Helios Technologies Reports Mixed Q1 2024 Results, Aligns with Analyst EPS Projections

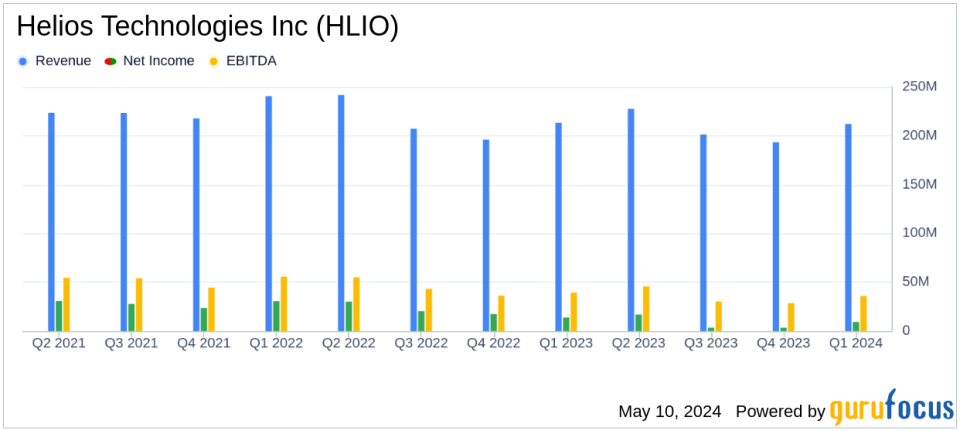

Revenue: Reported at $212.0 million, down 1% year-over-year, falling short of estimates of $216.30 million.

Net Income: Reached $9.2 million, a decrease of 34% from the previous year, below the estimated $19.10 million.

Earnings Per Share (EPS): Achieved $0.28, down from $0.42 year-over-year, significantly below the estimated $0.61.

Gross Margin: Declined to 31.7% from 33.3% year-over-year, a decrease of 160 basis points.

Operating Income: Totaled $20.3 million, down 18% from the previous year's $24.8 million.

Cash Flow from Operations: Increased to $17.8 million, up 45% compared to the year-ago period.

Debt Reduction: Continued focus on debt paydown as a capital allocation priority, with net debt reduced in the third sequential quarter.

On May 8, 2024, Helios Technologies Inc (NYSE:HLIO), a leader in engineered motion control and electronic controls technology, disclosed its first-quarter financial outcomes through an 8-K filing. The company, known for its innovative solutions in hydraulics and electronics across various industries, reported a revenue of $212 million, showcasing a 10% increase from the previous quarter but a slight decrease from the previous year's $213.2 million.

Helios Technologies operates through two primary segments: Hydraulics and Electronics. The Hydraulics segment, despite a year-over-year decline, saw a 7% sequential growth, while the Electronics segment increased by 17% sequentially and 6% over the previous year. This mixed performance highlights the company's resilience and adaptability in a dynamic market environment.

Financial Performance and Strategic Initiatives

The company achieved a diluted EPS of $0.28, aligning with analyst projections of $0.61 for non-GAAP EPS. Notably, the non-GAAP EPS saw a significant 40% increase from the previous quarter, underscoring strong operational improvements and cost management. Helios also continued its focus on reducing debt, marking the third consecutive quarter of net debt reduction, emphasizing its strategic priority in capital allocation for 2024.

President and CEO Josef Matosevic highlighted the company's robust start to the year, driven by disciplined cost management and operational efficiencies. Matosevic also noted the expansion into new markets such as commercial food service and water sensing solutions, which are expected to contribute to Helios's growth trajectory.

Challenges and Outlook

Despite the positive sequential growth, Helios faced challenges including a year-over-year decrease in net income and EPS, attributed to lower volumes and increased costs in materials and labor. The gross margin contracted by 160 basis points due to these factors. However, the company is affirming its full-year 2024 outlook, expecting continued growth and efficiency gains.

Chief Financial Officer Sean Bagan expressed confidence in achieving the 2024 financial goals, emphasizing the importance of operational leverage and sustainable working capital improvements. The company's proactive management strategies are pivotal in navigating the current economic landscape and achieving long-term success.

Investor and Analyst Perspectives

Helios Technologies' first-quarter results demonstrate a strategic balancing act of managing costs while investing in growth opportunities. The company's ability to maintain stable EPS amidst challenges and its strategic expansions into new markets are likely to hold the attention of investors and market analysts. As Helios continues to execute its growth strategies and enhance operational efficiencies, it remains a noteworthy contender in the industrial technology sector.

For detailed financial figures and future projections, stakeholders and potential investors are encouraged to view the full earnings report and participate in the upcoming webcast for a deeper dive into the company's strategies and market outlook.

Helios Technologies continues to exemplify resilience and strategic foresight in a fluctuating economic environment, making it a relevant entity for investors focusing on industrial innovation and market expansion.

Explore the complete 8-K earnings release (here) from Helios Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance