Tecnoglass Inc. (TGLS) Q1 2024 Earnings: Misses on EPS and Net Income, Revenue Slightly Above ...

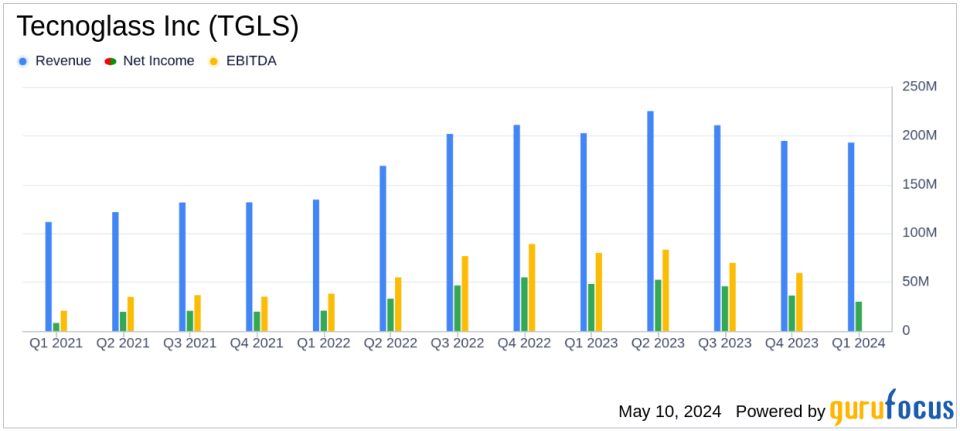

Revenue: Reported at $192.6 million, slightly above estimates of $191.04 million.

Net Income: Recorded at $29.7 million, falling short of estimates of $31.74 million.

Earnings Per Share (EPS): Achieved $0.63 per diluted share, below the estimated $0.67.

Adjusted EBITDA: Reached $51.0 million, representing 26.5% of revenues.

Cash Flow: Strong cash flow from operations at $33.4 million, representing 65% of Adjusted EBITDA.

Backlog: Continued to expand, reaching a record $916 million, up 18% year-over-year.

Net Leverage Ratio: Maintained an all-time record low of 0.1x at quarter end.

Tecnoglass Inc. (NYSE:TGLS), a prominent player in the architectural glass and windows industry, released its financial results for the first quarter ended March 31, 2024, through an 8-K filing on May 9, 2024. The company, known for its high-end aluminum and vinyl windows and architectural glass, reported a revenue of $192.6 million, surpassing the estimated $191.04 million by analysts. However, the earnings per share (EPS) of $0.63 and net income of $29.7 million fell short of expectations, with estimates at $0.67 EPS and $31.74 million net income respectively.

Company Overview

Tecnoglass Inc. operates primarily in the United States, accounting for 95% of its revenues, with its manufacturing base in Barranquilla, Colombia. The company's products, which include tempered, laminated, insulating, and Solar Control Low-E glass, are integral to various high-profile properties across the globe.

Financial Performance Insights

The first quarter of 2024 saw Tecnoglass achieving a slight increase in revenue compared to analyst expectations, attributed to robust commercial revenues aligned with scheduled project deliveries. However, the company faced challenges in the single-family residential sector due to inflationary pressures impacting consumer spending. This sector saw a decrease in activity, influenced by higher interest and mortgage rates, which also contributed to a year-over-year decline in net income and EPS.

Gross profit for Q1 2024 stood at $74.7 million with a gross margin of 38.8%, a significant decrease from the 53.2% margin reported in the same period last year. This decline was largely due to unfavorable foreign exchange impacts, reduced operating leverage, and an increased mix of installation and stand-alone product sales.

Adjusted EBITDA was $51.0 million, or 26.5% of total revenues, reflecting a decrease from $85.8 million, or 42.4% of total revenues in the prior year quarter. This was primarily due to the aforementioned factors impacting gross margin as well as lower year-over-year revenues.

Strategic Moves and Future Outlook

Despite the macroeconomic headwinds, Tecnoglass reported a record low net leverage ratio of 0.1x at the quarter's end and a strong cash flow from operations of $33.4 million. The company's backlog continued its record trajectory, expanding 18% year-over-year to $916 million, providing visibility well into 2025 and indicating potential for sustained growth.

For the full year 2024, Tecnoglass anticipates revenue growth with a projected full year revenue of $875 million and adjusted EBITDA of $267 million, considering various market and company-specific dynamics.

Management Commentary

CEO Jose Manuel Daes highlighted the resilience of the team amidst economic challenges and expressed optimism about the future, citing record levels of single-family residential orders and strong quoting activity for vinyl products. COO Christian Daes also emphasized the adaptability of the company in a dynamic operating landscape and confidence in driving further value creation through strategic investments and robust manufacturing capabilities.

Conclusion

While Tecnoglass faced several challenges in the first quarter of 2024, its strategic positioning and strong backlog suggest potential for recovery and growth in the upcoming periods. Investors and stakeholders will likely watch closely how the company navigates the macroeconomic environment and capitalizes on its strategic initiatives to enhance shareholder value.

Explore the complete 8-K earnings release (here) from Tecnoglass Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance