First Advantage Corp (FA) Q1 2024 Earnings: Misses Revenue Expectations and Reports Net Loss

Revenue: Reported at $169.4 million, falling short of the estimated $186.67 million.

Net Loss: Recorded a net loss of $2.9 million, significantly below contrary to the estimated net income of $31.47 million.

Adjusted Net Income: Achieved $24.8 million, contrasting the GAAP net loss and exceeding analyst net income expectations.

Adjusted EBITDA: Reached $46.6 million, demonstrating operational efficiency despite a revenue shortfall.

Adjusted Diluted EPS: Posted at $0.17, falling short of the estimated $0.22 per share.

Cash Flow: Generated $38.3 million from operations, indicating strong cash-generating capability.

Guidance: Reaffirmed full-year 2024 revenue guidance of $750 million to $800 million and adjusted EPS of $0.88 to $0.98.

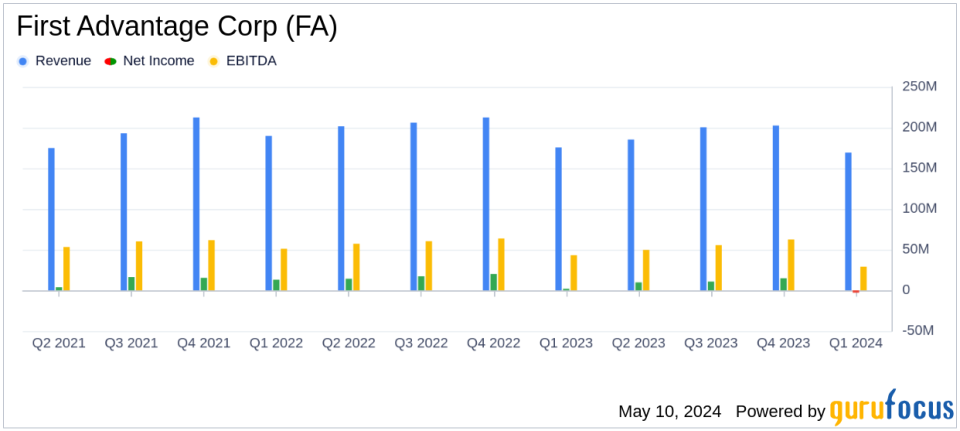

On May 9, 2024, First Advantage Corp (NASDAQ:FA), a leader in employment background screening and verification solutions, disclosed its financial outcomes for the first quarter ended March 31, 2024, through an 8-K filing. The company reported a decrease in revenues and a net loss, attributing significant costs to the ongoing acquisition of Sterling Check Corp.

Company Overview

First Advantage Corp operates primarily through two segments: Americas and International. The company offers a range of technology solutions for screening, verifications, safety, and compliance. It generates most of its revenue from the Americas, providing services that help manage risk and facilitate the hiring of talent.

Financial Performance

The company posted revenues of $169.4 million for Q1 2024, down 3.5% from $175.5 million in the same quarter the previous year, falling short of the estimated $186.67 million. The net loss stood at $2.9 million compared to a net income of $1.9 million in Q1 2023. This loss includes $11.1 million in costs related to the Sterling acquisition. Adjusted net income was $24.8 million, and adjusted EBITDA reached $46.6 million.

Strategic Developments and Management Commentary

CEO Scott Staples highlighted the strategic initiatives, including the adoption of generative AI and machine learning, and the development of new solutions like RightID for identity fraud prevention. "We delivered first quarter financial results at-or-above what we communicated on our fourth quarter earnings call...," said Staples. He also noted the progress in the Sterling acquisition, aimed at enhancing their service offerings.

David Gamsey, EVP and CFO, reaffirmed the 2024 full-year guidance, expecting revenues between $750 million and $800 million and adjusted EBITDA between $228 million and $248 million. The guidance reflects the anticipation of stable macroeconomic conditions and a potential recovery towards the year's end.

Financial Health and Future Outlook

As of March 31, 2024, First Advantage had $245.4 million in cash and equivalents, with total debt standing at $564.7 million. The company generated $38.3 million in cash flow from operations during the quarter. The ongoing integration with Sterling is expected to drive future growth and operational synergies.

The company's performance this quarter reflects the challenges of significant acquisition-related expenses impacting net earnings. However, the reaffirmed guidance and strategic initiatives indicate management's confidence in the company's direction and operational stability.

Investor and Analyst Information

First Advantage will host a conference call to discuss the Q1 2024 results and provide further details on its strategic initiatives and financial health. The call aims to provide investors and analysts with insights into the company's operations and future plans.

For detailed financial figures and future updates, stakeholders are encouraged to refer to the official documents and announcements directly from First Advantage.

Explore the complete 8-K earnings release (here) from First Advantage Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance