TaskUs Inc (TASK) Q1 2024 Earnings: Mixed Results Amidst Challenging Conditions

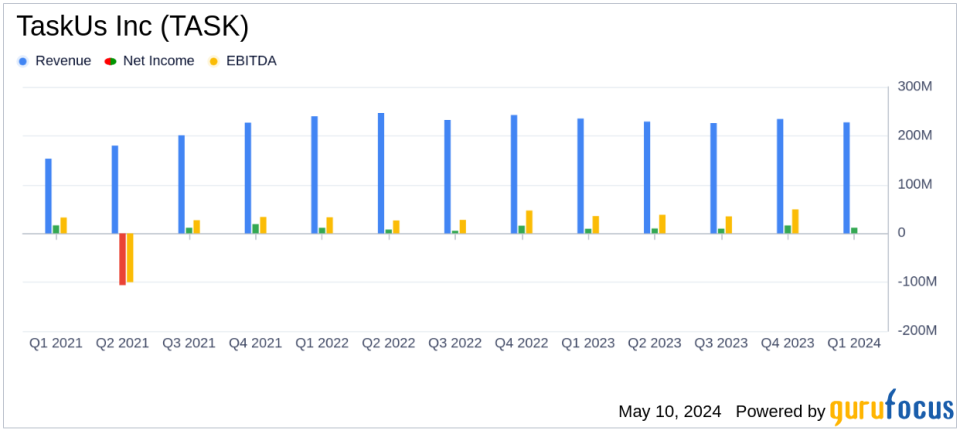

Revenue: Reported $227.5 million, slightly above estimates of $223.97 million.

Net Income: GAAP net income reached $11.7 million, significantly below the estimated $26.79 million.

Earnings Per Share (EPS): Non-GAAP Adjusted EPS was $0.30, slightly surpassing the estimated $0.29.

Free Cash Flow: Achieved $47.6 million, demonstrating strong operational efficiency with a 94.1% conversion of Adjusted EBITDA to Free Cash Flow.

Adjusted EBITDA: Recorded at $50.6 million with a margin of 22.2%, reflecting robust profitability metrics.

Workforce Expansion: Added 1,400 teammates, ending the quarter with a total of 49,600 employees.

Stock Activity: Repurchased 0.3 million shares, indicating confidence in the companys value and future prospects.

TaskUs Inc (NASDAQ:TASK) released its 8-K filing on May 8, 2024, disclosing the financial outcomes for the first quarter ended March 31, 2024. The company, a prominent provider of outsourced digital services and next-generation customer experiences, reported a total revenue of $227.5 million, surpassing the estimated $223.97 million. However, the non-GAAP adjusted net income of $27.3 million did not meet the anticipated $26.79 million, reflecting a mixed financial performance in a challenging macro environment.

Company Overview

TaskUs serves clients across dynamic sectors such as social media, e-commerce, gaming, and more, leveraging a global workforce of approximately 49,600 employees spread over 27 locations in 12 countries. The company's strategy focuses on integrating advanced technology and operational excellence to sustain its growth trajectory and competitive edge in the market.

Financial Performance Insights

TaskUs reported a GAAP net income of $11.7 million, marking a 23.2% increase from the previous year, with a net income margin of 5.1%. The diluted earnings per share (EPS) on a GAAP basis was $0.13, exceeding last year's $0.09. Despite these gains, the company saw a decline in non-GAAP adjusted net income and adjusted EPS, which came in at $0.30 compared to the previous year's $0.32, a decrease of 6.3%.

The company's adjusted EBITDA stood at $50.6 million with a margin of 22.2%, slightly down from the previous year's 23.4%. This decline reflects the ongoing investments and strategic initiatives undertaken by TaskUs to bolster its operational capacity and market reach.

Operational and Strategic Highlights

During the quarter, TaskUs expanded its global team by adding 1,400 employees, emphasizing its commitment to scaling operations and enhancing service delivery capabilities. The company also highlighted its recognition as a leader in various service categories by the Everest Group, underscoring its industry excellence and innovative approaches.

In terms of capital management, TaskUs repurchased 0.3 million shares and maintained a net debt to adjusted EBITDA leverage ratio of 0.4 times, demonstrating prudent financial stewardship and confidence in its business model.

Future Outlook and Management Commentary

Looking ahead, TaskUs has revised its full-year 2024 revenue projections to range between $925 million and $950 million, indicating a positive adjustment and a continued focus on growth. The company expects to return to year-over-year revenue growth starting from the second quarter of 2024.

"Our teams have continued to deliver in the face of an unpredictable macro environment. As a result of their efforts, we again outperformed the top end of our revenue and Adjusted EBITDA guidance," said Bryce Maddock, Co-Founder and CEO of TaskUs.

The company remains committed to its strategic investments and optimizing its cost structure to bolster its market position and financial health in the upcoming quarters.

Conclusion

TaskUs Inc's first quarter of 2024 reflects a resilient performance amidst economic uncertainties, with revenue exceeding expectations and a strategic focus on sustainable growth. Investors and stakeholders may look forward to the company's continued efforts to innovate and expand its global footprint in the digital services sector.

Explore the complete 8-K earnings release (here) from TaskUs Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance