Ormat Technologies Inc. Reports Strong Q1 2024 Results, Surpassing Analyst Expectations

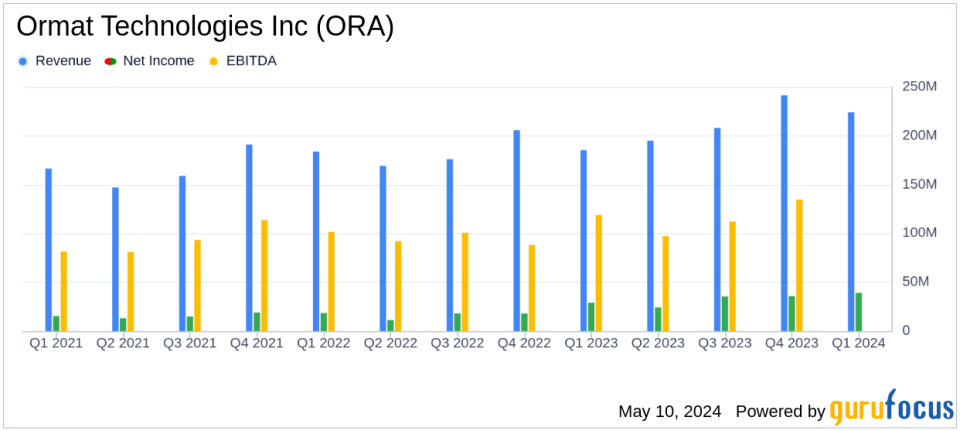

Total Revenue: Reached $224.2 million, a 21.0% increase year-over-year, surpassing the estimate of $218.77 million.

Net Income: Reported at $38.6 million, up 32.9% from the previous year, exceeding the estimated $38.06 million.

Earnings Per Share (EPS): Diluted EPS was $0.64, up 25.5% year-over-year, surpassing the estimated $0.63.

Gross Margin: Total gross margin declined to 35.2% from 41.1% year-over-year.

Adjusted EBITDA: Increased by 14.4% to $141.2 million, indicating strong operational efficiency.

Dividend: Declared a quarterly dividend of $0.12 per share, consistent with the company's dividend policy.

Segment Performance: Electricity revenue set a new quarterly record at $191.3 million, driven by enhanced performance and strategic acquisitions.

On May 8, 2024, Ormat Technologies Inc (NYSE:ORA), a leader in renewable energy, announced its first-quarter financial results for the period ended March 31, 2024. The company reported a significant increase in profitability across all business segments, with total revenues reaching $224.2 million, a 21.0% increase year-over-year. This performance exceeded analyst expectations, which projected revenues of $218.77 million.

Ormat Technologies, known for its geothermal energy power business, operates across three segments: Electricity, Product, and Energy Storage. Each segment contributed positively to the quarter's success, with particularly strong growth noted in the Product and Energy Storage segments, which saw revenue increases of 147.3% and 65.6% respectively.

The company's net income for the quarter was $38.6 million, surpassing the estimated $38.06 million. Earnings per share (EPS) also exceeded expectations at $0.64, compared to the estimated $0.63. This marks a substantial improvement from the $0.51 EPS reported in the first quarter of 2023.

CEO Doron Blachar highlighted the organic growth and strategic acquisitions as key drivers of the quarter's success. The acquisition of Enel Green Power North America's asset portfolio and operational improvements at existing facilities were particularly impactful. Blachar also noted the significant role of the Electricity segment, which set a new quarterly revenue record, and the Energy Storage segment, which benefited from new projects and stable revenue streams.

Ormat's gross profit margin saw a slight decrease to 35.2% from 41.1% in the previous year, primarily due to a $6.7 million business interruption insurance proceed received last year. However, the adjusted EBITDA increased by 14.4% to $141.2 million, indicating strong underlying operational efficiency.

The company reaffirmed its 2024 guidance, expressing confidence in continued growth and operational capacity expansion. Blachar emphasized the strategic positioning of Ormat to capitalize on the increasing demand for renewable energy, supported by favorable market conditions such as declining battery prices and attractive power purchase agreements.

Ormat also declared a quarterly dividend of $0.12 per share, consistent with its dividend policy, underscoring its commitment to delivering shareholder value. The dividend is payable on June 5, 2024, to shareholders of record as of May 22, 2024.

The company's balance sheet remains robust, with an increase in total assets to $5.52 billion from $5.21 billion at the end of 2023. This financial stability supports Ormat's ambitious growth plans and its ability to pursue further strategic initiatives.

In conclusion, Ormat Technologies Inc's first-quarter results reflect a strong start to 2024, with performance metrics exceeding analyst expectations and a positive outlook for the remainder of the year. The company's strategic expansions and operational enhancements position it well to leverage the growing demand for renewable energy solutions.

For more detailed information, you can view the full 8-K filing.

Explore the complete 8-K earnings release (here) from Ormat Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance