Privia Health Group Inc (PRVA) Q1 2024 Earnings: Mixed Results Amid Operational Growth

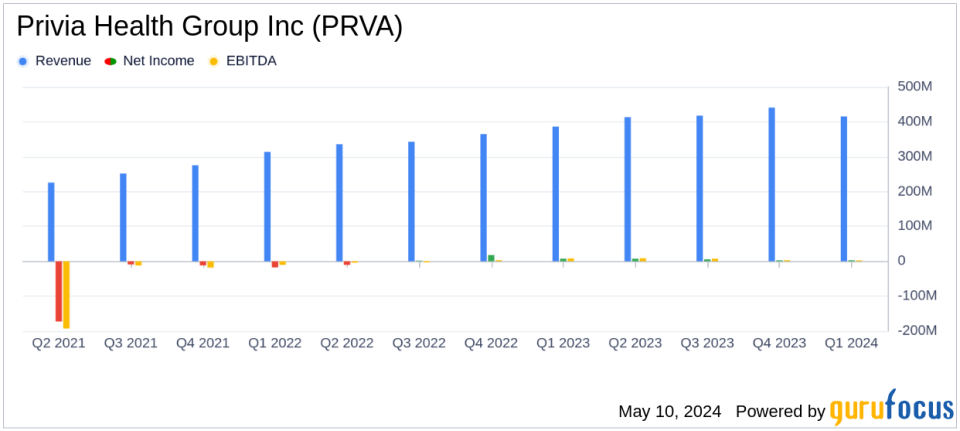

Total Revenue: Reached $415.2 million, up 7.5% from $386.3 million in the previous year, falling short of the estimated revenue of $703.83 million.

Gross Profit: Increased to $93.4 million, a 12.5% rise from $83.0 million year-over-year.

Operating Income: Declined significantly to $0.8 million, down 87.7% from $6.7 million in the prior year.

Net Income: Totaled $3.0 million, falling short of the estimated $7.76 million and down 59.3% from $7.3 million in the previous year.

Earnings Per Share (EPS): Reported at $0.03, below the estimated $0.06 and a 50% decrease from the prior year's $0.06.

Adjusted EBITDA: Increased by 18.1% to $19.9 million from $16.9 million in the prior year.

Implemented Providers: Grew by 17.3% to 4,359 providers from 3,716 in the previous year.

On May 9, 2024, Privia Health Group Inc (NASDAQ:PRVA) released its financial results for the first quarter of 2024, revealing a complex performance characterized by revenue growth but a significant dip in net income. The details of these results can be explored in their 8-K filing.

Privia Health, a technology-driven, national physician-enablement company, collaborates with various healthcare entities to enhance physician practices and patient experiences through both in-person and virtual care settings. This quarter, while the company showed promising growth in revenue and operational metrics, it faced challenges in net income and operating income.

Financial Performance Overview

For Q1 2024, Privia Health reported a total revenue of $415.2 million, marking a 7.5% increase from $386.3 million in the same quarter the previous year. This growth surpasses the analyst revenue estimates of $703.83 million for the current quarter. Gross profit saw a healthy increase of 12.5%, rising to $93.4 million from $83.0 million in Q1 2023.

However, the company's net income presented a stark contrast, totaling $3.0 million, a 59.3% decrease from $7.3 million in the prior year. This fall in net income is primarily attributed to a substantial $11.9 million in non-cash stock compensation expense. Earnings per share (EPS) also halved from $0.06 to $0.03, missing the estimated EPS of $0.06.

Operational Highlights and Strategic Growth

Privia Health's operational metrics indicated robust growth. The number of implemented providers increased by 17.3% year-over-year, reaching 4,359. The company also reported a 10.2% increase in value-based care attributed lives, now totaling 1,143,000. Practice collections grew by 7.4% to $707.7 million.

The company's adjusted EBITDA improved by 18.1%, amounting to $19.9 million, reflecting continued operational efficiency and effective management of resources. This financial metric is crucial as it provides a clearer picture of the companys operational performance by excluding non-recurring expenses and other non-cash charges.

Challenges and Forward-Looking Statements

Despite the revenue growth, the significant reduction in operating income, which plummeted by 87.7% to $0.8 million from $6.7 million, poses a challenge. This decrease highlights potential issues in cost management and operational efficiency that could impact future profitability.

Privia Health has reiterated its full-year 2024 guidance, projecting a stable growth trajectory. The guidance anticipates an increase in care margin and adjusted EBITDA, signaling confidence in the company's strategic initiatives and operational adjustments.

Conclusion

Privia Health's first quarter of 2024 illustrates a mixed financial landscape with significant revenue growth shadowed by challenges in net income and operating income. As the company continues to expand its provider base and improve its technology-driven platform, it remains poised to refine its strategies to enhance profitability and shareholder value. Investors and stakeholders will likely watch closely how Privia navigates its operational and financial hurdles in the upcoming quarters.

For more detailed information and to stay updated on Privia Health's progress, visit their investor relations website or join their upcoming earnings call, details of which can be found on their official website.

Explore the complete 8-K earnings release (here) from Privia Health Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance