Liberty Broadband Corp (LBRDA) Q1 2024 Earnings: Consistent with Analyst Projections

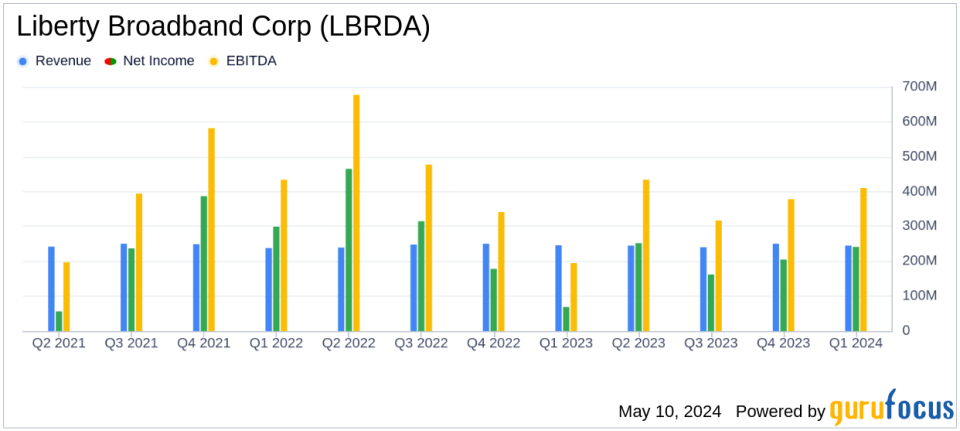

Revenue: Reported $245 million for Q1 2024, nearly stable year-over-year, falling below estimates of $247.40 million.

Operating Income: Increased to $28 million in Q1 2024, up from $16 million in Q1 2023, reflecting improved operational efficiency.

Adjusted OIBDA: Slightly rose to $85 million in Q1 2024 from $82 million in Q1 2023, indicating stable operational profitability.

Debt Reduction: Total debt decreased by $41 million in Q1 2024 due to proactive debt management, despite a $60 million repayment under the senior credit facility.

Cash Position: Decreased to $108 million as of March 31, 2024, down from $158 million at the end of 2023, primarily due to share repurchases and other investing activities.

Share Repurchases: Bought back 103 thousand shares of Series C common stock for $8.2 million, demonstrating ongoing commitment to returning value to shareholders.

Charter Equity Interest: Maintained below 26% in Charter, with no sales of Charter shares in the period from February 1, 2024, to April 30, 2024.

On May 8, 2024, Liberty Broadband Corp (NASDAQ:LBRDA) disclosed its first-quarter financial results for the year, aligning closely with analyst expectations. The company, a key player in the U.S. telecommunications sector, released these details through its 8-K filing. Liberty Broadband provides comprehensive cable services through its robust network infrastructure, significantly contributing to its revenue streams primarily from its segments, GCI Holdings and Charter.

Financial Highlights and Strategic Operations

The company reported a slight decrease in total revenue from $246 million in Q1 2023 to $245 million in Q1 2024. Despite this marginal decline, operating income saw a significant rise, improving from $16 million to $28 million, a testament to enhanced operational efficiency and cost management. The operating income margin also increased notably from 11.8% to 15.1%.

Liberty Broadband's strategic financial management was evident in its share repurchase activities, with 103 thousand shares reacquired from February to April 2024, amounting to a total expenditure of $8.2 million. This move is part of a broader repurchase authorization, which stands at approximately $1.7 billion as of the end of April 2024.

Challenges and Operational Adjustments

Despite stable revenue figures, the company faced challenges in its consumer segment, particularly with a 1% decline in consumer revenue, influenced by reduced video service revenues. However, this was partially offset by a growing demand for consumer data services. The business segment maintained its revenue, supported by an increase in data service revenue which balanced declines in wireless and other revenues.

Liberty Broadband's GCI Holdings showed resilience with its leverage ratio improving slightly to 2.8x, down from 2.9x, reflecting prudent debt management and robust cash flow management strategies. The company's total debt decreased by $41 million in the first quarter, further strengthening its balance sheet.

Analysis of Financial Statements

The balance sheet of Liberty Broadband remains solid with a slight decrease in total cash and equivalents, from $158 million at the end of 2023 to $108 million by March 2024. This reduction primarily resulted from share repurchases and other investing activities, overshadowing the proceeds from Charter share sales and borrowings under the Charter margin loan.

Adjusted Operating Income Before Depreciation and Amortization (OIBDA) remained stable at $90 million for GCI Holdings, indicating consistent operational profitability. The comprehensive financial metrics and strategic financial maneuvers underscore Liberty Broadband's commitment to maintaining financial stability while enhancing shareholder value.

Future Outlook and Strategic Initiatives

Looking ahead, Liberty Broadband is poised to continue its strategic investments, particularly in expanding network capabilities in key markets. The planned capital expenditures of approximately $200 million for 2024 will focus on high-return projects in rural Alaska, including the Bethel and AU-Aleutians fiber projects, which are expected to drive future revenue growth and operational efficiencies.

In conclusion, Liberty Broadband Corp (NASDAQ:LBRDA) has demonstrated a robust strategic approach to navigating the competitive telecommunications landscape, maintaining financial discipline while laying down significant groundwork for future growth. Investors and stakeholders can anticipate continued progress as the company advances its operational and financial objectives in upcoming quarters.

Explore the complete 8-K earnings release (here) from Liberty Broadband Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance