AvePoint Inc (AVPT) Q1 2024 Earnings: Revenue and Operating Income Surpass Expectations

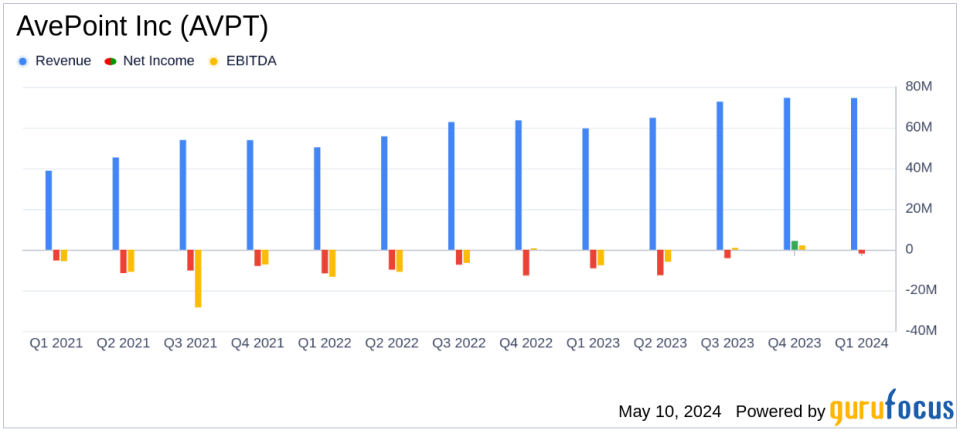

Total Revenue: $74.5 million, up 25% year-over-year, surpassing estimates of $72.33 million.

Net Loss: $1.95 million, an improvement from a net loss of $9.18 million in the same quarter last year, but compared unfavourably with the estimated net income of $2.67 million.

Earnings Per Share (EPS): -$0.01, below the estimated EPS of $0.01.

SaaS Revenue: $51.3 million, a significant increase of 44% year-over-year.

Non-GAAP Operating Income: $6.6 million, a notable improvement from a non-GAAP operating loss of $0.3 million in the first quarter of 2023.

Gross Margin: Non-GAAP gross margin increased to 74.1% from 71.5% year-over-year.

Cash Flow: Generated $7.8 million from operations, significantly higher than $1.3 million in the prior year period.

AvePoint Inc (NASDAQ:AVPT), a leader in Microsoft 365 data management solutions, announced its financial results for the first quarter ended March 31, 2024, revealing substantial year-over-year growth in both total and SaaS revenues. The company's detailed financial performance was disclosed in its recent 8-K filing.

Financial Performance Overview

In Q1 2024, AvePoint reported total revenue of $74.5 million, a 25% increase from $59.6 million in Q1 2023. This growth was significantly driven by its SaaS segment, which soared by 44% to $51.3 million. The company's Annual Recurring Revenue (ARR) also saw a robust increase, reaching $274.5 million, up 23% compared to the previous year. These figures not only reflect AvePoint's solid business model but also its ability to exceed the revenue estimates of $72.33 million projected by analysts.

The gross profit for the quarter stood at $54.1 million under GAAP and $55.2 million on a non-GAAP basis, with the non-GAAP gross margin improving to 74.1% from 71.5% in the prior year. This margin expansion underscores AvePoint's enhanced operational efficiency and cost management.

Operational Highlights and Future Outlook

Operational performance saw a significant turnaround with a GAAP operating loss narrowing to $(3.2) million from $(8.8) million in Q1 2023. Non-GAAP operating income was reported at $6.6 million, a substantial improvement from a non-GAAP operating loss of $(0.3) million last year. This reflects stringent cost control measures and an optimized operational strategy.

Looking ahead, AvePoint is optimistic about its future performance, raising its full-year guidance for total ARR, revenues, and non-GAAP operating income. For Q2 2024, the company anticipates revenues between $73.8 million and $75.8 million and a non-GAAP operating income ranging from $3.6 million to $4.6 million. For the full year, AvePoint expects total ARR to be between $316.8 million and $321.8 million, with total revenues projected to be between $314.3 million and $320.3 million.

Strategic Developments and Market Position

AvePoint continues to innovate and expand its product offerings, as evidenced by the addition of three new FedRAMP Authorized products and enhancements to its tyGraph for Microsoft 365. These developments not only enhance its product suite but also strengthen its competitive position in the data management and governance market.

The company's focus on strategic markets like the US Public Sector and global healthcare through compliance achievements like HITRUST CSF v11.0.1 further positions AvePoint as a leader in secure and compliant data solutions.

Conclusion

AvePoint's Q1 2024 results demonstrate a strong trajectory with significant revenue growth and operational improvements. The company's upward revision of its full-year outlook reflects confidence in its business strategy and market position. Investors and stakeholders may look forward to continued growth and innovation from AvePoint as it capitalizes on expanding market opportunities in data management and governance.

For detailed financial figures and further information, refer to AvePoint's official 8-K filing.

Explore the complete 8-K earnings release (here) from AvePoint Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance