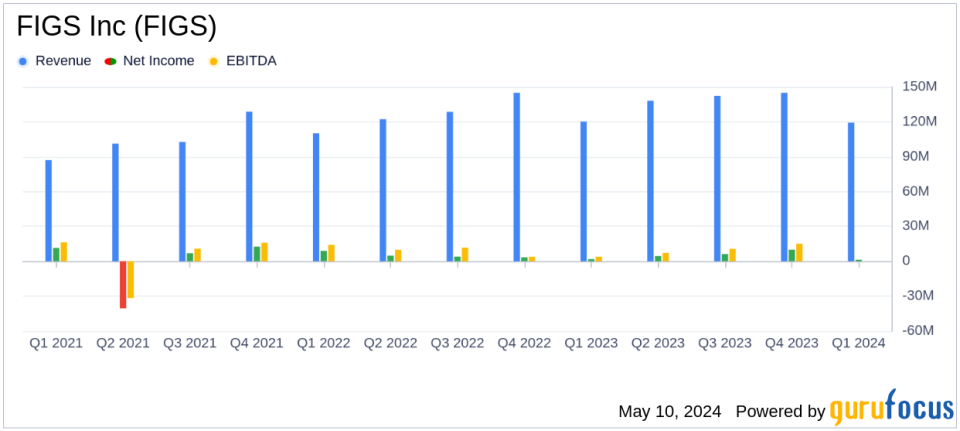

Revenue: Reported at $119.3 million, slightly above the estimated $117.54 million, showing a minor year-over-year decrease of 0.8%.

Net Income: Achieved $1.4 million, surpassing the estimated loss of $0.87 million, but reflecting a decrease from the previous year.

Earnings Per Share (EPS): Recorded at $0.01, exceeding the estimated $0.00.

Gross Margin: Declined to 68.9%, a drop of 2.4% from the previous year, primarily due to shifts in product mix.

Adjusted EBITDA: Fell to $13.0 million from the prior year, with the margin also decreasing to 10.9% from 13.4%.

Active Customers: Increased by 8.7% year-over-year to 2.6 million, indicating growth in customer base.

Average Order Value (AOV): Increased by 1.8% year-over-year to $116, driven by higher average unit retail and more units per transaction.

On May 9, 2024, FIGS Inc (NYSE:FIGS), a leading healthcare apparel brand, announced its financial results for the first quarter of 2024. The company released its 8-K filing, revealing a mix of achievements and challenges during the period. Despite a slight year-over-year decline in net revenues, FIGS managed to hit the upper end of its revenue outlook and exceed its adjusted EBITDA margin projections.

Company Overview

FIGS Inc is renowned for its specialized approach to healthcare apparel, offering a range of products from scrubs to lab coats, primarily through its digital platforms. The company's commitment to innovation and quality has positioned it as a key player in the apparel industry, catering to healthcare professionals across the United States.

Financial Performance Highlights

For Q1 2024, FIGS reported net revenues of $119.3 million, a slight decrease of 0.8% from the previous year, primarily due to a drop in orders which was somewhat offset by a higher average order value (AOV). The gross margin saw a decline to 68.9%, attributed to shifts in product mix. Operating expenses were slightly reduced to $81.7 million, maintaining consistency at 68.5% of net revenues, thanks to lower selling expenses balanced by increased general and administrative costs due to strategic investments in personnel.

Net income for the quarter stood at $1.4 million, or $0.01 per diluted share, marking a decrease from the previous year's figures. The net income margin was reported at 1.2%, a slight decrease from 1.6% in the same period last year. Adjusted EBITDA was $13.0 million, down by $3.1 million year-over-year, with the adjusted EBITDA margin at 10.9%, compared to 13.4% in the prior year.

Operational Metrics and Market Engagement

FIGS saw an 8.7% increase in active customers, totaling 2.6 million as of March 31, 2024. However, net revenues per active customer decreased by 2.8% year-over-year, and AOV increased by 1.8%, driven by higher unit prices and more units per transaction. These metrics indicate a mixed response to the company's offerings and pricing strategies.

Strategic Outlook and Adjustments

CEO Trina Spear highlighted the improved business momentum towards the end of Q1, driven by new product innovations and effective storytelling in marketing campaigns. In response to these positive trends, FIGS is increasing its investment in marketing to fuel further growth. Consequently, the company has raised its full-year revenue outlook but revised its adjusted EBITDA margin expectations.

Financial Stability and Future Prospects

Despite the challenges, FIGS remains focused on sustaining strong free cash flow to support long-term, sustainable profitable growth. The company's strategic adjustments and operational metrics suggest a cautious yet optimistic approach to navigating the current market dynamics.

As FIGS continues to innovate and adjust its strategies, investors and stakeholders will be watching closely to see how these changes translate into financial performance in the upcoming quarters.

Conference Call and Additional Information

FIGS management will further discuss the quarterly results and outlook in a conference call and webcast. Detailed financial tables and non-GAAP reconciliations can be found in the original earnings release and on the company's investor relations website.

This summary provides a comprehensive overview of FIGS Inc's performance in the first quarter of 2024, reflecting both the achievements and the areas requiring attention as the company progresses through a pivotal year.

Explore the complete 8-K earnings release (here) from FIGS Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance