Getty Images Holdings Inc (GETY) Q1 2024 Earnings: Navigating Challenges with a Focus on Growth

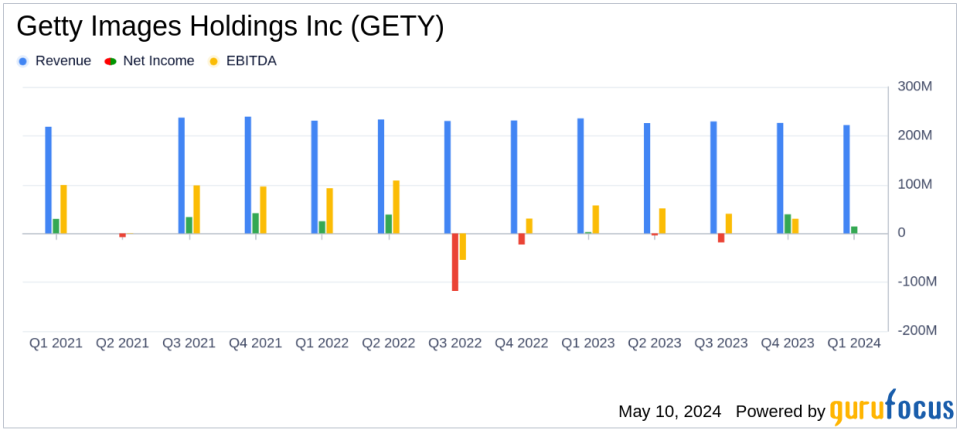

Revenue: Reported at $222.3 million, down 5.7% year-over-year, falling short of estimates of $225.5 million.

Net Income: Achieved $13.6 million, significantly exceeding the estimated $11.9 million.

Annual Subscription Revenue: Increased to 55.4% of total revenue, up from 50.7% in the previous year.

Adjusted EBITDA: Recorded at $70.2 million, a decrease of 7.9% year-over-year.

Free Cash Flow: Totaled $7.0 million, down from $16.4 million in the prior year period.

Net Cash from Operating Activities: Amounted to $21.5 million, compared to $31.9 million in the previous year.

Total Debt: Stood at $1.386 billion, including a voluntary repayment of $30 million on the USD term loan post-quarter.

On May 9, 2024, Getty Images Holdings Inc (NYSE:GETY) disclosed its first quarter earnings for the year, revealing a mix of challenges and strategic advancements. The company, a global leader in visual content creation and marketplace, released its earnings details in a recent 8-K filing. This report comes at a crucial time as the company navigates through what it anticipates to be a tough year, yet remains optimistic about returning to topline growth.

Company Overview

Getty Images Holdings Inc is renowned for its comprehensive visual content solutions which include a vast array of creative and editorial images and videos. The company has been at the forefront of integrating advanced technologies such as artificial intelligence and machine learning into its offerings, enhancing its e-commerce platforms, and expanding its content subscriptions. Operating globally, with a significant revenue generation from the Americas, Getty Images serves a diverse clientele, aiming to engage audiences through powerful visual content.

Financial Performance Insights

The first quarter of 2024 saw Getty Images reporting a revenue of $222.3 million, marking a decrease of 5.7% year-over-year. This decline was consistent across both reported and currency neutral bases. The dip in revenue was reflected across its creative and editorial segments, with creative revenue down by 5.2% and editorial revenue decreasing by 6.2%. Despite these decreases, the company achieved a significant milestone in its subscription services, with annual subscription revenue now comprising 55.4% of total revenue, up from 50.7% in the previous year.

Net income for the quarter stood at $13.6 million, a substantial increase from $3.2 million in Q1 2023. This improvement was largely due to a $16.4 million unrealized gain related to the fair value change of the companys euro term loan. The net income margin also improved, reaching 6.1% compared to 1.4% in the same period last year.

Operational Highlights and Strategic Moves

Getty Images has continued to expand its market presence through strategic partnerships and acquisitions. A notable development in Q1 was the acquisition of Motorsport Images, which enhances its existing offerings with a rich archive of automotive imagery. Furthermore, the company's collaboration with NVIDIA has bolstered its AI capabilities, introducing tools like Generative AI by iStock, which offers enterprise services for custom fine-tuning to specific brand visuals.

The company also highlighted its commitment to diversity and inclusion through the expansion of its Historically Black Colleges & Universities (HBCUs) Program, which supports the digitization of photographic libraries at these institutions.

Challenges and Forward-Looking Statements

Despite the positive strides in subscriber growth and strategic initiatives, Getty Images faced headwinds that impacted its financial results. The decrease in overall revenue and the challenges in the creative and editorial segments underscore the competitive and dynamic nature of the visual content market. However, the management remains confident in their strategic direction and the ability to leverage their advanced technological capabilities and diverse content portfolio to navigate these challenges effectively.

Looking ahead, Getty Images has reaffirmed its full-year 2024 guidance, projecting a revenue range of $928 million to $947 million, with a slight anticipated growth in revenue year-over-year. The company's focus remains on maintaining fiscal discipline and executing its strategic initiatives to achieve sustained growth.

For detailed insights and further information, Getty Images will be hosting a webcast and conference call to discuss the Q1 2024 results and address investor queries.

Conclusion

Getty Images Holdings Inc's first quarter of 2024 encapsulates a period of strategic repositioning and adaptation to market dynamics. While facing revenue challenges, the company's robust subscriber growth and strategic expansions highlight its potential for recovery and future growth. Investors and stakeholders will likely watch closely as Getty Images continues to evolve and adapt in the competitive landscape of global visual content.

Explore the complete 8-K earnings release (here) from Getty Images Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance