Aeva Technologies Inc (AEVA) Q1 2024 Earnings: Narrowing Losses Amidst Record Product Shipments

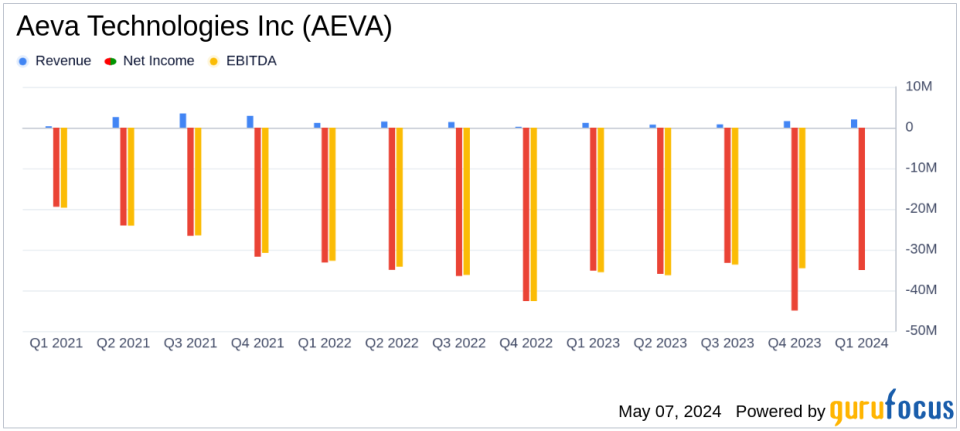

Revenue: Reported at $2.1 million for Q1 2024, up from $1.1 million in Q1 2023, exceeding the estimate of $1.7 million.

Net Loss: GAAP net loss widened to $35.3 million in Q1 2024 from $35.2 million in Q1 2023, exceeding the estimated net loss of $33.3 million.

Earnings Per Share: GAAP net loss per share was $0.67, compared to $0.80 in Q1 2023, above the estimated loss per share of $0.61.

Cash Position: Ended the quarter with $189.3 million in cash, cash equivalents, and marketable securities, down from $221 million at the end of 2023.

Operating Loss: GAAP operating loss remained flat at $37.3 million, with a non-GAAP operating loss of $32.1 million in Q1 2024.

Stock-Based Compensation: Total stock-based compensation expense was $5.3 million in Q1 2024, reflecting a decrease from $6.0 million in Q1 2023.

Aeva Technologies Inc (NYSE:AEVA), a pioneer in next-generation sensing and perception systems, disclosed its financial results for the first quarter of 2024 on May 7, 2024. The company's detailed performance was revealed in its 8-K filing. Aeva is known for its innovative 4D LiDAR technology which is crucial in various sectors including automated driving and industrial automation, primarily operating across North America, EMEA, and Asia.

Financial Performance Highlights

For Q1 2024, Aeva reported revenue of $2.1 million, which marks a significant improvement from $1.1 million in the same quarter the previous year, thereby exceeding the analyst's revenue estimate of $1.7 million. However, the company experienced a GAAP net loss of $0.67 per share, which was slightly above the anticipated $0.61 per share loss. This loss compares favorably to the $0.80 loss per share from Q1 2023, indicating a reduction in losses year-over-year.

The company's operating loss remained stable at $37.3 million, mirroring the loss reported in the first quarter of the previous year. This consistency in operating losses comes despite the increase in revenue, reflecting ongoing investments in research and development as well as operational expansions, such as the establishment of a new Automotive Center of Excellence in Germany.

Operational and Strategic Developments

Aeva has shown notable operational progress, having shipped a record number of sensors to customers, including significant deliveries to Daimler Truck. The company remains on track with the Daimler Truck program milestones and the start of production timeline. Additionally, Aeva has completed a manufacturing and quality audit with a global top 10 passenger OEM, which underscores the company's growing traction in the automotive sector.

Co-Founder and CEO Soroush Salehian highlighted the company's robust start to the year, with significant achievements in both the truck and passenger vehicle segments. Salehian's commentary underscores the strategic advancements Aeva has made:

"In the first quarter, Aeva continued to build on our exciting start to the year, with significant milestones achieved for Daimler Trucks series production program and strong progress in passenger vehicles including multiple automotive RFQs."

Financial Stability and Outlook

Aeva reported a solid financial position with $189.3 million in cash, cash equivalents, and marketable securities by the end of Q1 2024. The company's balance sheet remains robust, enabling sustained investments in technology and market expansion efforts.

Despite the reported losses, Aeva's strategic initiatives and the expansion of its technological capabilities could set the stage for future revenue growth and market penetration. The ongoing developments with Daimler Truck and other automotive RFQs are expected to transition into significant business opportunities, potentially improving the company's financial metrics in upcoming quarters.

Investors and stakeholders may look forward to Aeva's continued progress in the LiDAR technology space, with a keen eye on how its strategic investments translate into financial performance in a competitive and rapidly evolving industry.

For detailed financial tables and further information, refer to Aeva's full earnings release and financial statements.

Explore the complete 8-K earnings release (here) from Aeva Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance