Veritone Inc (VERI) Q1 2024 Earnings: Revenue Beats Expectations Amidst Operational Challenges

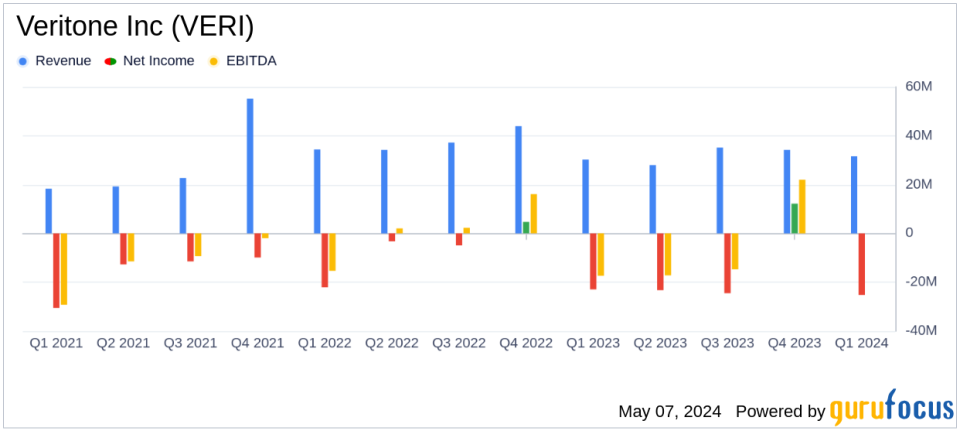

Revenue: Reported $31.6 million, a 4.3% increase year-over-year, exceeding the estimated $30.7 million.

Net Loss: Recorded at $25.2 million, widening from $23.0 million in Q1 2023, far exceeding the estimated net loss of $7.2 million.

Annual Recurring Revenue (ARR): Decreased to $72.1 million from $112.7 million in the previous year, driven by a decline in consumption-based revenue.

Software Products & Services Revenue: Grew by 7.8% to $15.2 million, despite a 32.1% decrease in Pro Forma Software Revenue.

Total Software Products & Services Customers: Decreased by 10% year-over-year to 3,384 customers.

Total New Bookings: Declined significantly by 43.1% to $13.0 million from $22.8 million in Q1 2023.

Non-GAAP Net Loss: Improved by 20.3%, recording a loss of $7.6 million compared to a loss of $9.6 million in Q1 2023.

On May 7, 2024, Veritone Inc (NASDAQ:VERI), a leading provider of artificial intelligence (AI) computing solutions, announced its first-quarter results for the year, revealing a revenue of $31.6 million, which surpassed the high end of their guidance. This announcement was detailed in their recent 8-K filing. The company, known for its comprehensive AI solutions that serve various sectors including media, entertainment, and public safety, has shown a commendable increase of 4.5% in revenue compared to Q1 2023.

Financial Performance Insights

Veritone reported a mixed financial performance with several key highlights and challenges. The company's revenue increase is attributed to a 7.8% rise in Software Products and Services revenues, amounting to $15.2 million. This growth was primarily driven by the acquisition of Broadbean in Q2 2023, which contributed $8.5 million in revenue. Despite this, the company faced a significant decrease in consumption-based revenue from major customers like Amazon, which offset some of the gains.

Managed Services revenue saw a modest increase of 1.9% year-over-year, reaching $16.4 million. However, the total number of Software Products & Services customers decreased by 10% compared to the previous year, reflecting a reduction in consumption-based customers. This was further evidenced by a substantial 36% year-over-year decrease in Annual Recurring Revenue (ARR), now standing at $72.1 million.

The company's operational losses showed improvement, with a loss from operations narrowing to $21.8 million from a loss of $23.6 million in Q1 2023. The Non-GAAP net loss improved by 20.3%, indicating effective cost management and restructuring efforts that resulted in over $13.0 million in forecasted annualized savings.

Strategic Developments and Future Outlook

Veritone's CEO, Ryan Steelberg, emphasized the company's strategic realignment and operational restructuring which are expected to accelerate Non-GAAP net income by Q4 2024. The company has been actively expanding its AI capabilities and market reach, as evidenced by new partnerships and customer acquisitions in sectors like public safety, media, and entertainment.

Looking ahead to Q2 2024, Veritone anticipates revenue to be in the range of $31.0 million to $32.0 million and projects a Non-GAAP net loss between $5.5 million and $6.5 million. For the full year of 2024, the company expects revenue to range from $136.0 million to $142.0 million and a Non-GAAP net loss in the range of $11.0 million to $15.0 million.

Conclusion

Despite facing significant challenges, particularly from the decline in consumption-based revenue, Veritone's strategic initiatives and restructuring efforts are setting the stage for improved profitability and operational efficiency. The company's focus on expanding its AI solutions portfolio and strengthening customer relationships bodes well for its long-term growth trajectory. Investors and stakeholders will likely watch closely as Veritone continues to navigate its transformation and capitalize on the growing demand for enterprise-wide generative AI applications.

For a detailed analysis of Veritone Inc's financials and future prospects, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Veritone Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance