PDF Solutions Inc (PDFS) Q1 2024 Earnings: Meets Analyst EPS Estimates, Reveals Modest Revenue ...

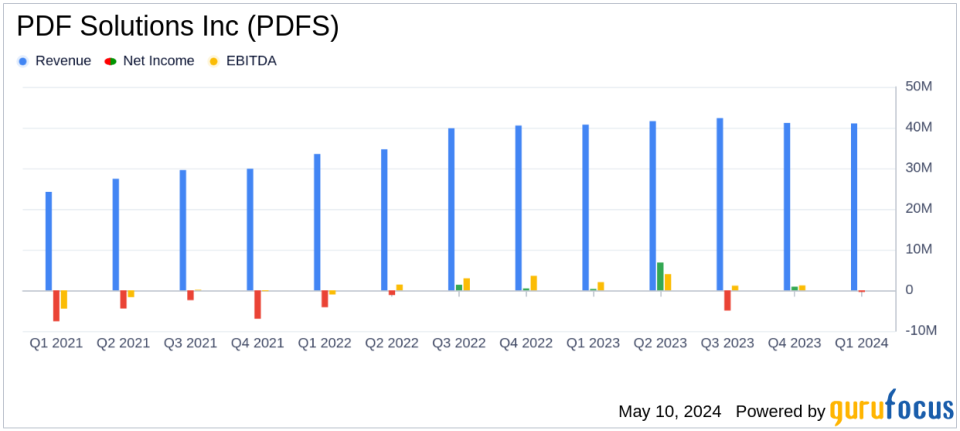

Revenue: Reported $41.3 million, a slight increase from $40.8 million in the same quarter last year, exceeding estimates of $40.76 million.

Non-GAAP Net Income: Achieved $5.7 million, or $0.15 per diluted share, meeting the estimated earnings per share of $0.15 and meeting the estimated net income of $5.52 million.

GAAP Gross Margin: Declined to 67% from 71% in the first quarter of the previous year.

Non-GAAP Gross Margin: Maintained at 72%, although down from 75% in the same quarter last year.

GAAP Net Loss: Recorded a net loss of $0.4 million, or ($0.01) per diluted share, compared to a net income of $0.4 million, or $0.01 per diluted share, in the first quarter of 2023.

Liquidity: Cash, cash equivalents, and short-term investments totaled $122.9 million as of March 31, 2024.

Future Outlook: Expects revenue growth of 20% in the second half of the year over the comparable period of the prior year.

On May 9, 2024, PDF Solutions Inc (NASDAQ:PDFS), a leader in data solutions for the semiconductor ecosystem, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a slight increase in total revenues, achieving $41.3 million, up from $40.8 million in the same quarter the previous year, aligning closely with analyst expectations of $40.76 million.

About PDF Solutions Inc

PDF Solutions Inc provides a broad range of products and services designed to enhance the performance and profitability of engineering and data science teams across the semiconductor sector. The company's offerings include proprietary software, physical IP for IC designs, electrical measurement hardware, and professional services, catering to a diverse clientele that includes IDMs, fabless companies, foundries, OSATs, and system houses.

Financial Performance Overview

The company's revenue composition for Q1 2024 included $38.5 million from analytics and $2.8 million from integrated yield ramp services. Despite a slight decline in analytics revenue from the previous quarter, the integrated yield ramp segment showed improvement. The GAAP gross margin stood at 67%, a decrease from 71% in Q1 2023, reflecting some cost pressures.

On a non-GAAP basis, PDF Solutions reported a net income of $5.7 million, or $0.15 per diluted share, consistent with the previous quarter and meeting the analyst EPS estimate of $0.15. This figure, however, represents a decrease from $7.3 million, or $0.19 per diluted share, in the same quarter last year.

Balance Sheet and Cash Flow Insights

As of March 31, 2024, PDF Solutions maintained a strong liquidity position with $122.9 million in cash, cash equivalents, and short-term investments. The balance sheet remains robust, with total assets amounting to $286.8 million. The company's financial stability is further underscored by a healthy equity ratio, with total stockholders' equity at $225.4 million.

Strategic Developments and Outlook

PDF Solutions' CEO, John Kibarian, highlighted the impact of strategic investments such as the DFI initiative, which contributed to new customer acquisitions and supported presales activities. The company anticipates a 20% revenue growth in the latter half of the year over the comparable period of the prior year, driven by its enhanced enterprise platform and MLOps products.

Analysis and Future Prospects

Despite facing a challenging macroeconomic environment, PDF Solutions has managed to sustain its revenue stream and continues to invest in strategic areas that promise growth. The alignment of Q1 results with analyst expectations reflects the company's operational resilience and strategic foresight in navigating market fluctuations.

The company's focus on expanding its analytics and yield ramp services, coupled with a robust financial position, positions it well to capitalize on the growing demand for advanced data solutions in the semiconductor industry. Investors and stakeholders may look forward to potential gains from the company's strategic initiatives aimed at long-term growth and profitability enhancement.

Explore the complete 8-K earnings release (here) from PDF Solutions Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance