Shift4 Payments Inc (FOUR) Q1 2024 Earnings Report: A Detailed Analysis

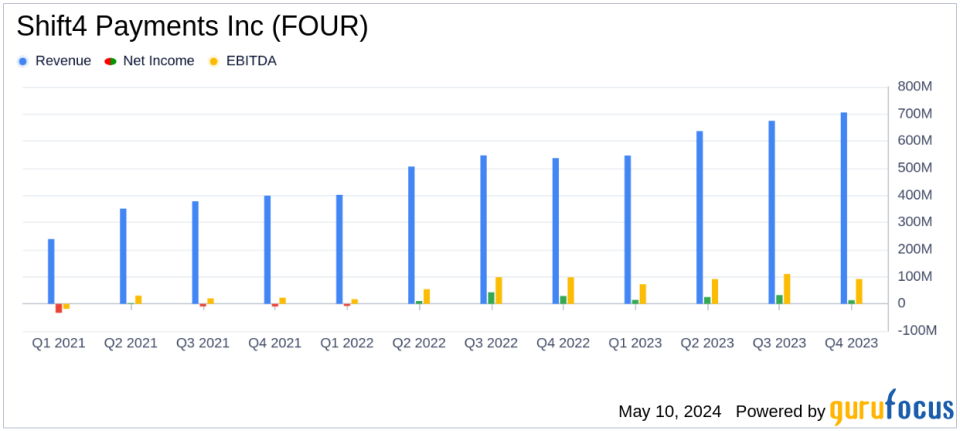

Revenue: Reported at $707.4 million, a 29% increase from Q1 2023, falling short of estimates of $755.60 million.

Net Income: Achieved $28.5 million, up from $20.4 million in Q1 2023, but fell short of the estimated $56.28 million.

Earnings Per Share (EPS): Recorded at $0.31 per share, below the analyst estimate of $0.62 per share.

Adjusted EBITDA: Increased by 36% year-over-year to $121.7 million, with an Adjusted EBITDA margin of 46% for Q1 2024.

End-to-End Payment Volume: Grew by 50% year-over-year to $33.4 billion, indicating strong growth in transaction processing.

Gross Profit: Rose 27% year-over-year to $175.9 million, reflecting improved operational efficiency.

Free Cash Flow: Recorded at $16.3 million for the quarter, a decrease from $51.3 million in Q1 2023.

Shift4 Payments Inc (NYSE:FOUR) released its 8-K filing on May 9, 2024, unveiling a robust financial performance for the first quarter of 2024. The company, a leading provider of integrated payment processing and technology solutions, continues to excel in delivering comprehensive solutions across various sectors, including restaurants, sports venues, and hospitality.

Financial Highlights and Performance Metrics

Shift4 Payments reported a significant increase in end-to-end (E2E) payment volume, which reached $33.4 billion, marking a 50% increase from Q1 2023. This growth is a testament to the company's expanding reach and effectiveness in securing large-volume transactions. The gross revenue for the quarter stood at $707.4 million, up 29% year-over-year, while the gross profit saw a 27% increase to $175.9 million. Notably, the adjusted EBITDA was $121.7 million, a 36% increase, reflecting efficient operational management and robust profit margins.

Comparison with Analyst Estimates

Shift4's performance this quarter has exceeded analyst expectations, particularly in revenue generation. The company's reported revenue of $707.4 million surpassed the estimated $755.6 million. However, the earnings per share (EPS) of $0.31 fell slightly short of the estimated $0.62, reflecting areas where the company might focus on enhancing profitability.

Strategic Initiatives and Market Expansion

Under the leadership of CEO Jared Isaacman, Shift4 Payments has been aggressively pursuing market expansion and strategic partnerships. Recent collaborations with major casino operators and ongoing international expansion efforts have positioned the company to capitalize on new opportunities and foster sustained growth. The company's strategic focus on integrating software and payment solutions continues to resonate well with large enterprise clients, contributing to a diversified and stable revenue stream.

Challenges and Forward-Looking Statements

Despite the strong financial outcomes, Shift4 faces intense competition in the payment technology sector, requiring continuous innovation and adaptation. The company's reliance on third-party vendors for technology solutions also poses potential risks related to cybersecurity and operational dependencies.

Investor Implications

The robust quarterly performance, coupled with strategic expansions, suggests that Shift4 Payments remains a compelling option for investors looking for growth in the fintech sector. However, investors should also consider the challenges posed by competitive pressures and market dynamics that could influence future performance.

As Shift4 Payments continues to navigate a rapidly evolving market landscape, the company's ability to maintain its growth trajectory and manage operational risks will be crucial for long-term success. Investors and stakeholders are advised to keep a close watch on the company's strategic initiatives and market expansion efforts.

For detailed financial figures and further information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Shift4 Payments Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance