Will Top-Line Improvement Aid GigaCloud's (GCT) Q1 Earnings?

GigaCloud Technology Inc. GCT is scheduled to report its first-quarter 2024 results on May 9, before the bell.

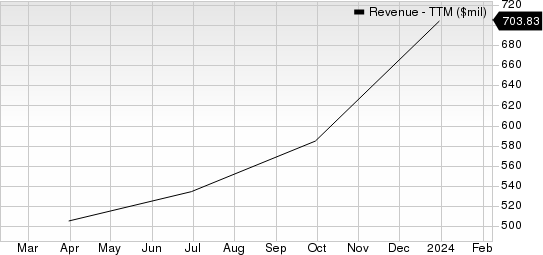

We expect a significant year-over-year improvement in the company’s top line in the to-be-reported quarter, driven by an increase in both service and product revenues. The current Zacks Consensus Estimate for total revenues stands at $235 million, indicating 83.9% growth from the year-ago reported quarter.

GigaCloud Technology Inc. Revenue (TTM)

GigaCloud Technology Inc. revenue-ttm | GigaCloud Technology Inc. Quote

We are expecting the company to report strong growth from last-mile delivery, ocean transportation, packaging and warehouse services in the quarter. Product revenues are expected to have been driven by an increase in the number of buyers and spend per active buyer. Product revenues from off-platform ecommerce are likely to have benefited from an increase in the number of sales channels and the sales in third-party off-platform ecommerce.

Robust sales along with strong operating performance are expected to have positively impacted the bottom line in the to-be-reported quarter, the Zacks Consensus Estimate for which is pegged at 51 cents, suggesting 30.8% year-over-year growth.

GCT currently carries a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings Snapshots of Some Service Stocks

Omnicom OMC reported impressive first-quarter 2024 results, wherein both earnings and revenues beat the Zacks Consensus Estimate.

OMC’s earnings of $1.67 per share beat the consensus estimate by 9.9% and increased 7.1% year over year. Total revenues of $3.6 billion surpassed the consensus estimate by 1.6% and increased 5.4% year over year.

Equifax EFX reported mixed first-quarter 2024 results, wherein earnings surpassed the Zacks Consensus Estimate, but revenues missed the same.

EFX’s adjusted earnings were $1.5 per share, ahead of the Zacks Consensus Estimate by 4.2% and up 4.9% from the year-ago quarter. Total revenues of $1.4 billion missed the consensus estimate by a slight margin but increased 6.7% from the year-ago quarter.

ManpowerGroup MAN reported mixed first-quarter 2024 results, with earnings beating the Zacks Consensus Estimate but revenues missing the same.

Quarterly adjusted earnings of 94 cents per share surpassed the consensus mark by 4.4% but declined 41.6% year over year. Revenues of $4.4 billion lagged the consensus mark by 0.6% and fell 7% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

GigaCloud Technology Inc. (GCT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance