Protagonist Therapeutics Inc (PTGX) Surpasses Q1 Revenue Estimates with Strategic Collaborations

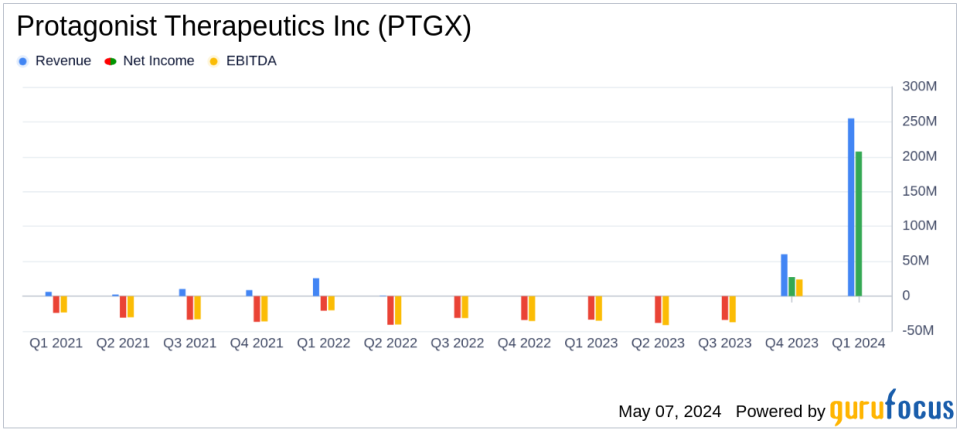

License and collaboration revenue: Reported at $254.953 million, significantly exceeding the previous year's Q1 where no revenue was recorded.

Net income: Achieved $207.34 million, a substantial increase from a net loss of $33.725 million in the same quarter last year.

Earnings per share (EPS): Basic EPS soared to $3.41 from a loss of $0.67 per share in Q1 of the previous year, and diluted EPS rose to $3.26 from a loss of $0.67 per share.

Research and development expenses: Increased to $33.734 million from $27.416 million in Q1 of the previous year, reflecting continued investment in product development.

General and administrative expenses: Rose to $14.91 million, up from $8.605 million in the previous year, indicating expanded administrative activities.

Cash, cash equivalents, and marketable securities: Reported at $322.635 million, showing a slight decrease from $341.617 million at the end of the previous year.

Working capital: Improved significantly to $587.643 million, up from $334.303 million, demonstrating stronger liquidity and financial health.

On May 7, 2024, Protagonist Therapeutics Inc (NASDAQ:PTGX) unveiled its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The clinical-stage biopharmaceutical company reported a significant revenue surge, primarily driven by a lucrative collaboration with Takeda. This partnership not only bolstered its financial standing but also extended its operational runway, promising sustained advancements in its peptide-based therapeutic developments.

Financial Performance Highlights

Protagonist Therapeutics reported an exceptional increase in its license and collaboration revenue, which soared to $254.95 million for the quarter, compared to none in the same period last year. This remarkable increase is attributed to the $300 million upfront payment from Takeda, part of a broader collaboration aimed at co-developing and co-commercializing rusfertide. This influx of capital has significantly strengthened the company's financial position, with net income reaching $207.34 million, or $3.41 per basic share, a drastic improvement from a net loss of $33.73 million, or $0.67 per basic share, in Q1 2023.

Research and development expenses were $33.73 million, up from $27.42 million in the previous year, reflecting intensified efforts in advancing clinical programs. General and administrative expenses also rose to $14.91 million from $8.61 million, indicative of expanded operational scale and increased administrative activities.

Strategic Developments and Future Outlook

Protagonist Therapeutics' strategic maneuvers in Q1 2024, particularly the collaboration with Takeda, have not only provided immediate financial benefits but also reinforced the company's pipeline development. The company has successfully completed enrollment for the Phase 3 trials of JNJ-2113 for treating moderate to severe psoriasis, with results anticipated by year-end. This positions JNJ-2113, a novel oral IL-23 receptor antagonist, as a potential leader in psoriasis treatment.

Moreover, the company's robust pipeline includes rusfertide, currently in a global Phase 3 development program for polycythemia vera. Positive results from earlier trials suggest promising prospects for this candidate. Protagonist Therapeutics also plans to nominate a development candidate from its oral IL-17 program by the end of 2024, further expanding its clinical portfolio.

Investor Implications

The strategic initiatives and financial results reported by Protagonist Therapeutics signify a pivotal phase in the company's growth trajectory. The collaboration with Takeda not only bolsters its financial stability but also enhances its capability to accelerate its core pipeline projects. Investors should note the potential long-term benefits from its diversified portfolio, particularly in the immunology therapeutic area, which could drive substantial value pending successful clinical outcomes and subsequent commercialization phases.

Overall, Protagonist Therapeutics stands out as a compelling entity in the biopharmaceutical space, with a clear strategic direction and robust financial health, underscored by promising pipeline developments that could potentially reshape treatment paradigms in their respective indications.

Explore the complete 8-K earnings release (here) from Protagonist Therapeutics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance