Verano Holdings Corp Reports Q1 2024 Earnings: Revenue Exceeds Expectations Despite Net Loss

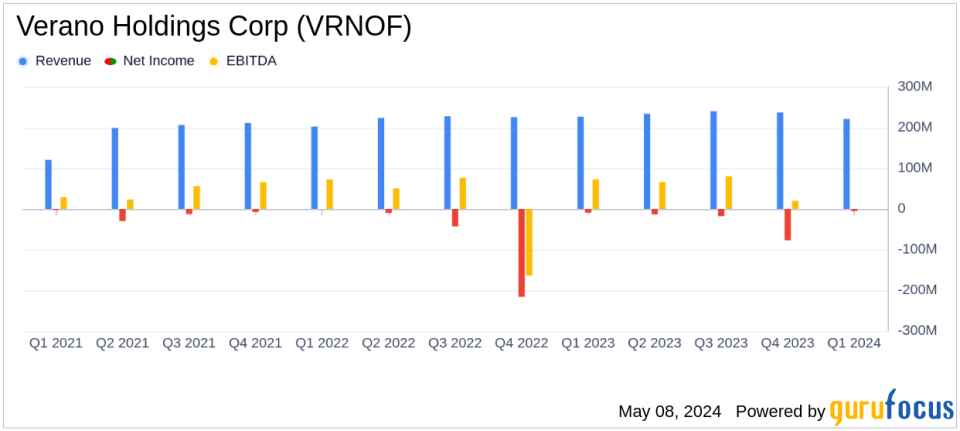

Revenue: Reported $221 million, a decrease of 3% year-over-year and 7% from the previous quarter, surpassing estimates of $215.92 million.

Net Loss: Recorded at $(5) million, improved from $(9) million year-over-year, but exceeded the estimated net loss of $11.83 million.

Gross Profit Margin: Increased to 51% from 48% year-over-year, indicating nearly 300 basis points improvement.

Adjusted EBITDA: Reached $67 million, representing 30% of revenue, showcasing strong operational efficiency.

Free Cash Flow: Grew significantly to $21 million from $8 million in the same quarter last year, indicating enhanced liquidity.

Capital Expenditures: Increased slightly to $10 million from $9 million year-over-year, reflecting ongoing investments in growth.

Operating Cash Flow: Improved to $31 million, up from $17 million in the first quarter of 2023, demonstrating stronger cash generation capabilities.

On May 8, 2024, Verano Holdings Corp (VRNOF) disclosed its financial outcomes for the first quarter ending March 31, 2024, through an 8-K filing. The company, a prominent vertically integrated multi-state cannabis operator in the U.S., reported a revenue of $221 million, surpassing the analyst's expectation of $215.92 million. Despite this, the company experienced a net loss of $4.82 million, aligning closely with the anticipated $4.83 million loss.

Company Overview

Verano Holdings Corp operates in the cannabis sector with a focus on both retail and wholesale segments. Its consumer brands include Encore, Avexia, MUV, Savvy, BITS, and Verano, while its retail dispensaries are branded as Zen Leaf and MUV. The company's revenue primarily stems from its retail operations.

Financial Performance Insights

The reported revenue of $221 million marks a 3% decrease year-over-year but still exceeds company guidance. This decline was attributed mainly to the saturation of retail dispensaries in New Jersey, although it was partially offset by a robust performance in the wholesale segment. Gross profit saw an increase, reaching $113 million or 51% of revenue, up nearly 300 basis points from the previous year, primarily due to higher third-party wholesale sales.

Operating expenses, particularly SG&A, climbed to $90 million or 41% of revenue, up from 33% the previous year, driven by new dispensary openings and investments in operational capabilities. Despite these increased costs, the net loss improved from the prior year's $9.23 million to $4.82 million, mainly due to a reduced provision for income tax expense.

Strategic Initiatives and Market Expansion

CEO George Archos highlighted the strategic moves setting the stage for significant growth in 2024, including potential legislative changes and market expansions in Ohio, Florida, and Pennsylvania. The innovative launch of the Cabbage Club dispensary membership model and proactive expansion in key states underline Verano's commitment to capturing market share and enhancing consumer engagement.

"I am tremendously proud of the strong foundation weve built in the first quarter, which positions Verano to capitalize on what may be one of the most transformative years for legal cannabis in our nation's history," said George Archos, Verano founder and Chief Executive Officer.

Operational and Financial Metrics

Adjusted EBITDA stood at $67 million or 30% of revenue, reflecting efficient operational management. The company also reported a healthy liquidity position with $194 million in cash and equivalents, and a proactive approach to debt management was evident as it prepaid $50 million of its senior credit facility.

Future Outlook

For the upcoming quarter, Verano anticipates flat to low single-digit revenue growth. This conservative forecast considers the ongoing market adjustments and strategic investments that might impact short-term profitability but are expected to bolster long-term growth.

Verano's first quarter of 2024 paints a picture of a company navigating the complexities of a dynamic market, leveraging strategic initiatives to maintain its market position while setting the stage for future profitability and expansion.

Conclusion

Verano Holdings Corp's latest earnings snapshot reveals a company adept at managing market fluctuations and positioning itself for significant future opportunities. Investors and market watchers will likely keep a close eye on how its strategic investments and market expansions play out in the evolving cannabis industry landscape.

Explore the complete 8-K earnings release (here) from Verano Holdings Corp for further details.

This article first appeared on GuruFocus.