GoodRx Holdings Inc (GDRX) Q1 2024 Earnings: Navigates Market Challenges with Strategic Adjustments

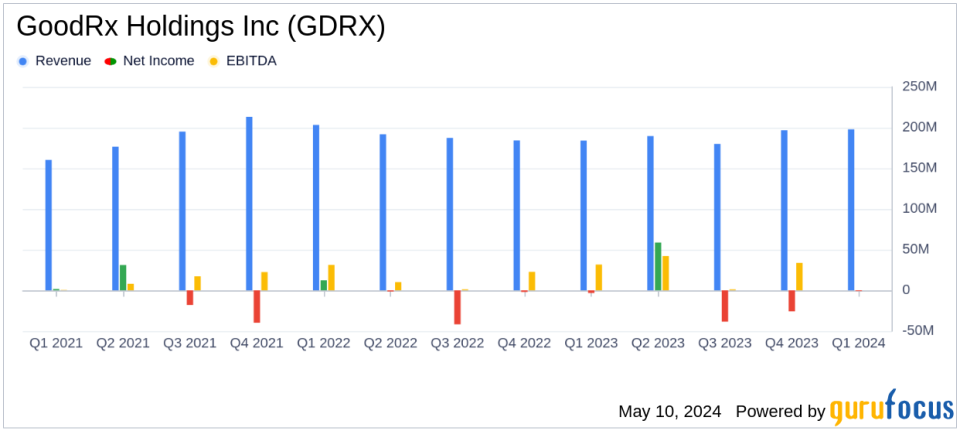

Revenue: Reported at $197.9 million, an increase of 8% year-over-year, slightly exceeding estimates of $196.08 million.

Net Loss: Recorded a net loss of $1.0 million, improving from a net loss of $3.3 million in the previous year, but compares with the estimated net income of $31.35 million.

Adjusted Net Income: Achieved $32.6 million, surpassing the estimated $31.35 million.

Adjusted EBITDA: Rose to $62.8 million from $53.2 million last year, with an Adjusted EBITDA Margin of 31.7%.

Cash Flow: Net cash provided by operating activities increased to $42.6 million, up from $32.3 million in the prior year.

Share Repurchases: Repurchased 21.3 million shares of Class A common stock for $154.8 million during the quarter.

Guidance: For Q2 2024, anticipates revenue of approximately $200 million, indicating a 5% year-over-year growth; full-year revenue guidance adjusted to $800 million to $810 million.

On May 9, 2024, GoodRx Holdings Inc (NASDAQ:GDRX), a leading digital healthcare platform in the U.S., disclosed its financial outcomes for the first quarter of 2024 through its 8-K filing. The company reported a revenue of $197.9 million, closely aligning with analyst expectations and marking an 8% increase from the previous year's $184.0 million. Despite facing a net loss of $1.0 million, GoodRx showcased a significant improvement from a $3.3 million loss in the same quarter the previous year.

Company Overview

GoodRx Holdings Inc operates a consumer-focused digital healthcare platform designed to make healthcare more affordable in the U.S. The platform offers a comprehensive price comparison tool for prescriptions, allowing consumers to access lower drug prices through negotiated rates and discounts. GoodRx's revenue streams include partnerships with pharmacy benefit managers, subscriptions, and telehealth services, among other healthcare offerings.

Financial and Operational Highlights

The first quarter saw GoodRx continue its trajectory towards operational efficiency and market expansion. Prescription transactions, which remain a core revenue driver, increased by 10% due to growth in Monthly Active Consumers. However, subscription revenue saw a decline of 6%, influenced by the phase-out of the Kroger Savings Club. Notably, the company's pharma manufacturer solutions revenue grew by 20%, underscoring its expanding market penetration.

Cost management also improved, with a 25% reduction in cost of revenues, contributing to a healthier margin profile. Adjusted EBITDA stood at $62.8 million, up from $53.2 million in the prior year, reflecting an Adjusted EBITDA Margin of 31.7%. This profitability metric highlights GoodRx's adept cost control and operational efficiency.

Strategic Moves and Market Positioning

Under the leadership of Interim CEO Scott Wagner, GoodRx has focused on key strategic priorities that have reignited growth and enhanced the company's value proposition. The restructuring of their pharma manufacturer solutions and the ongoing adjustments to their market strategy are pivotal to their sustained growth. GoodRx's commitment to capital discipline, as evidenced by their share repurchase program and debt repayment efforts, aligns with their long-term strategy to optimize shareholder value.

Future Outlook

Looking ahead, GoodRx provided guidance for the second quarter and full year of 2024, projecting revenues to reach approximately $200 million and $800 million to $810 million, respectively. This forecast suggests a steady growth trajectory, albeit moderated by strategic realignments and market dynamics. The anticipated Adjusted EBITDA for the full year is expected to exceed $250 million, marking a significant year-over-year increase.

GoodRx's strategic initiatives, focused on enhancing user engagement and expanding service offerings, are set to fortify its market position. Despite the challenges posed by competitive pressures and market fluctuations, GoodRx's adaptive strategies and robust operational framework provide a solid foundation for sustained growth and profitability.

Investor and Analyst Perspectives

Investors and analysts may find GoodRx's consistent revenue growth, strategic cost management, and clear forward-looking strategies as indicators of the company's potential for long-term value creation. The alignment of Q1 results with analyst expectations further solidifies confidence in the company's financial health and market strategy.

For detailed financial figures and future projections, stakeholders are encouraged to review the full earnings report and tune into the upcoming investor conference call, details of which are available on GoodRxs investor relations website.

Explore the complete 8-K earnings release (here) from GoodRx Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance