Sylvamo Corp (SLVM) Q1 2024 Earnings: Aligns with EPS Projections, Reveals Strong Outlook

Net Income: Reported at $43 million, slightly below the estimated $42.88 million.

Earnings Per Share (EPS): Achieved $1.02 per diluted share, falling short of the estimated $1.03.

Revenue: Totaled $905 million, surpassing the estimated $864.38 million.

Free Cash Flow: Recorded a negative $33 million, indicating a significant decrease compared to the previous quarter's $104 million.

Adjusted EBITDA: Stood at $118 million with a 13% margin, showing a slight improvement from $117 million and a 12% margin in the previous quarter.

Dividends: Declared a second quarter dividend of $0.30 per share, underlining ongoing shareholder returns.

Share Repurchases: Continued share buyback with $20 million repurchased, highlighting confidence in financial stability and shareholder value enhancement.

Sylvamo Corp (NYSE:SLVM), a leading uncoated papers company, announced its first quarter results for 2024 on May 10, aligning closely with analyst expectations for earnings per share. The detailed financial outcomes were disclosed in their recent 8-K filing. Sylvamo is renowned for its extensive portfolio of paper products and operates through three major geographical segments: Europe, Latin America, and North America.

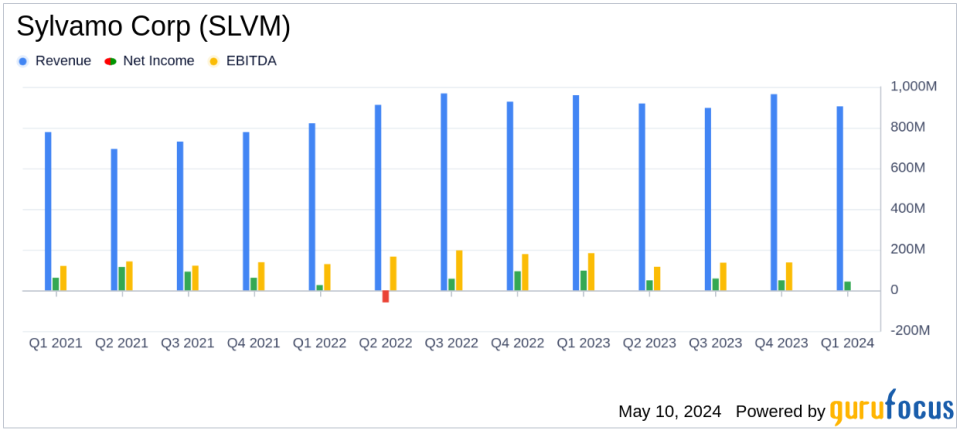

Quarterly Financial Performance

For the first quarter of 2024, Sylvamo reported a net income of $43 million, or $1.02 per diluted share, a slight decrease from the $49 million, or $1.16 per diluted share, recorded in the previous quarter. The company achieved adjusted operating earnings of $45 million ($1.07 per diluted share) and an Adjusted EBITDA of $118 million, indicating a stable margin of 13%. These figures reflect a robust operational stance despite the seasonal downturn in demand particularly noted in the Latin American market.

Operational Highlights and Strategic Initiatives

During the quarter, Sylvamo experienced stable pricing and product mix, while volume dipped by $12 million due to anticipated weaker demand. However, operational improvements and reduced maintenance outages contributed positively by $19 million. The company also highlighted an increase in input and transportation costs, primarily within North America, amounting to an additional $9 million.

Chairman and CEO Jean-Michel Ribieras commented on the quarter's performance stating, "As uncoated freesheet conditions improved in the first quarter, we experienced strengthening order books, resulting in less economic downtime. Price and mix were better than expected while input costs stabilized." He also emphasized the ongoing success of Project Horizon, a cost reduction initiative projected to achieve $110 million in savings by year-end.

Future Outlook

Looking ahead to the second quarter of 2024, Sylvamo anticipates an Adjusted EBITDA between $145 million and $160 million. This optimistic forecast is supported by expected improvements in price and mix, volume increases, and operational cost efficiencies across various regions. The company also plans to address the incremental maintenance expenses and stabilize input and transportation costs.

Investor and Shareholder Returns

Sylvamo continues to demonstrate its commitment to shareholder returns, having repurchased $20 million of shares in the recent quarter and declaring a dividend of $0.30 per share paid at the end of April. With $130 million remaining under its current share repurchase authorization, the company underscores its robust financial strategy aimed at enhancing shareholder value.

Comprehensive Financial Analysis

The company's balance sheet remains strong with significant reductions in gross debt, positioning Sylvamo to effectively navigate through industry cycles and invest in high-return projects. The detailed financial statements reveal a disciplined approach to capital management and reinvestment in core business areas.

Sylvamo's first quarter performance, aligned with strategic initiatives and a positive outlook for the coming months, positions it well within the competitive paper industry. For detailed financial figures and further information, refer to the full earnings release and supplementary financial data provided by the company.

Explore the complete 8-K earnings release (here) from Sylvamo Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance