Main Street Capital Corp (MAIN) Q1 2024 Earnings: Surpasses Analyst Expectations with Strong ...

Net Investment Income: $89.8M, translating to $1.05 per share, surpassing the estimated earnings per share of $1.03.

Distributable Net Investment Income: Reported at $94.4M, or $1.11 per share, indicating strong dividend coverage and operational efficiency.

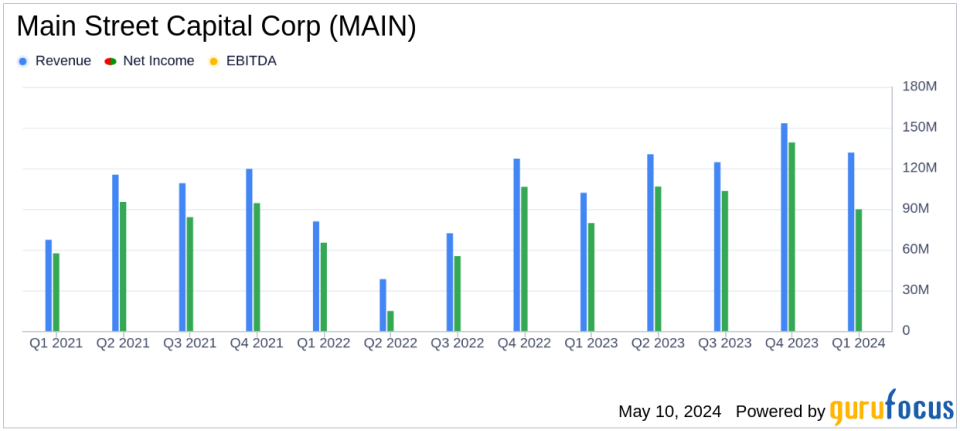

Total Investment Income: Reached $131.6M, demonstrating a robust increase and surpassing the estimated revenue of $128.01M.

Net Asset Value: Increased to $29.54 per share, up 1.2% from previous quarter, reflecting positive asset growth and financial health.

Dividends: Declared regular monthly dividends totaling $0.72 per share for Q2 2024, marking a 6.7% increase year-over-year, alongside a supplemental dividend of $0.30 per share.

Investment Activity: Executed $91.8M in new lower middle market investments and $154.5M in private loan investments, showing active portfolio management and growth.

Return on Equity: Reported at 17.2% for the quarter, highlighting effective capital utilization and profitability.

Main Street Capital Corp (NYSE:MAIN) released its 8-K filing on May 9, 2024, unveiling robust financial results for the first quarter of 2024. The company reported a net investment income of $1.05 per share and a distributable net investment income of $1.11 per share, both figures notably surpassing the analyst estimates of $1.03 earnings per share.

Main Street Capital Corp, a leading investment firm, focuses on providing customized debt and equity financing to lower middle market companies and debt capital to middle market companies across diverse industry sectors in the United States. The firm's strategic investments are primarily directed towards management buyouts, recapitalizations, growth financings, refinancings, and acquisitions.

Financial Highlights and Achievements

The company's financial achievements in Q1 2024 underscore its industry-leading position in cost efficiency and investment success. MAIN reported a total investment income of $131.6 million, a 9% increase year-over-year, driven by a significant rise in interest income and fee income, which offset a slight decline in dividend income. This performance reflects the company's adept strategy in navigating the investment landscape and maximizing income from its diverse portfolio.

The net asset value per share increased to $29.54, marking a continuous growth trend for the seventh consecutive quarter. This increase, along with a net increase in net assets resulting from operations of $107.1 million or $1.26 per share, highlights MAIN's effective asset management and robust financial health.

Moreover, MAIN declared and paid a supplemental dividend of $0.30 per share, resulting in total dividends of $1.02 per share for Q1 2024, which is a 20% increase from the same period last year. This dividend growth not only rewards shareholders but also reflects the company's strong earnings and confidence in its financial stability.

Operational and Strategic Developments

In Q1 2024, MAIN completed $91.8 million in new investments in the lower middle market and $154.5 million in the private loan portfolio. These strategic investments contributed to a net increase in the total cost basis of the respective portfolios, demonstrating MAIN's active and successful investment approach. Additionally, the issuance of $350.0 million of 6.95% senior unsecured notes due March 2029 further diversified MAIN's capital structure and enhanced its financial flexibility.

Dwayne L. Hyzak, CEO of Main Street, commented on the results:

"We are extremely pleased with our performance in the first quarter, which resulted in continued strong operating results highlighted by a return on equity of 17.2%, net investment income per share and distributable net investment income per share that significantly exceeded the dividends paid to our shareholders and a new record for net asset value per share for the seventh consecutive quarter."

Outlook and Future Projections

Looking ahead, MAIN is well-positioned to sustain its growth trajectory with an attractive investment pipeline in both lower middle market and private loan investment strategies. The firm's robust liquidity position, conservative leverage profile, and strong lender relationships support its strategic objectives and operational needs, ensuring resilience in various market conditions.

Overall, Main Street Capital Corp's Q1 2024 performance not only surpassed analyst expectations but also solidified its market position through strategic portfolio expansions and efficient capital management, promising continued growth and shareholder value enhancement in upcoming quarters.

Explore the complete 8-K earnings release (here) from Main Street Capital Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance