Crinetics Pharmaceuticals Inc (CRNX) Reports Q1 2024 Financial Results

Revenue: Reported $0.6 million for Q1 2024, exceeding the estimated $0.26 million.

Net Loss: Increased to $66.9 million in Q1 2024, exceeding the estimated loss of $58.97 million.

Earnings Per Share: Recorded a loss of $0.93 per share, above the estimated loss of $0.81 per share.

Research and Development Expenses: Rose to $53.3 million, up from $38.5 million in Q1 2023, reflecting increased investment in clinical and development activities.

General and Administrative Expenses: Increased to $20.8 million, driven by higher personnel costs.

Liquidity Position: Strengthened with cash, cash equivalents, and investments totaling $901.0 million as of March 31, 2024, following a significant private placement financing.

Future Outlook: Plans include submission of a New Drug Application for paltusotine and initiation of a Phase 3 study for carcinoid syndrome by end of 2024.

On May 9, 2024, Crinetics Pharmaceuticals Inc (NASDAQ:CRNX), a clinical-stage pharmaceutical company specializing in novel therapeutics for rare endocrine diseases and tumors, disclosed its financial outcomes for the first quarter ended March 31, 2024. The period was marked by significant clinical advancements but also by increased financial losses.

Overview of Financial Performance

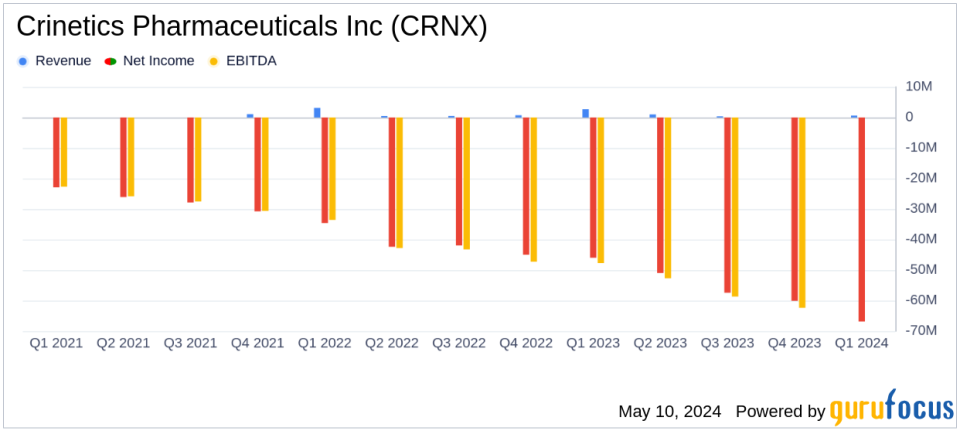

Crinetics Pharmaceuticals reported a net loss of $66.9 million for Q1 2024, a substantial increase from the $46.0 million loss recorded in the same period last year. This escalation in losses was primarily due to heightened research and development (R&D) expenses, which surged to $53.3 million from $38.5 million in Q1 2023. The increase in R&D spending reflects the company's intensified efforts in advancing its clinical programs, particularly the late-stage trials for its lead compounds, paltusotine and atumelnant.

General and administrative expenses also rose significantly, reaching $20.8 million compared to $12.2 million in the prior year, driven largely by increases in personnel costs. Revenue for the quarter was reported at $0.6 million, a sharp decline from the $2.7 million seen in Q1 2023, reflecting changes in licensing arrangements for its product candidates.

Clinical Developments and Strategic Moves

The quarter was notable for several key milestones in Crinetics clinical development pipeline. The company reported positive results from its Phase 3 PATHFNDR-2 study of paltusotine in acromegaly and from a Phase 2 study in carcinoid syndrome. These successes are paving the way for a New Drug Application (NDA) submission expected in the latter half of 2024.

Additionally, Crinetics is preparing to report initial results from Phase 2 studies of atumelnant for congenital adrenal hyperplasia and Cushings syndrome at the upcoming ENDO 2024 conference. The company also bolstered its financial position through a $350 million private placement financing in February, enhancing its balance sheet to support continued development and potential commercial launches.

Financial Health and Future Projections

As of March 31, 2024, Crinetics boasts a robust balance sheet with $901.0 million in unrestricted cash, cash equivalents, and investments, a significant increase from $558.6 million at the end of 2023. This financial cushion is expected to fund the company's operations well into 2028, according to current projections.

Despite these strengths, the widened net loss underscores ongoing challenges as the company scales up its operations and invests heavily in its clinical and preclinical programs. The increased losses and operational expenses reflect a critical phase of investment as Crinetics aims to transition from a purely developmental to a fully integrated pharmaceutical entity.

Investor and Analyst Perspectives

The financial trajectory and strategic developments of Crinetics Pharmaceuticals will be crucial for investors and analysts monitoring the company's ability to manage costs while advancing its clinical programs towards commercialization. The upcoming milestones, particularly the potential NDA submissions and initiation of Phase 3 trials, will be pivotal in shaping the company's financial and operational outlook in the near term.

For additional details, investors and interested parties are encouraged to access the full earnings report and join the management's conference call and webcast scheduled for today at 4:30 p.m. ET.

Explore the complete 8-K earnings release (here) from Crinetics Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance