Honda (HMC) to Report Q4 Earnings: Here's What to Expect

Honda Motor Co., Ltd. HMC is slated to release fourth-quarter fiscal 2024 results on May 10. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings and revenues is pegged at 44 cents per share and $37.96 billion, respectively.

For the fiscal fourth quarter, the consensus estimate for HMC’s earnings per share has moved down by 13 cents in the past 90 days. Its bottom-line estimates imply a decline of 13.73% from the year-ago reported number.

The Zacks Consensus Estimate for revenues suggests a year-over-year rise of 14.50%.

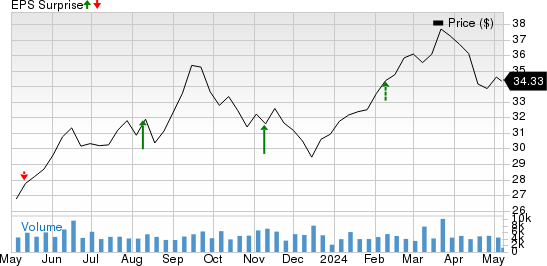

HMC surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 31.25%. This is depicted in the graph below:

Honda Motor Co., Ltd. Price and EPS Surprise

Honda Motor Co., Ltd. price-eps-surprise | Honda Motor Co., Ltd. Quote

Q3 Highlights

In third-quarter fiscal 2024, Honda posted adjusted earnings of $1.06 per share, surpassing the Zacks Consensus Estimate of 85 cents. This company reported adjusted earnings of $1.02 per share in the year-ago quarter. Honda posted revenues of $36.5 billion, missing the Zacks Consensus Estimate of $37.7 billion but rising from $31.5 billion in the year-ago quarter.

Things to Note

In the United States, Honda sold 333,824 units in the fourth quarter of fiscal 2024, up 17.3% year over year. The automaker sold 61,915 units of electric vehicles in the same period, representing an uptick of 25.5% from the corresponding quarter of 2023. A year-over-year improvement in sales volume is likely to have boosted Honda’s top line.

Discouragingly, HMC expects research and development (R&D) expenses for fiscal 2024 to negatively impact operating income. For fiscal 2024, R&D costs are expected at ¥990 billion, implying an uptick from ¥852 billion recorded in fiscal 2023. The automaker expects sales of Power Products to decrease 31.8% year over year to 3,850,000 units in fiscal 2024. Rising costs and a decline in sales of Power Products are likely to have hurt Honda’s performance in the to-be-reported quarter.

Here's a sneak peek at the firm’s key revenue projections for the to-be-reported quarter.

Our estimate for quarterly revenues from the Automobile segment, which has the highest contribution to the company’s revenues, is pegged at ¥3.5 trillion, suggesting a rise from ¥2.87 trillion recorded in the prior-year quarter. Our estimate for revenues from Motorcycle segment is pegged at ¥848 billion, indicating a rise from ¥706 billion recorded in the year-ago quarter.

Our estimate for revenues from the Financial Services segment is pegged at ¥718 billion, indicating a rise from ¥693 billion recorded in the year-ago period. Our estimate for quarterly revenues from the Power Product and Other segment is pegged at ¥100 billion, indicating a decline from ¥114 billion reported in the year-ago quarter.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Honda this time around, as it does not have the right combination of the two key ingredients. A positive Earnings ESP, combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the odds of an earnings beat. This is not the case here.

Earnings ESP: HMC has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate is in line with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Honda currently carries a Zacks Rank #3.

Key Predictions for Other Players

Canoo Inc. GOEV has an Earnings ESP of 0.00% and sports a Zacks Rank #1 at present. It is scheduled to post first-quarter earnings on May 14. The Zacks Consensus Estimate is pegged at a loss of 86 cents per share. You can see the complete list of today’s Zacks #1 Rank stocks here.

AutoZone, Inc. AZO has an Earnings ESP of +0.26% and a Zacks Rank #3 at present. The company is scheduled to post third-quarter fiscal 2024 earnings on May 21. The Zacks Consensus Estimate for earnings is pegged at $35.75 per share.

AZO surpassed earnings estimates in each of the trailing four quarters, the average surprise being 7.69%.

Advance Auto Parts, Inc. AAP has an Earnings ESP of 0.00% and a Zacks Rank #3 at present. The company is slated to post first-quarter 2024 earnings on May 29. The Zacks Consensus Estimate for earnings is pegged at 69 cents per share.

AAP missed earnings estimates in each of the trailing four quarters, the average negative surprise being 148.19%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Advance Auto Parts, Inc. (AAP) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

Canoo Inc. (GOEV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance