Taboola.com Ltd (TBLA) Q1 2024 Earnings: Surpasses High-End Guidance, Optimistic Outlook Maintained

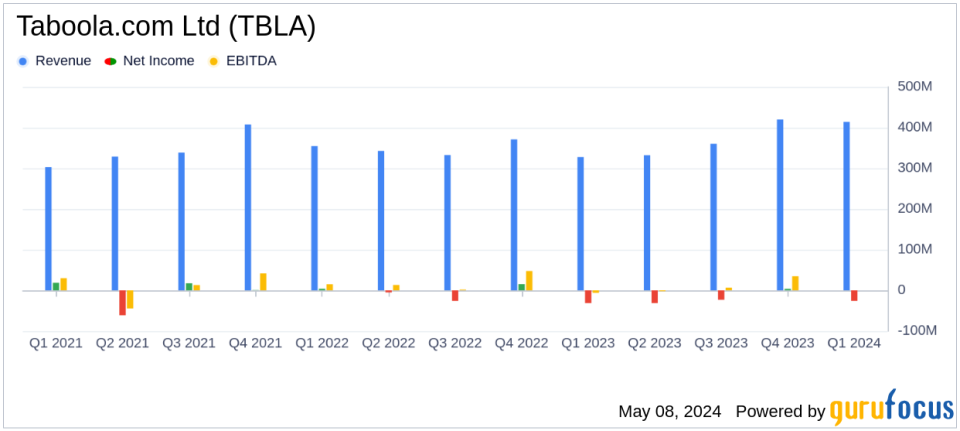

Revenue: Reported Q1 2024 revenue of $414 million, surpassing estimates of $403.10 million and showing a significant increase from $327.7 million in Q1 2023.

Net Loss: Q1 2024 net loss of $26.2 million, an improvement from a net loss of $31.3 million in Q1 2023, but still exceeding the estimated net loss of $9.53 million.

Earnings Per Share (EPS): Diluted EPS for Q1 2024 was -$0.08, falling short of the estimated -$0.03 and showing a slight improvement from -$0.09 in Q1 2023.

Free Cash Flow: Increased to $26.8 million in Q1 2024 from $11.2 million in the same quarter last year, indicating stronger operational efficiency.

Gross Profit: Grew to $109.0 million in Q1 2024 from $89.6 million in Q1 2023, reflecting better profitability metrics.

Share Buyback: $28 million worth of shares repurchased in Q1, with $92 million remaining under the current authorization, signaling confidence in future financial health.

Guidance for FY 2024: Revenue expectations set between $1,892 million to $1,942 million, aiming for continued growth and profitability improvements.

On May 8, 2024, Taboola.com Ltd (NASDAQ:TBLA) announced its first-quarter results for 2024, which surpassed the high end of its guidance across all key metrics. The company also reiterated its full-year guidance, signaling confidence in sustained growth. The details were disclosed in its 8-K filing.

Taboola, a leading technology firm specializing in recommendations for the open web, reported a revenue of $414 million in Q1 2024, a significant increase from $327.7 million in the same quarter the previous year. This growth is attributed to the company's robust AI-driven recommendation platform which serves top global digital properties like CNBC and BBC.

Financial Highlights and Strategic Initiatives

The company's gross profit rose to $109 million from $89.6 million year-over-year, while net losses improved to $26.2 million from $31.3 million. Despite the net loss, Taboola achieved a notable reduction in the ratio of net loss to gross profit, demonstrating enhanced operational efficiency.

CEO Adam Singolda highlighted the company's focus on advertiser success and the ramping of initiatives like Yahoo, which crossed $100 million in Q1. Taboola's strategy also includes a significant share buyback program, with $28 million repurchased in Q1 and an additional $92 million planned for the year.

Outlook and Guidance for 2024

For Q2 2024, Taboola forecasts revenues between $410 million and $440 million, and for the full year, revenues are projected to be between $1,892 million and $1,942 million. The company expects continued growth in gross profit and adjusted EBITDA, reflecting strong operational performance and effective cost management.

Taboola's management remains committed to enhancing shareholder value through strategic initiatives and operational excellence. The company's focus on improving yield and expanding its global footprint, especially in premium advertising experiences, is expected to drive further growth and profitability.

Investor and Analyst Perspectives

Despite surpassing revenue estimates, Taboola's EPS of -$0.08 did not meet the analyst expectation of -$0.03. However, the company's strong revenue performance and strategic investments in technology and global expansion are viewed positively by investors.

Taboola's ability to maintain robust growth metrics amidst challenging market conditions demonstrates the effectiveness of its platform and the strength of its business model. With ongoing investments in AI and partnerships, Taboola is well-positioned to capitalize on the growing demand for digital advertising solutions on the open web.

For detailed financial figures and future projections, investors and stakeholders are encouraged to view Taboolas Q1 2024 Shareholder Letter and Investor Presentation available on Taboolas investor relations website.

Explore the complete 8-K earnings release (here) from Taboola.com Ltd for further details.

This article first appeared on GuruFocus.