ADMA Biologics Inc (ADMA) Surpasses Analyst Revenue and Earnings Forecasts in Q1 2024

Revenue: Reported $81.9 million, a 44% increase year-over-year, surpassing estimates of $77.28 million.

Net Income: Achieved $17.8 million, a significant improvement from a net loss of $6.8 million year-over-year, exceeding estimates of $12.43 million.

Adjusted EBITDA: Reached $26.4 million, marking a 970% increase from the previous year.

Gross Margin: Improved to 48% in Q1 2024 from 29% in Q1 2023.

Future Revenue Guidance: Increased for FY 2024 to over $355 million and for FY 2025 to over $410 million.

Future Net Income Guidance: Raised to more than $85 million for FY 2024 and over $135 million for FY 2025.

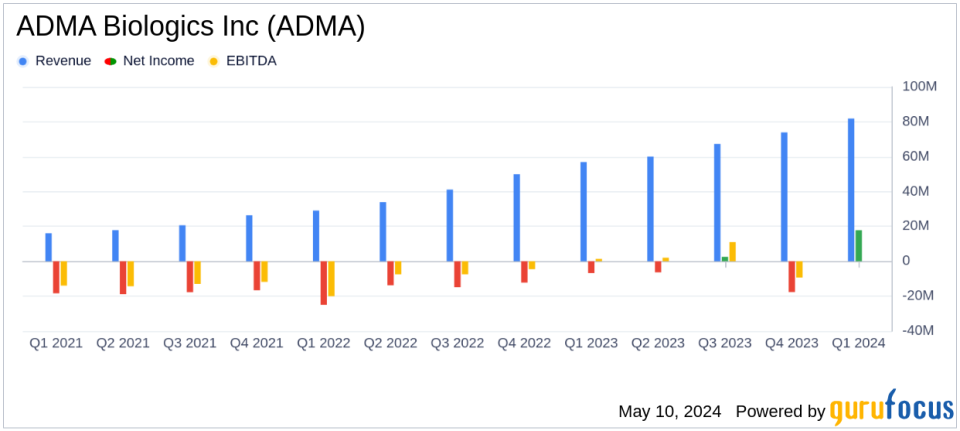

On May 9, 2024, ADMA Biologics Inc (NASDAQ:ADMA) released its first quarter financial results for 2024, showcasing a significant outperformance against analyst expectations. The company announced these details through its 8-K filing. ADMA Biologics, a prominent biopharmaceutical company focused on the manufacturing, marketing, and development of specialty plasma-derived biologics, reported a substantial year-over-year increase in revenue and net income.

Financial Highlights and Performance

For the first quarter ended March 31, 2024, ADMA Biologics reported total revenues of $81.9 million, marking a 44% increase from $56.9 million in the same period last year. This performance significantly exceeds the estimated revenue of $77.28 million projected by analysts. The increase was primarily driven by heightened sales of the company's immunoglobulin products.

The company also reported a GAAP net income of $17.8 million, a stark contrast to the net loss of $6.8 million recorded in the first quarter of 2023. This result substantially surpasses the estimated net income of $12.43 million. Adjusted EBITDA saw an impressive rise to $26.4 million, up from $2.5 million in the prior year, reflecting a 970% increase year-over-year.

ADMA's gross profit for the quarter stood at $39.1 million with a corporate gross margin of 48%, compared to $16.5 million and a 29% margin in the first quarter of 2023. The significant improvement in gross margin underscores the company's enhanced operational efficiency and cost management.

Strategic Initiatives and Market Positioning

According to Adam Grossman, President and CEO of ADMA, the company's robust quarterly performance is attributed to the record utilization of ASCENIV and the deepening market penetration of BIVIGAM in the U.S. immunoglobulin (IG) market. The company's strategic initiatives, including innovations in biologics production and advancements in its preclinical pipeline, are set to propel further growth.

ADMA has also revised its financial guidance upwards for the fiscal years 2024 and 2025, reflecting confidence in its continued commercial success and operational strategies. For FY 2024, the company now expects total revenue to exceed $355 million and net income to surpass $85 million. For FY 2025, revenue is anticipated to top $410 million with net income likely exceeding $135 million.

Advancing Growth Opportunities

The company highlighted its ongoing initiatives to combat S. pneumonia, a leading cause of community-acquired pneumonia in the U.S. ADMA's proprietary pneumococcal hyperimmune technology could potentially generate significant revenue, enhancing its market position in immune globulin therapies.

Financial Position and Outlook

As of March 31, 2024, ADMA reported a strong working capital position of approximately $223.3 million, supported by significant holdings in inventory and cash equivalents. This financial stability is crucial as the company scales up its operations and invests in growth initiatives.

Overall, ADMA Biologics Inc's first quarter results not only exceeded analyst expectations but also demonstrated the company's potential for sustained growth and profitability. With strategic expansions and a strong product pipeline, ADMA is well-positioned to capitalize on the increasing demand for specialized biologics in the healthcare sector.

Investor and Analyst Information

ADMA Biologics will host a conference call to discuss the quarterly results and provide further details on its strategic initiatives. Stakeholders are encouraged to participate or access the replay via the company's investor relations website.

For detailed financial figures and future projections, investors and interested parties are advised to review the full 8-K filing and tune into the upcoming webcast presentations.

Explore the complete 8-K earnings release (here) from ADMA Biologics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance