ESCO Technologies Inc (ESE) Surpasses Q2 Earnings Estimates with Strong Growth

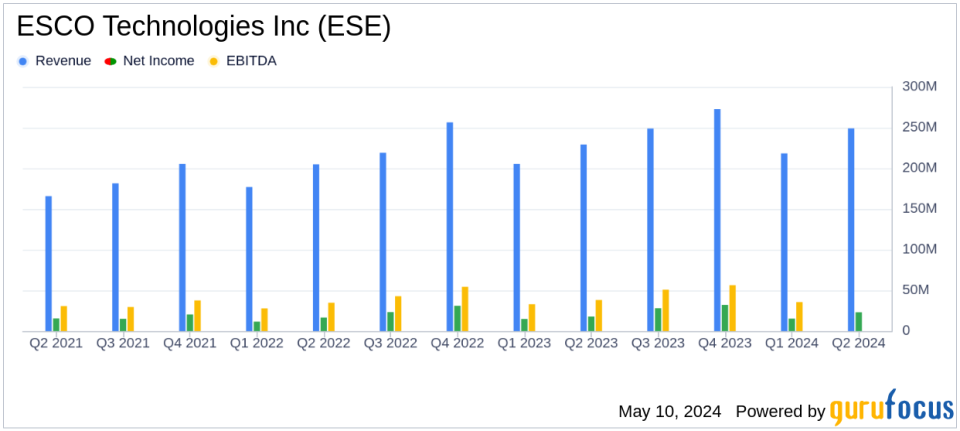

Quarterly Revenue: Reported at $249 million, up 9% year-over-year, surpassing estimates of $242.85 million.

Net Income: Achieved $23.22 million, exceeding the estimated $22.07 million.

Earnings Per Share (EPS): GAAP EPS was $0.90, significantly higher than the estimated $0.87.

Adjusted EPS: Increased to $0.94, indicating strong profit margins and operational efficiency.

Segment Performance: Notable decrease in RF Test & Measurement segment with sales down 8% to $47.1 million from the previous year.

Share Repurchase: Bought back approximately 72,000 shares for $7.2 million during the quarter, highlighting confidence in financial stability.

Future Outlook: Maintains full-year adjusted EPS guidance at $4.15 to $4.30, projecting continued double-digit earnings growth.

On May 9, 2024, ESCO Technologies Inc (NYSE:ESE) released its 8-K filing, announcing robust financial results for the second quarter of fiscal year 2024. The company, a key player in engineered products for utility, industrial, aerospace, and commercial applications, reported a significant 9% increase in sales and a 30% rise in GAAP EPS.

Company Overview

ESCO Technologies Inc operates through three primary segments: Aerospace & Defense, Utility Solutions Group (USG), and RF Shielding and Test. These segments cater to a diverse range of markets, providing specialty products from naval and aerospace components to diagnostic testing solutions and electromagnetic shielding.

Financial Highlights

The company's financial performance this quarter was impressive, with net sales reaching $249 million, surpassing the estimated $242.85 million. This growth was driven by increased activity in aerospace, Navy, and utility markets. GAAP EPS for the quarter stood at $0.90, outperforming the analyst estimate of $0.87, while adjusted EPS grew by 24% to $0.94.

Segment Performance and Challenges

The Aerospace & Defense segment saw a notable increase in sales, contributing significantly to the overall growth. However, the RF Test & Measurement segment experienced a decline, with sales dropping by 8% due to decreased volumes in wireless, filters, and acoustics, despite the addition of $2.2 million in revenue from the recent MPE acquisition.

Strategic Initiatives and Shareholder Returns

ESCO Technologies has continued its shareholder-friendly activities, repurchasing approximately 72,000 shares for $7.2 million during the quarter. Additionally, the company declared a quarterly cash dividend of $0.08 per share, to be paid in July 2024.

Outlook and Forward Guidance

Looking ahead, the company maintains its full-year adjusted EPS guidance in the range of $4.15 to $4.30, reflecting continued double-digit earnings growth. Sales are projected to align with initial forecasts, targeting a 7 to 9 percent annual increase.

Operational and Financial Metrics

ESCO's operational efficiency is evident in its EBITDA performance, with significant contributions across all business segments. The company's focus on strategic acquisitions and operational optimization continues to enhance its market position and financial stability.

Management Commentary

Bryan Sayler, CEO and President, remarked on the quarter's success, stating, "Q2 was a solid quarter highlighted by both top and bottom-line growth. The sales performance translated to the bottom line very well as Adjusted EPS increased 24 percent compared to the prior year quarter."

Conclusion

ESCO Technologies Inc's Q2 2024 results not only demonstrate a robust financial position but also highlight the company's resilience and strategic foresight in navigating market dynamics. With a strong portfolio and continued focus on growth markets, ESCO is well-positioned to maintain its upward trajectory in the coming periods.

For a deeper dive into ESCO Technologies Inc's financial details and future prospects, investors and stakeholders are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from ESCO Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance